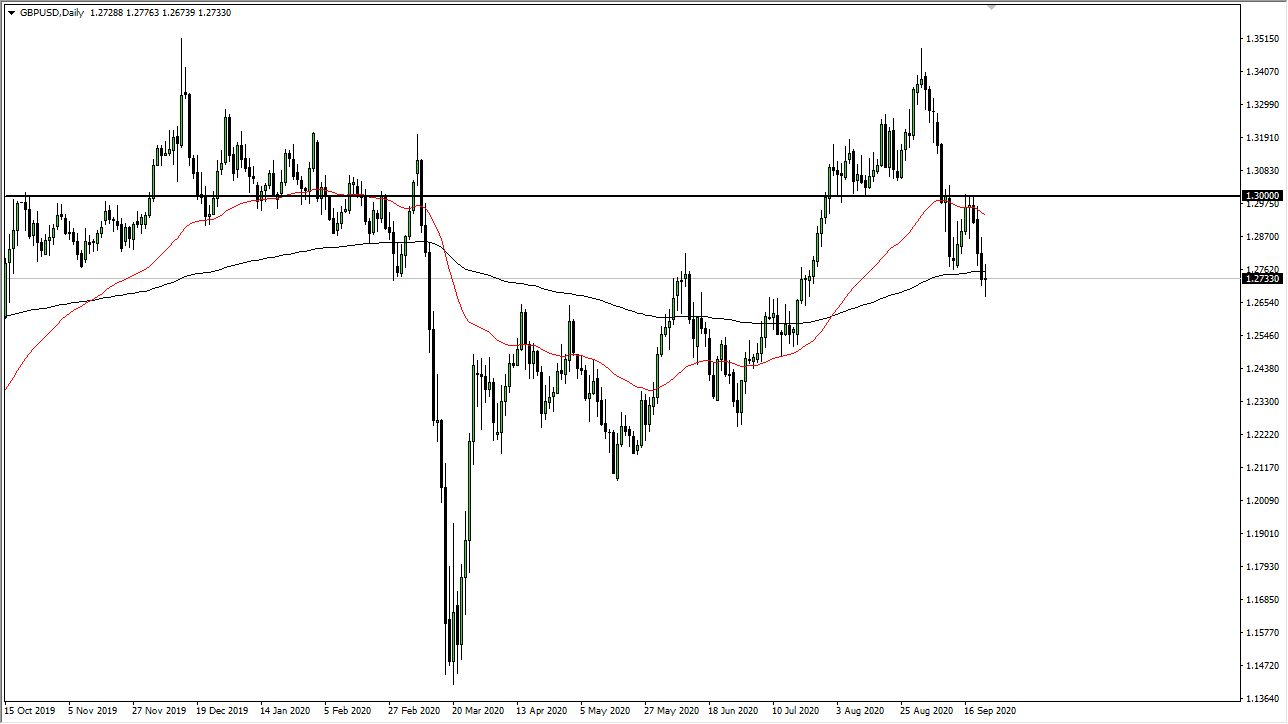

This is a neutral candlestick and it does suggest that perhaps we have a little bit of stability ahead of us. That is quite different in comparison to other currencies against the US dollar, which as strengthen quite radically. With this being the case, it is very difficult to imagine that we should be selling the British pound, even though I certainly do not want to be shorting the US dollar. Ultimately, the British pound is a little bit of an outlier right now all of the noisy nonsense that we have going on around Brexit will continue to cause issues.

Looking at the candlestick, it is placed almost perfectly, and if we can break above the top of it is likely that the British pound will try to rally. Having said that, we have made a “lower low”, and therefore I think that any signs of exhaustion after a rally will probably be jumped upon. Having said that, I am very pro-US dollar at the moment, and I think that it is probably the main currency I want to own. However, with all of the volatility and sudden stability that we see in the British pound, I think it is probably best to leave this market alone until we get some type of resolution. Having said that, if the market was to turn around a break above the 1.30 level on a daily close, then we would have a major turnaround, and it could in fact be a bit of a “Quasimodo pattern”, which is something that some people trade at the bullish sign.

On the other hand, if we break down below the candlestick from the trading session on Wednesday, then it opens up a move towards the 1.25 handle. I think if that happens then it is probably a shorting opportunity as well, but it will probably have more traction against other currencies as there are so many moving pieces when it comes to the British pound. Of particular interest would be the New Zealand dollar, Canadian dollar, and a whole host of emerging market currencies. Looking at this chart, I believe that buying is impossible, and selling is something that you should only do we get a better price on the greenback.