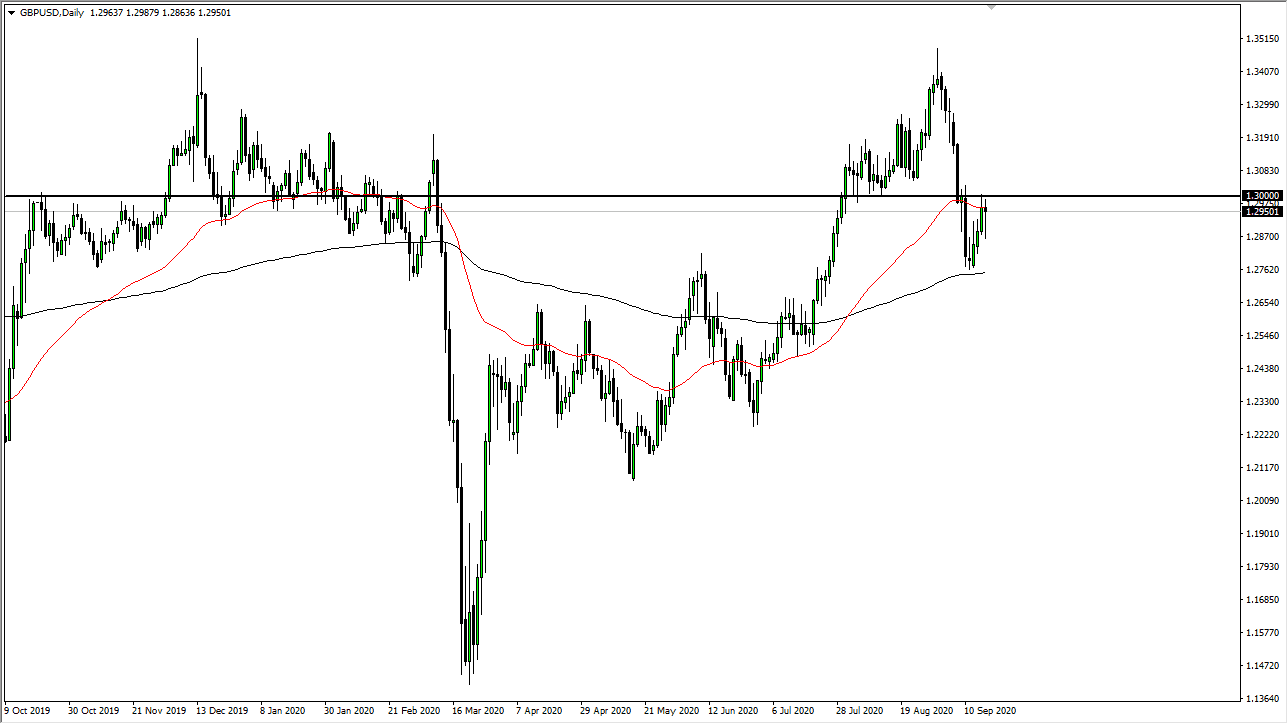

The British pound has initially fallen during the trading session but also has turned around to show signs of strength again. By closing the way it has, it looks like the British pound is going to threaten the 1.30 level, and therefore we could be ready to see a bit of a recovery after the recent selloff that had occurred. It is also worth noting that the market bounced from the 200 day EMA, an area that a lot of people will pay quite a bit of attention to. The candlestick for the trading session of course looks bullish, as it has formed a bit of a hammer. That being said, I believe that we need to clear the 1.3050 level on a daily close to feel “comfortable.”

The reason why I put the word comfortable in quotes is that we are going to be held hostage to the latest Brexit headlines, which of course will be in flux the entire time. Twitter is rife with rumors and headlines that algorithmic bots will come in and out of the market based upon, so you need to be very cautious about putting significant size on, as you may suddenly get stopped out, only to see the market turn around and go against you again.

With that being said, I have been putting on about half the normal position size, when I do trade this market. I think if we can get that daily close above the 1.3050 level, then it is likely that the market could go towards the 1.3250 level, perhaps even followed by the 1.35 handle. However, if we were to break down below the candlestick from the Friday session it would be a negative sign and we would almost certainly have to go down to test the 200 day EMA yet again.

I think it is almost impossible to imagine a scenario where volatility will not be a main factor, so keep that in mind when you are trading. The one thing that you need to pay attention to more than anything else right now is your risk parameters, as it is the only thing that will get you through this Brexit nonsense if history is any indicator, as just a few years ago we were all over the place. I think we are back in that theme again.