The British pound shot straight up in the air during the trading session on Monday, as a member of the Monetary Policy Committee stated that the idea of negative interest rates coming out the United Kingdom was a bit of a stretch. People bought the British pound because that of course is good for a currency, the fact that it is not going to have negative rates, but at the end of the day that is not necessarily the biggest concern for the British economy or the Pound itself.

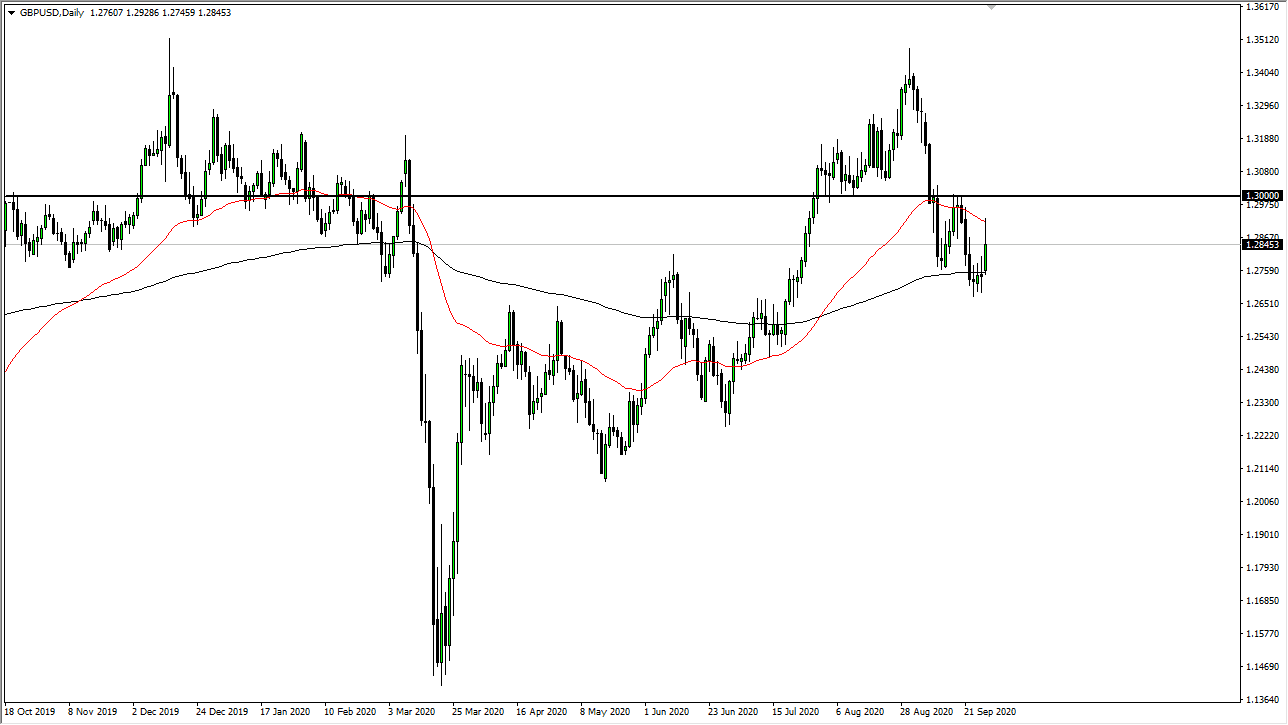

The market raced towards the 50 day EMA and then sold off quite drastically. We have given back about half of the gains already, which tells me there is no real demand for the British pound at this point. The market seems to have rolled over significantly but there is support underneath, so I think we are going to enter another bounce of choppiness. To be honest, I am not overly surprised that we rallied a bit, I just did not expect it to be all in one shot.

To the downside we have the 200 day EMA which is obvious support, especially around the 1.2750 level. With that in mind, I like the idea of aiming for that area as a target, but I also recognize that if we break down below the candlesticks from late last week, it is very likely we go looking towards 1.25 handle. The British pound could very well drop to that level, as we are talking about facing further lockdowns in the United Kingdom, which of course will wreak havoc on the economy there. Furthermore, there is still the whole Brexit issue, which is nowhere near being solved. We are getting closer to the end of the year and therefore we are getting closer to the idea of a “no deal Brexit.” If that is going to be the case, currency traders have already shown more than once that they are willing to punish the British pound in that scenario. It really does not matter what you think will happen in the future, the reality is that is how the markets behave.

I expect a lot of back and forth over the next couple of days and as we get closer to the end of the week, we have the jobs report on Friday in the United States, which of course always causes quite a bit of noise and volatility. At this point, structure still looks very negative, as we had a massive surge lower, a small bounce to the 50 day EMA, a break down again to a new low, and then now it looks like we very well could have just made another lower high.