If you have been trading for more than a few months, you probably remember the nonsense and noise that was a major feature of the entire Brexit situation. There would be spoofing on Twitter, rumors, and headlines coming out of politicians in order to put pressure on the other side in the public. Algorithms are reading headlines and trading accordingly. In other words, we get a random headline that comes across in order to spike the British pound 50 pips, only to see it roll right back over. In fact, about a year ago I remember many professional traders suggesting that trading the British pound was almost impossible in the circumstances. Unfortunately, I think we may be entering that scenario again.

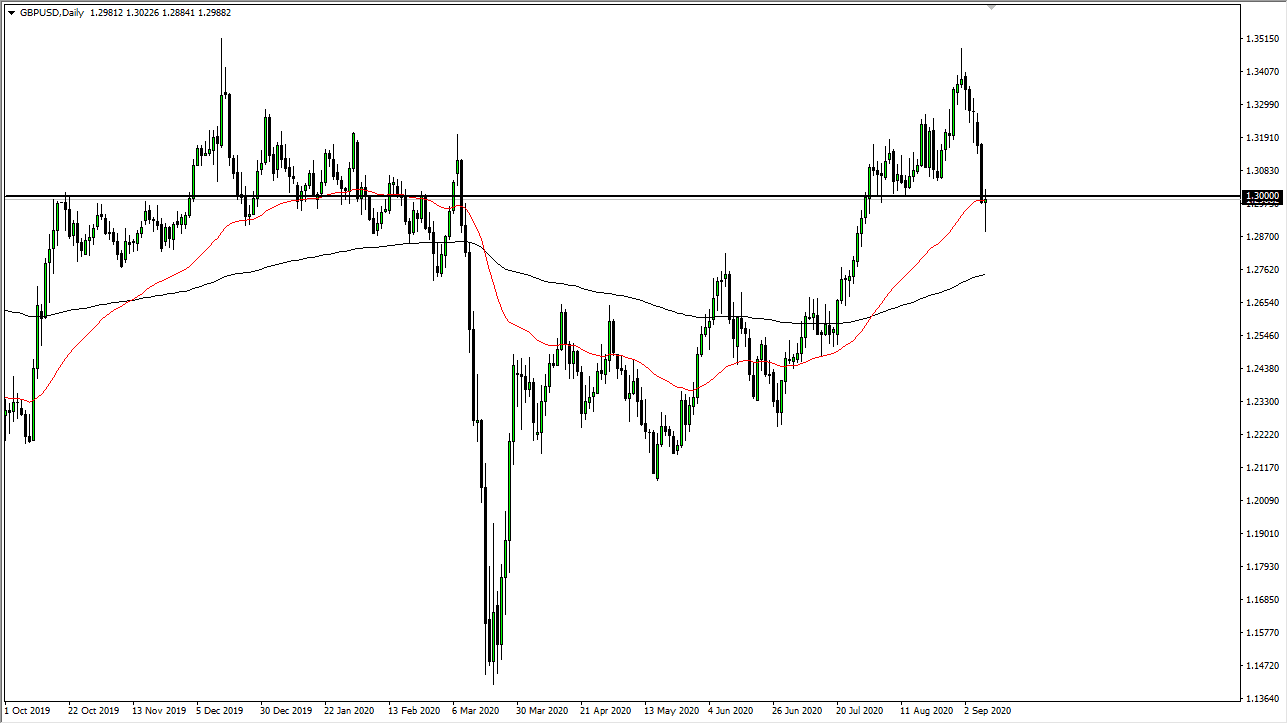

From a purely technical standpoint, we have formed a bit of a hammer during the trading session, sitting just below the 1.30 level. That being said, if the market does recapture and break above the top of the range for the trading session on Wednesday, that would in theory be a buying opportunity and it could send the British pound higher. Part of what is driving this now is the fact that the European Union did not cancel talks despite the fact that some moves that the British are taking could theoretically be illegal according to international law. Furthermore, the PM of the UK suggested recently that they were more than likely going to leave without some type of deal, so you know the routine - people start freaking out.

With that being said, you can use the candlestick from the session on Wednesday as a bit of a binary set up, meaning that you buy on a break above, or sell on a break below. Your stop loss goes on the other side of this candlestick. If we do break down, then the market is likely to go looking towards 1.2750 level. Break higher, then we could go as much as 500 pips to the upside. That being said, it is very difficult to imagine a scenario where the British pound has a clean move after the nasty, choppy, volatility that we have seen as of late. This is literally going to be one of those times where the market is going to move upon the latest headlines and will have sudden flashes in both directions. Caution is advised to say the least.