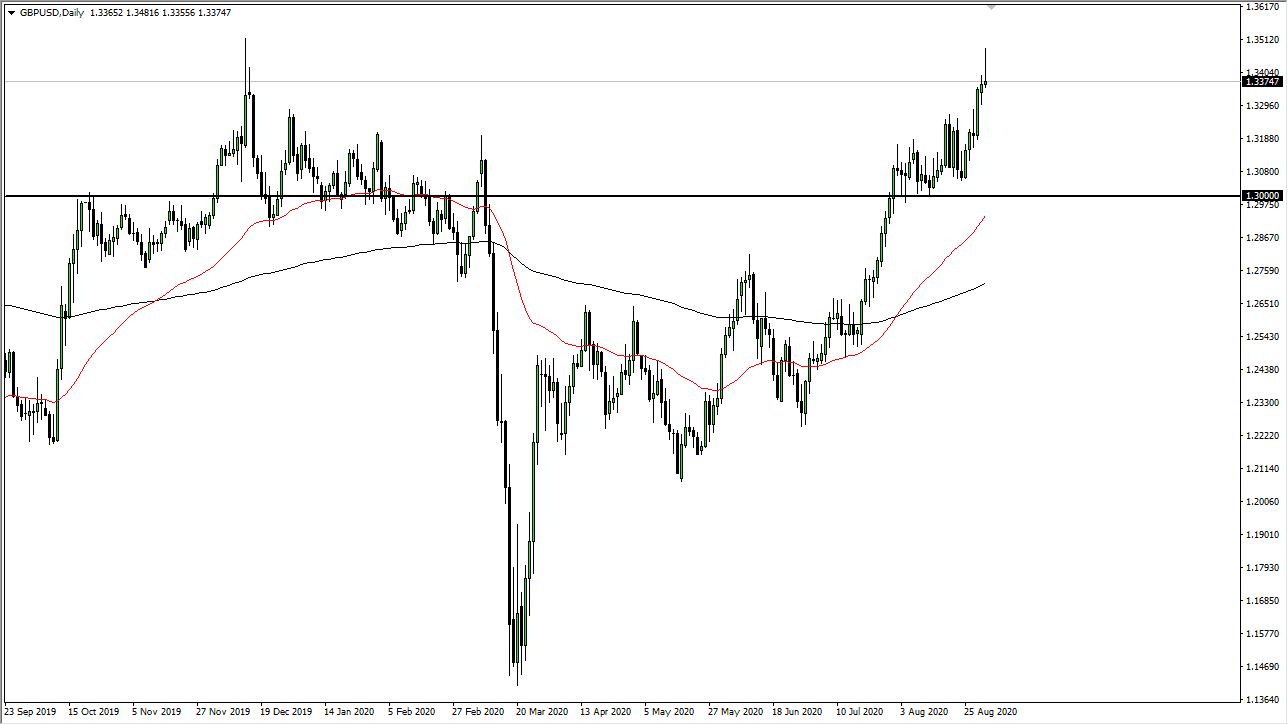

British pound traders initially bought during the trading session on Tuesday but gave back the gains as we try to reach towards the crucial 1.35 handle. That being said, this is still a very bullish pair, but I think we may have gotten a bit ahead of ourselves. Looking for some type of pullback, I will be watching to see if I get a supportive candlestick that I can take advantage of, more than likely based upon the daily timeframe. One of the most obvious candidates for a buying opportunity is at the 1.32 handle.

The candlestick is perfect as far as its shape is concerned, but unless something changes fundamentally, it is very difficult to imagine where the market will come up for a reason to start breaking down drastically. I believe that the “floor” right now is at the 1.30 level that I would be surprised if we get anywhere near that region. The 50 day EMA is racing towards that level as well, so that is also something to pay attention to. All things being equal, I think it is only a matter of time before we see an opportunity to pick up the Pound “on the cheap.”

The Forex markets have been trading mainly on the US dollar and its fundamentals as opposed to anything else. Yes, we start to worry about Brexit, but it does not seem as if anybody is out there paying attention to it right now. At this point in time, I like the idea of buying pullbacks because it offers value in what is obviously a very bullish asset. That being said, after we have seen so much bullish pressure just above the 1.30 level, I do think that a breakdown below that level is very unlikely, but if it happens that could cause a lot of chaos. Having said that, I do not know the scenario where that happens, it would obviously have to be some type of serious catalyst to get this market running towards safety.

The alternate scenario is that we break above the 1.35 handle and continue to go higher. Once we do, then it opens up the possibility of a move towards the 1.3750 level, and then possibly even the 1.40 level after that. While I would take that trade, I prefer buying on pullbacks as they are offered.