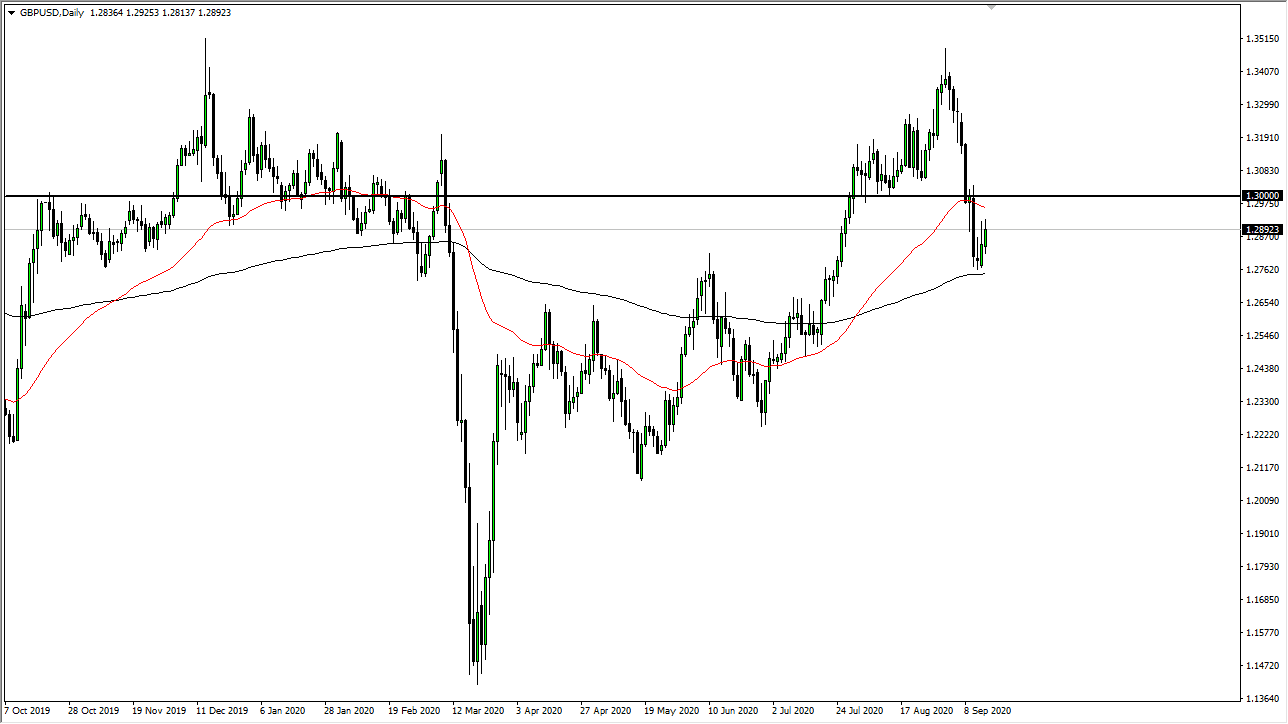

The British pound continued to grind to the upside during the trading session on Tuesday as we see a lot of choppiness in general. Ultimately, the market has bounced from the 200 day EMA which is a bullish sign, and it does suggest that we are ready to perhaps go to the upside. However, the 50 day EMA sits just above and it is worth noting that we continue to struggle right around the 1.29 level. That is an area that is a minor resistance barrier, perhaps based upon psychology more than anything else. Above there, we have an even more formidable level in the form of the 1.30 level.

Looking at the size of the candlestick for the Tuesday session, it has been rather large, but you can see that the sellers have stepped back in to push the market back down right around the same level as they did on Monday. This does not mean we cannot go higher, because it looks like the resiliency is something worth paying attention to. Having said that, the question now is whether or not the US dollar can strengthen? I suspect that this pair is probably moving more about Brexit headlines and rumors than anything else. Because of this, we may see a sudden move of 100 pips or more, so you need to be very cautious about your position size.

All things being equal, if we were to turn around and break above the 1.30 level and close above there on a daily candlestick, it would be a great confidence booster for the markets. I suspect that between here and there it is more than likely going to see negativity come back into the market, and it is probably going to be the way things are for a while. As Brexit headlines continue to cross the wires, I anticipate that people will be watching very closely the voting process in the United Kingdom as to whether or not parliament and the House of Lords will give Boris Johnson everything he wants. So far, we have seen the first vote past. With all of that, keep in mind that the European Union has threatened to sue the United Kingdom that they leave the existing Brexit deal, something that I think they ultimately will do. That is weighed upon the value of the British pound.