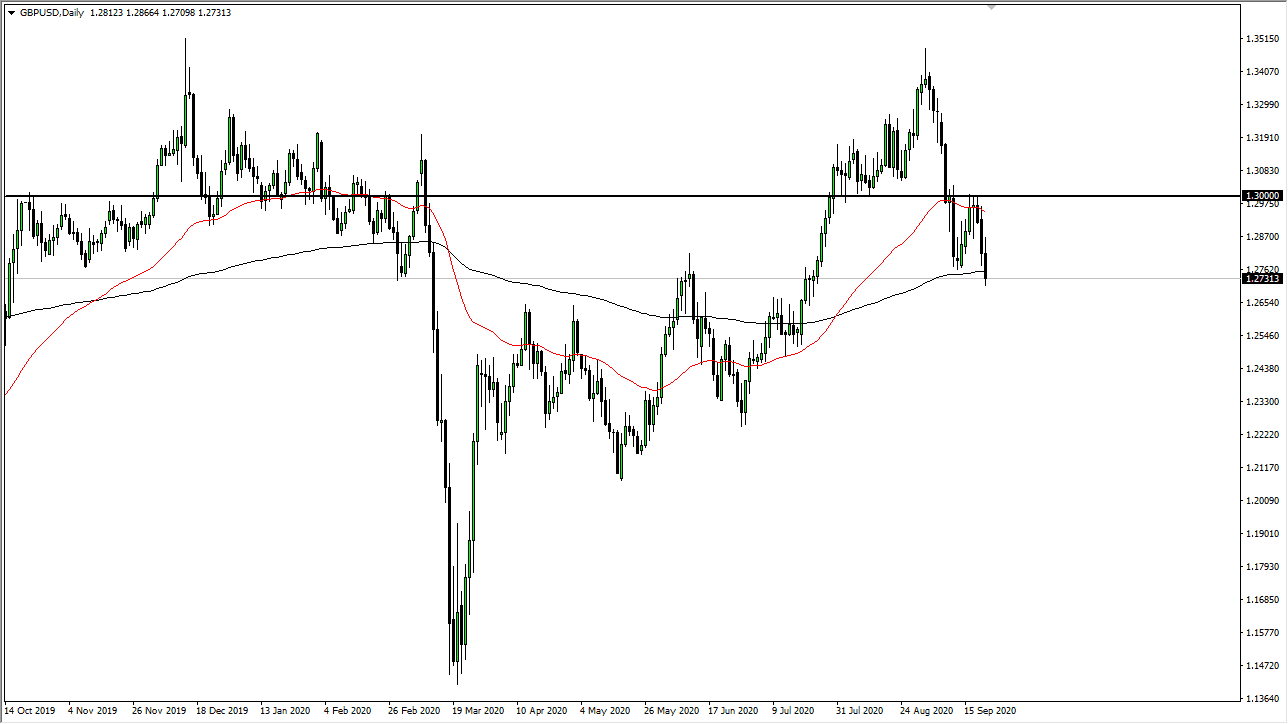

The British pound has broken below the 200 day EMA during the trading session on Thursday as we continue to see a lot of weakness when it comes to Sterling. This is being exacerbated by the fact that the United Kingdom is in fact locking itself down due to the coronavirus situation, so this will more than likely weigh upon the British pound going forward. Looking at this chart, it looks like we are trying to favor the greenback again, and that could end up being the big story when it comes to not only Forex but various markets around the world.

Now that we have broken below the 200 day EMA, the question is whether or not we can sustain this downward pressure? I do think it is possible because we have just made a “lower low” as well, as we have broken down through the bounce from the previous week. The question I have is whether or not we can get down to the 1.25 handle, which is my target. That does not mean that we get there right away, and it does not mean that is going to be easy to trade this pair. After all, the market seems to be teetering on a lot of uncertainty and volatility is most certainly higher than it once was.

Unfortunately, Brexit is still out there, and we will get the occasional Tweet, rumor, and politician speaking that could throw this market all over the place. Remember, the last time we were at this point when it came to Brexit, we had random headlines that would manipulate the market in one direction or the other. I suspect that is probably going to be the way we are behaving going forward. Because of this, position size is crucial, and you need to be very cautious about whether or not you put a trade on, and then even more importantly the size of the trade. I am bearish on Sterling, but I also recognize that we will get the occasional surprise bounce. These bounces are to be sold until we can break significantly above the 1.30 level on a daily close. Obviously, things can change but as things stand right now, I look at this market, especially as I am seeing the US dollar strengthened against multiple currencies, not just the British pound.