This week will determine the fate and future of relations between the European Union and Britain, after the end of the transitional period at the end of 2020 with the eighth round of negotiations between the two sides of Brexit. Therefore, the GBP/USD performance may continue to witness a state of volatility and instability amid the continuation of the recent downward pressure that pushed it towards the 1.2675 support, its lowest level in two months before stabilizing around the 1.2770 level at the time of writing. In addition to the Brexit file, the pair will also interact this week with the first American election debate and the situation of the Coronavirus in Europe, especially since the United Kingdom was proactive in imposing strict restrictions to contain the outbreak.

The GBP/USD dropped -1.3% over the past week, which is the third smallest loss of any major currency compared to the dollar.

Commenting on recent performance. David Sneddon, Head of Technical Analysis at Credit Suisse, says: “The GBP/USD continues to stabilize at our target of a set of support levels at 1.2722/1.2655. A correction back above 1.2777/81 is needed to relieve pressure on the pair" Brexit talks will continue during these days, starting tomorrow, Tuesday, and the results of the round of negotiations will be announced on Friday. The two sides will have only two weeks to reach an agreement from that point before the deadline for negotiations on October 15th, so the British pound will be sensitive to any signal of “limited progress” or “big divergences” as is usual for global financial markets.

On the economic side of the USA, August existing home sales and new home sales matched expectations of 6 million and 2.4%, respectively. Prior to that, it was announced that the preliminary manufacturing PMI from Markit for September had surpassed expectations of 53.2 with a reading of 53.5, while services PMI missed expectations of 54.7 with a reading of 54.6. Then came the initial and continuing jobless claims, slightly against expectations. On the other hand, new home sales exceeded estimates. By the end of the week, durable goods orders were reported to exceed expectations by 1.5%, recording 0.4%, while non-defense capital goods orders excluding aircraft were reported to exceed expectations by 0.5%, recording 1.8%.

This week, the focus will be on announcing the US job numbers according to the ADP survey and according to the details of the official report from the US Labour Department on Friday. This is in addition to the first debate of the US presidential elections in the early hours of Wednesday morning, which puts President Donald Trump in the face of Joe Biden from the Democratic Party.

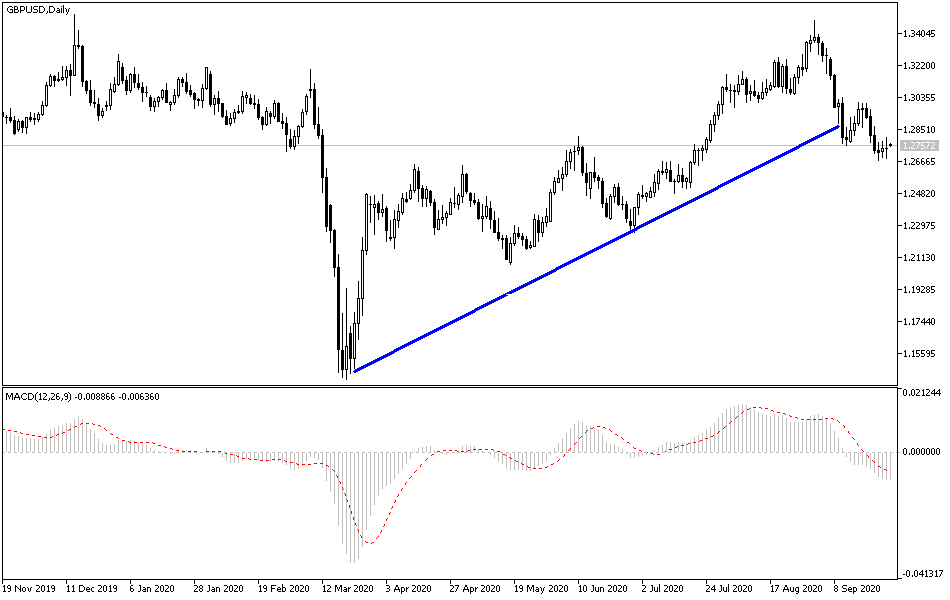

According to the technical analysis of the pair: In the short term and according to the performance hourly chart, it appears that the GBP/USD pair is trading within a descending triangle formation. This indicates a strong downtrend in market sentiment on the short term. Therefore, the bears will look to extend the current drop towards the 1.2690 support or lower at the 1.2615 support. On the other hand, bulls will be targeting short-term recovery gains around 1.2795 or higher at 1.2868 resistance.

In the long term and based on the performance on the daily chart, it appears that the GBP/USD has recently made a bearish breakout from an upward channel. This indicates an attempt by the bears to dominate the market in the long term. Accordingly, bears will target long-term gains at 50% and 38.20% Fibonacci levels at 1.2464 and 1.2223 support, respectively. On the other hand, bulls will target long-term profits at 76.40% Fibonacci level at 1.3019 resistance or higher at 1.3272.