The current market environment has changed from one of crisis to a questionable rebound as global stock market indices recovered to reach new all-time highs before correcting, despite the continuing spread of the coronavirus pandemic which is still sweeping the world.

Big Picture 27th September 2020

In my previous piece two weeks ago, I saw the most attractive trade set-up as likely to be in short-term trades against the British Pound using either the Euro or the U.S. Dollar as a counterpart. This worked out better as a strategy for trading the EUR/GBP currency cross than it did trading the GBP/USD currency pair.

Last week’s Forex market saw the strongest rise in the relative value of the U.S. Dollar and the strongest fall in the relative value of the Australian Dollar. The U.S. Dollar had its strongest week in the Forex market since April.

Fundamental Analysis & Market Sentiment

The focus now of stock market analysts in the U.S. is centered mostly on the deadlocked political dispute in the U.S.A. over the terms of additional fiscal stimulus which the U.S. economy is seen to require as the U.S. economic recovery in endangered by coronavirus. This looks highly unlikely to be resolved before the U.S. presidential election takes place in early November and due to the large number of mailed ballots, the result of this election may not become clear for some time after the polls close. There are some signs the initial recovery is faltering, with more and more banks and analysts lowering their forecasts for near-term U.S. and global economic growth. This is echoed in other countries around the world, with markets watching to see how effectively local economies bounce back from the initial part of the crisis.

The U.S. stock market has continued to correct from its recent all-time high. Most analysts see the correction as nothing out of the ordinary as stock markets had been making a parabolic rise for some time.

The third major issue now is progress being made in a number of channels towards a safe and effective coronavirus vaccine. A related issue here which saw a major development five weeks ago is the announcement by Abbot Laboratories that they will be rolling out 50 million units from October of a very cheap and accurate home coronavirus test every month. If well used, this tool could enable severe containment or even localized eradication of the virus.

Last week saw a monthly policy release from the central bank of Switzerland. The SNB did little and kept interest rates unchanged. Greater attention has been paid towards the escalating breakdown in the prospect of a trade agreement between the E.U. and the U.K. as the period of the interim agreement runs down. If the U.K. were to finalize its exit from the E.U. without a trade deal, this would be very negative for the British Pound, and we have already seen the Pound fall quite strongly last week on this prospect.

Last Friday saw the second highest ever number (317,951) of daily new confirmed coronavirus cases worldwide, suggesting that the current wave of infection is far from over.

We have seen the epicenter of the global coronavirus pandemic move into Latin America. The number of new cases in the U.S.A. has declined from its peak rate over recent weeks. Globally, coronavirus deaths are still lower than they were during their peak in early April, suggesting the virus may have become less lethal, or medical systems have effectively improved their treatment capacities. However, a worrying development has come in the form of a strong rise in new daily cases within the European Union over recent weeks, not to mention the enormous number of new confirmed cases which are being seen currently every day in India (currently running at approximately 90,000 per day).

The only country currently recording a daily coronavirus death toll over 1,000 is India.

Latin America is responsible for approximately 38% of confirmed new daily deaths, with India at 18%, the U.S.A. at 13% and Europe at about 8%. The strongest growth in new confirmed cases is happening in Argentina, Armenia, Austria, Belarus, Belgium, Belize, Brazil, Bulgaria, Burma, Canada, Costa Rica, Croatia, Czech Republic, Denmark, Ecuador, El Salvador, Estonia, Finland, France, Georgia, Germany, Greece, Guatemala, Hungary, Iceland, Indonesia, Iran, Iraq, Ireland, Israel, Italy, Jordan, Lebanon, Malaysia, Mexico, Moldova, Morocco, Nepal, Netherlands, North Macedonia, Norway, Peru, Poland, Portugal, Romania, Russia, Slovakia, Slovenia, Sweden, Tunisia, U.A.E., Ukraine, the United Kingdom, the United States, and Venezuela.

The coming week is likely to bring a more active Forex market as we will be getting key U.S. non-farm payrolls jobs data.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar index printed another bullish candlestick which ended the week with the highest closing price seen in ten weeks. The price also broke above a key resistance level, which has now been invalidated. Despite these bullish signs, there is a long-term bearish trend, as the price is lower than it was both 3 and 6 months ago. It may also be that the zone the price has now arrived at centered on 12200 will be resistant to any further significant price rise. Overall, next week’s price movement in the U.S. Dollar looks slightly likely to be downwards due to the prevalent trend, although markets are currently in “risk-off sentiment” mode which suggests that the Dollar will not weaken. The Dollar had its strongest week since last April.

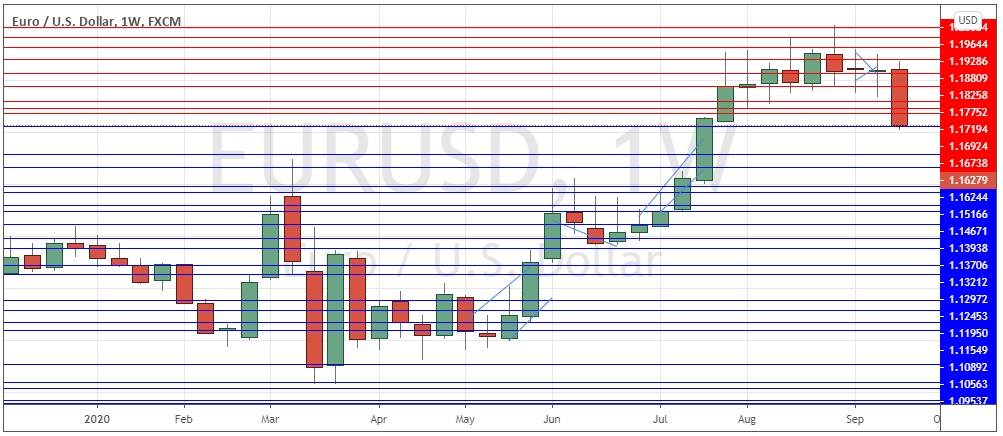

EUR/USD

The EUR/USD currency pair fell strongly last week. In fact, this was its strongest fall since the initial impact of the coronavirus pandemic last March. This fall comes after a multi-week top appears to have been made recently just beneath the 1.2000 area. Risk-off markets have boosted a formerly weak U.S. Dollar, while the increasing pace of new coronavirus cases within the Eurozone has begun to hit the Euro. The price is not far from new 50-day lows and the price may well fall further over the coming week.

S&P 500 Index

The S&P 500 Index bounced from what seems to be support at the level of the 10% correction from the all-time high made 4 weeks ago. We have a weekly bullish pin candlestick rejecting that low at 3228. The price is in a statistically valid “buy zone” between the 200-day and 50-day simple moving averages. If Monday is an up day, I see this index as a worthwhile buy. Bottom Line

Bottom Line

As the U.S. Dollar is moving firmly counter-trend, I see the best likely opportunity in the Forex market this week in looking for short-term short trades in the EUR/USD currency pair. Otherwise, the best opportunity is long of the S&P 500 Index if Monday’s close is higher than last Friday’s close.