The sharp and continuous EUR/USD selling since the end of last week’s trading pushed it towards the 1.1691 level, its lowest level in two months, before settling around 1.1705 at the time of writing. Gains in the US currency increased, supported by its popularity as a safe haven, coinciding with fears of the Coronavirus second wave strength within the European continent. In the event of an emergency shutdown, losses of the single European currency may increase. Despite stalled negotiations for more stimulus plans for the US economy. What supported the dollar’s gains was the optimism from both the governor of the US Federal Reserve Bank and the Secretary of the Treasury regarding the future recovery of the largest economy in the world from the devastating human and economic effects of Corona.

Powell told the House Financial Services Committee that he believes the US economy is "recovering". Mnuchin, the Trump administration's chief economic spokesman, said the country was in "the midst of the fastest economic recovery of any crisis in history" after the biggest economic downturn since the Great Depression of the 1930s.

On another level, preliminary data from the European Commission showed that consumer confidence in the Eurozone rose more than expected in September to its highest level in six months. Accordingly, the consumer confidence index increased to a reading of -13.9 from a reading of -14.7 in August. Economists had expected a score of -14.6. The latest reading was the highest since March when it was -11.6. According to the results, the corresponding European Union index rose to a reading of -14.9 from a reading of -15.5 in August. This was also the highest level since March, when the Coronavirus, or COVID-19, the pandemic began spreading in the region.

Final readings are due to be released along with economic sentiment data on September 29th.

On the US side, existing-home sales in the US increased to their highest level in nearly fourteen years during the month of August, according to a report issued by the National Association of Realtors. The association said existing home sales jumped 2.4 percent to an annual rate of 6.000 million in August, after jumping 24.7 percent to a rate of 5.860 million in July. The continued increase in sales matched economists' estimates.

With the sharp increase, existing home sales reached their highest level since December 2006.

“Home sales are continuing to stagger, and there are a lot of buyers in the pipeline poised to enter the market,” said Lawrence Yun, chief economist at NAR. "Further gains in sales are likely for the remainder of the year, with mortgage rates hovering around 3% as jobs continue to recover," he added.

The report stated that the average existing-home price for all housing types in August was $310,600, up 11.4 percent from $278,800 in August of 2019. NAR also said that the total housing stock at the end of August was 1.49 million units, down 0.7 percent from July. And down 18.6 percent from the previous year. The unsold inventory represents 3 months of supply at the current sales pace, down from 3.1 months in July and 4.0 months in August 2019.

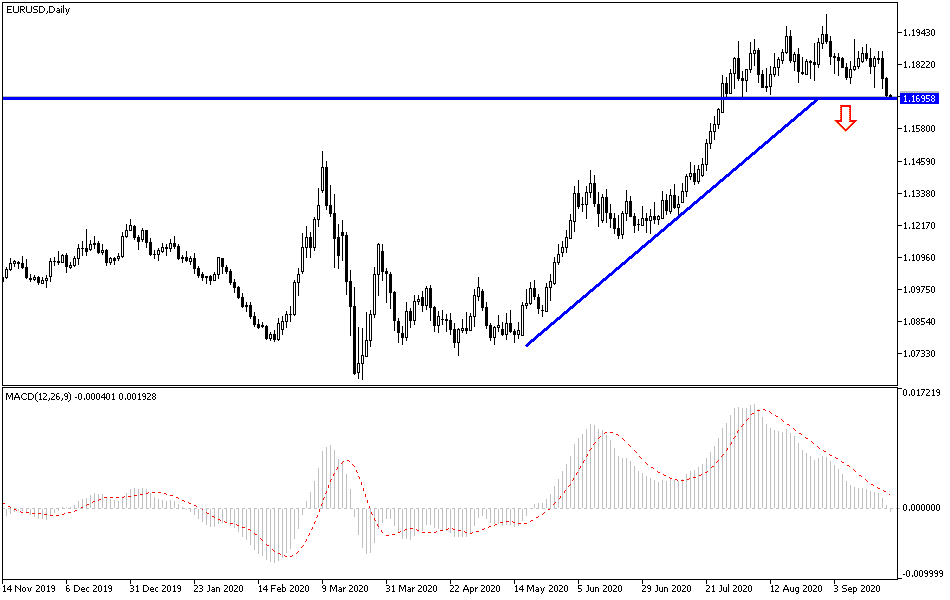

According to the technical analysis of the pair: The general EUR/USD trend has turned downward since it failed to breach the psychological resistance at 1.2000, and after the recent collapse, forex traders are wondering now about the most appropriate levels to buy. Support levels at 1.1685, 1.1600, and 1.1545 may be best suited to do so. This is because these levels will confirm that the technical indicators have reached strong oversold areas. On the upside, and as I mentioned before, bulls will still need to move towards and above the psychological resistance at 1.2000 to confirm the strength of their control over the performance.

As for the economic calendar data today: From the Eurozone, the focus will be on the announcement of the manufacturing and services sectors PMI reading. Then to the US session, and the announcement of the manufacturing and services sectors PMI reading, then to the second testimony of Federal Reserve Governor Jerome Powell.