For the second day in a row, the EUR/USD currency pair is trying to rebound to the upside after sell-offs that pushed it towards the 1.1612 support, its lowest in two months, and is currently stabilizing around 1.1680, awaiting any new developments. Bear domination remains the strongest. The pair awaits the US Consumer Confidence release, and at 5.00 AM ET, the European Commission is to release data on its economic sentiment survey. Economic confidence in the Eurozone is expected to rise to 89 in September from 87.7 in August. The single European currency declined for the second week in a row, the first consecutive loss in the third quarter. The decline of 1.7% was the largest in five months and hit a new low at the end of the week's trading.

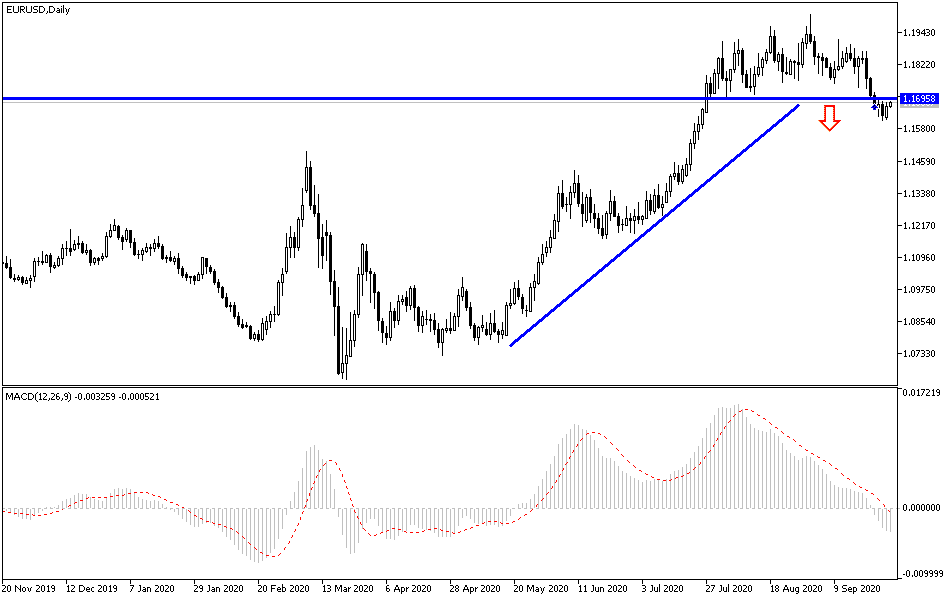

Momentum indicators extended excessively but still allowing for another downside push. A break of $1.1600 would target the $1.15 just below, which could exhaust the move. The $1.1485 area corresponds to 38.2% of the six-month rally and 61.8% of the rally that began in late June. The Euro has ended the past four sessions below the lower Bollinger Bands.

On the other hand, and through a referendum, the Swiss voters strongly rejected the proposal to end the current freedom of movement arrangements with the European Union. Several other arrangements with the European Union are associated with it, including some commercial concessions. In 2014, a slight majority voted in favor of a similar proposal, and a compromise was reached in the Swiss parliament that keeps freedom of movement intact. While major disruption has been avoided, the focus will quickly shift to an “institutional framework agreement” with the European Union. Basically, this means that Switzerland automatically adopts EU rules unless it has specific objections.

The Swiss often adopt EU rules to maintain market access. It is not so much about territorial borders (applying one’s laws outside one’s country) as it is about the tragedy of being a small country next to a larger economic entity (in terms of size). Britain’s exit from the European Union is the opposite strategy. Although the institutional framework agreement was sealed, it was not ratified by Parliament, as the majority seemed out of reach. The question is whether the referendum will change European dynamics, and the answer is yes without a doubt.

According to the technical analysis of the pair: There is no change in my technical view of the EUR/USD performance, as the general trend is still downward as long as it is stable below the 1.1800 resistance and the continuation of the current performance may push the bears to move the pair to stronger support levels, the closest of which are currently 1.1625. 1.1545 and 1.1480, respectively. The pair will still need stronger incentives to avoid these losses. The strength of the second COVID-19 wave and European measures to contain the disease, as well as the abandonment of the US currency as a safe haven, will determine the fate of the pair in the coming days. So far, the trend is still bearish.

As for today's economic calendar data: From the Eurozone, the CPI will be announced from Germany and Spain. Then to the announcement of US consumer confidence and the comments of a large number of monetary policy officials from the US Federal Reserve.