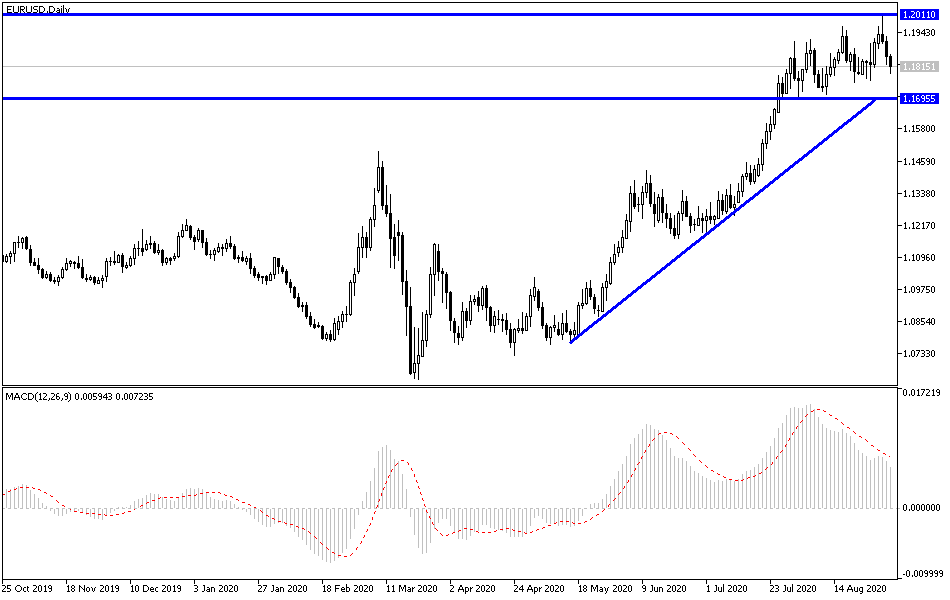

For the third day in a row, the EUR/USD has been exposed to a downward correction that pushed it towards the 1.1796 support at the time of writing, with the pair abandoning its highest level in two years when it reached the 1.2010 resistance during Tuesday's trading. This is with an expected uprising of the USD after its recent sharp losses since the US Federal Reserve announced an update on its monetary policy settings in line with what the COVID-19 pandemic imposes on the US and global economies.

The latest Eurozone figures, especially regarding inflation and the labor market, raise the concern of the European Central Bank as it tries to revive the Eurozone economy from COVID-19 consequences. In July, the Eurozone Producer Price Index (PPI) rose 0.6%, above market expectations of 0.5%. Prices rose for industrial producers of energy, consumer durables, and intermediate goods. On an annual basis, the producer price index decreased by 3.3%, and according to Eurostat, the Fast Consumer Price Index (CPI) reading decreased by 0.4% last month. Consumer prices are expected to decline 0.2% compared to the same period last year, the first drop since May 2016.

For the second month in a row, the IHS Markit Eurozone Manufacturing Purchasing Managers' Index (PMI) grew, reaching a reading of 51.7 in August. The Eurozone saw growth in production, new export orders, new business, and business optimism. However, employment levels were reduced for the 16th consecutive month. On the other hand, the unemployment rate for the month of July was slightly lower than the market expected in its early estimates of 7.9% compared to 8%.

Although the money supply grew by 10.2% year-on-year in July, the Euro appreciated against the US dollar. Since April, the single European currency has risen more than 12%, topping 1.20 against the dollar for the first time in nearly two years. However, this does not satisfy the European Central Bank (ECB) as the strong Euro may affect economic recovery.

Whereas a higher Euro would make purchasing Eurozone exports more expensive, and reduce import price growth. All eyes will be on the press conference of European Central Bank President Christine Lagarde next week, where her remarks may indicate what the institution plans to do about the European currency boom. However, direct intervention by the central bank with the specific goal of devaluing the currency is considered manipulative. The ECB's actions are likely to be limited to verbal intervention, especially as the Trump administration has proven to be very sensitive to currency valuation as a tool to undermine the commercial competitiveness of the United States.

According to the technical analysis of the pair: On the daily EUR/USD chart, the head and shoulders formation appeared clear, which supported the recent selling operations and will increase the bearish momentum for the pair in the event it moves below the 1.1765 support because it will support the move towards support levels at 1.1698 and 1.1600 Respectively, the latest support level confirms the reversal of the current trend, which still has a chance to rise. All in all, the 1.2000 psychological resistance will remain an important symbol of how much bulls can control performance.

As for today's economic calendar data: From the Eurozone, The services and retail sales PMI will be announced. From the United States of America, jobless claims, trade balance, and non-agricultural productivity will be announced, and then the ISM Services PMI will be released.