For four trading sessions in a row, the EUR/USD pair has been moving in a downward correction range, which pushed it towards the 1.1780 support. At the beginning of this week's trading, the pair tried to rebound higher, but its gains did not exceed the 1.1848 level before settling around the 1.1810 level in the beginning of today’s trading, before the announcement of the growth rate in the Eurozone economy, amid expectations of continued sharp contraction resulting from the COVID-19 outbreak. The single European currency abandoned 1.2000 psychological resistance, its highest in more than two years, amid a hint from the European Central Bank that it is not satisfied with the strength of the Euro.

As we expected, the Euro will remain under pressure until the European Central Bank announces its monetary policy next Thursday, amid expectations that the bank will make a verbal hint without making decisions on the ground about the Euro’s exchange rate. Adding to the market’s interest in the exchange rate for this global pair was the statements of chief economist at the European Central Bank, Philip Lane, that the EUR/USD rate is important, even though the bank does not seek to manage exchange rates, due to its effect on growth and inflation. Lynn's comments sparked fears of an ongoing attempt by the European Central Bank to push the Euro lower.

Commenting on this, Andreas Steno Larsen, Senior Forex Strategist at Nordea Markets says, “Lean will likely continue to defend the 1.20 area of the EUR/USD pair with verbal intervention. The European Central Bank will also likely consider further easing measures as financial conditions in the Eurozone remain rather tight (unlike the United States) adding, “Ultimately, the ECB’s ammunition has become significantly less robust than that of the US Federal Reserve. That is why the EUR/USD is likely to go higher in 2021, but we remain steadfast that 1.20 will not be crossed over the next 1-2 months. ”

In general, the rise in exchange rates is sometimes a problem for policymakers because it hurts the country's exports by making it more expensive while impeding inflation expectations by lowering import costs and ultimately consumer prices. The European Central Bank has rarely achieved its target since the debt crisis, like many other crises, but it may be more sensitive to the continuously rising currency against other international currencies because it is seen as having some very limited capacity to support its economy.

Recent developments confirm that investors have bet on another rate cut from the European Central Bank next year, especially after Lynn's recent comments, and at the same time, there are doubts that the bank will go to this extent to curb the strength of the Euro. The latest IMM report revealed that record long Euro positions are under pressure. In the biggest reversal, the European Central Bank will remain under pressure to provide more stimulus and test its reluctance to cut interest rates. Commenting on this, says Lee Hardman, analyst at MUFG. "The EUR/USD will remain under selling pressure this week."

Expectations Highlights: Nomura and MUFG are expecting EUR/USD rat to be at 1.20 by the end of the year while Nordea expects it at 1.17. One of the important determinants that turns out to be correct will be the approach taken by the European Central Bank on Thursday and in the coming months.

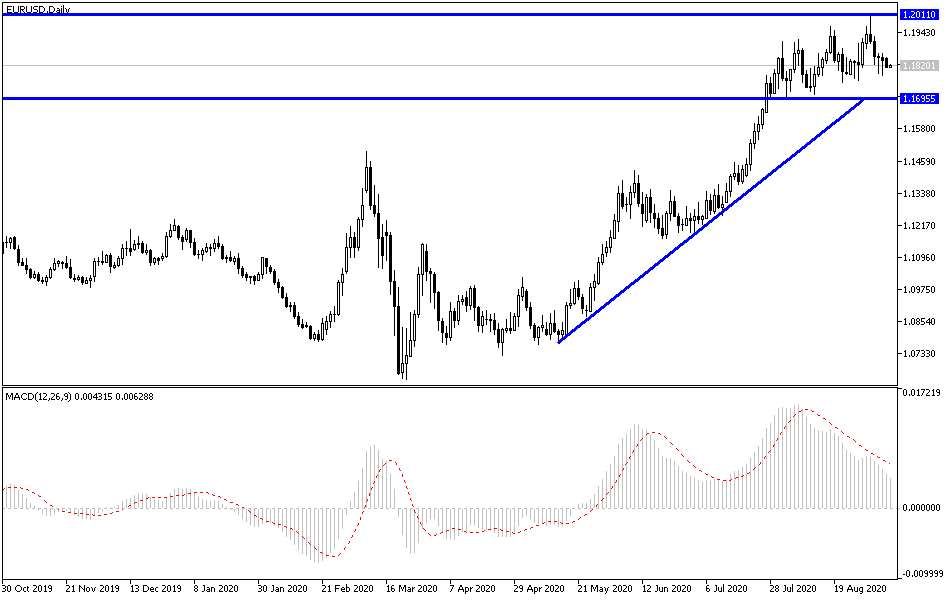

According to the technical analysis of the pair: On the daily EUR/USD chart, there is a real threat to the uptrend if the pair moves below the 1.1760 support. In return, the 1.2000 psychological resistance will remain an important target for bulls to control performance. After recent comments by European Central Bank officials, it is better to sell the pair at every upward level. The closest resistance levels for the pair are currently at 1.1885, 1.1945, and 1.2075, respectively.

As for the economic calendar data today: The beginning will be with the announcement of the German and French trade balance figures, then the announcement of the employment rate of change and the GDP growth rate for the Eurozone. For the second day, the economic calendar has no important US economic data.