A state of cautious anticipation for the reaction from the most important event of this week, which is the European Central Bank’s announcement of its monetary policy at a time when the Eurozone needs historic measures to revive the economy from the COVID-19 effects. Interest in today's meeting increased after the recent measures by the US Federal Reserve to amend some targets in line with the changes imposed by this epidemic, as well as the recent strongest gains for the Euro in the currency exchange market. After hinting from the bank’s chief economist regarding the importance of the EUR/USD exchange rate, after the pair recorded its highest levels in more than two years last week, with the pair reaching the 1.2011 resistance last week. These comments heightened market fears that the Euro’s gains would not satisfy the bank nor its team because the Eurozone economy relies on exports, and the currency’s strength makes it less competitive. Rapid selling pushed the pair towards the 1.1752 support before the pair stabilized around 1.1830 at the time of writing.

From the United States, employers announced more jobs but hired fewer workers in July, sending mixed signals about the job market in the wake of the coronavirus outbreak. In this regard, the Department of Labour said that the number of vacancies in the United States on the last day of July rose to 6.6 million from 6 million at the end of June. A year ago, employers declared 7.2 million jobs. Employment decreased to 5.8 million from 7 million in June. The number of Americans laid off has decreased to 1.7 million from nearly 2 million in June.

By the end of last week, the government reported that the US economy created 1.4 million new jobs in August, down from 1.7 million in July and 4.8 million in June. The United States reclaimed just under half of the 22 million jobs lost when the pandemic hit the country hard in March and April, forcing businesses to close at least temporarily. And there were more than 2.9 million people who left their jobs in July, up from 2.6 million in June. The rise was unusual because people are usually reluctant to quit their jobs when the job market is weak but some people seem to stay home to avoid infection and others look after children who cannot return to school due to the pandemic.

The job listing site Indeed reported that job announcements in late August were 20% lower than the previous year, and it actually found that listings in hospitality and tourism companies were 47% lower last year.

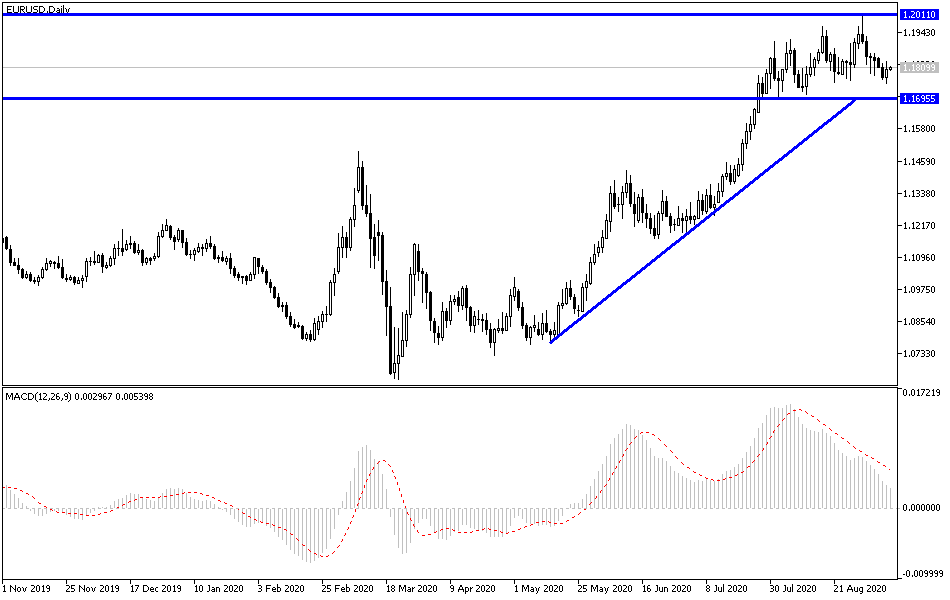

According to the technical analysis of the pair: On the EUR/USD daily chart, a break of the bullish trend occurred, and we previously indicated that the pair's move towards the 1.1760 support may interest the Euro investors to think about buying and that the 1.2000 psychological resistance will remain important for the return of bulls’ control over longer performance. I still prefer to buy the pair from every lower level and the closest support levels are currently at 1.1775, 1.1690, and 1.1600, respectively. The pair will be greatly be affected by the European Central Bank’s announcement of its monetary policy, followed by Christine Lagarde’s statements, at the time when the number of US unemployed and the producer price index reading, one of the inflation measuring tools in the United States, will be announced.