The EUR/USD pair did not enjoy last week’s gains, which reached its highest level in two years when it tested the 1.2010 resistance. Profit-taking Sales were quick and as a result, the pair retreated towards the 1.1780 support and closed the week’s trading around the 1.1840 level after the announcement of a variation in the US job figures for August. We expect a kind of stability until the European Central Bank announces its monetary policy decisions later this week. The importance of this meeting is due to increasing statements recently about the strength of the Euro in the currency exchange market, which negatively affected the path of reviving the Eurozone economy from COVID-19 effects, which is still affecting the European economy strongly despite containment attempts. The Financial Times reported that few ECB board members mentioned that the Euro's rise within the DXY index, and risks of other major currencies, is hampering the economic recovery in the Eurozone. During the past few weeks, there has been a sharp rise in the Euro price, which may be of concern if you have weaker demand, especially as the Eurozone is the largest open economy worldwide and is unusually dependent on global demand.

The pair has now slipped below the 100-hour and 200-hour simple moving average lines on the hourly charts. The recent sell-off has also pushed the pair near oversold levels for the 14-hour RSI. This may lead to a temporary rebound.

On the economic front, from the United States, the most prominent was details of the US Labor Department report, as the US economy and in the non-agricultural sector returned a total of 1.37 million jobs, while expectations indicated that 1.4 million people would be added. Average hourly wage growth for the month beat expectations of 4.5% at 4.7% (YoY) while the US unemployment rate was affected by 8.4% compared to the expected rate of 9.8%. The labor force participation rate for the month slightly exceeded the projected rate of 61.4% with a participation rate of 61.7%.

From the European Union, the retail sales figures for July missed expectations (YoY) of 3.5% with a change of 0.4%. Prior to that, the core EU CPI for August was lower than the 9-year year-on-year forecast of 0.9% with a change of 0.4%. The general consumer price index recorded a negative reading of -0.2%, less than expectations of 0.2% inflation.

Technical Outlook for EUR/USD: In the near term, it appears that the pair is trading within a slightly bullish channel on the hourly chart, and this indicates a slight short-term bullish tendency in market sentiment. The recent pullback has pushed the pair near the oversold levels of the 14-hour RSI. Accordingly, bulls will target short-term gains around 1.1843 or higher at 1.1902. On the other hand, bears will be looking for profits from a decline around 1.1747 or lower at 1.1697.

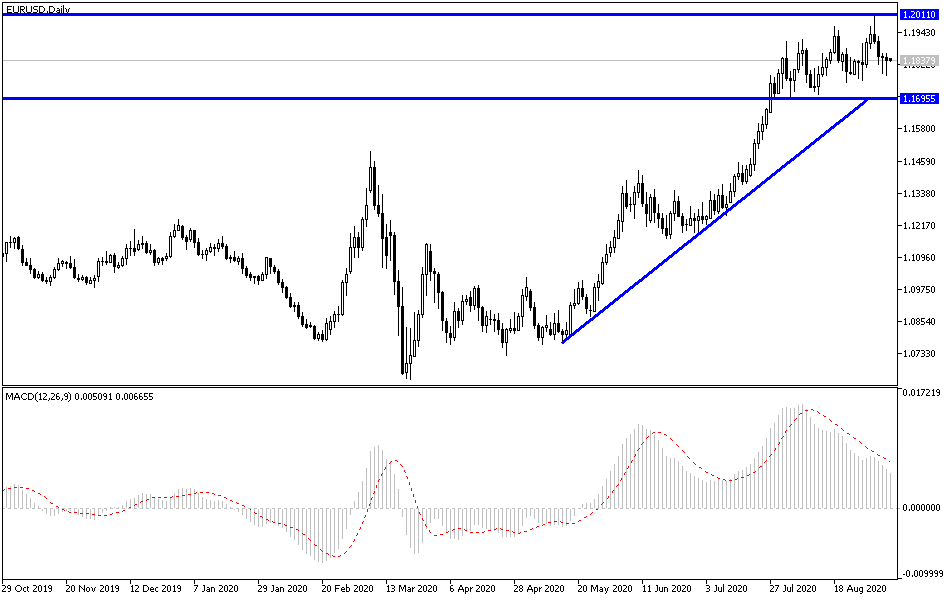

On the long term, and based on the daily chart performance, it appears that the EUR/USD is trading within a sharp upward channel. This may lead to a strong long-term bullish bias in market sentiment. The pair recently pulled back to avoid crossing over into overbought levels in the 14-day RSI. Accordingly, bulls will target long-term gains around 1.1948 or higher at 1.2104. On the other hand, bears will be looking to continue selling in order to target profits around the 1.1610 support or below at 1.1432.

As for the economic calendar data today: German Industrial Production and the Sentix investor confidence index in the Eurozone will be announced. There is a holiday for US banks.