Continuing the downward path of the EUR/USD pair, the pair fell to the 1.1731 support at the beginning of this week’s trading, its lowest level in more than a month, before stabilizing around the 1.1753 level at the time of writing and before the important testimony of US Federal Reserve Governor Jerome Powell Later today. The markets still want more clarity about the future of the bank’s policy, especially with the renewed increase in cases and deaths due to the Coronavirus and the Congress's failure to approve new stimulus plans for the US economy. What added to the pressure on the single European currency at the beginning of this week's trading was statements by European Central Bank President Christine Lagarde, in which she said that the European economy is recovering, but that the recovery is still uncertain and incomplete and depends on containing the outbreak of COVID-19.

European Central Bank President Christine Lagarde said in a joint meeting of parliamentarians from France and Germany yesterday that the data received indicated a strong economic recovery in the third quarter, that is, from July to September. But, she added, "the strength of the recovery is still largely uncertain, as well as its “variability and incompleteness" She added that "It remains highly dependent on the future development of the pandemic and the success of containment policies."

The European Central Bank is pumping 1.35 trillion Euros ($1.6 trillion) of newly printed cash into the economy through continuous bond purchases through the end of next year. This is a broad monetary stimulus designed to prevent the pandemic from causing turmoil in financial markets and to keep borrowing costs low for companies to help support growth. The European Central Bank is the main monetary authority for the 19 countries that use the Euro, such as the Federal Reserve in the United States or the Bank of England in Britain.

On the American side, efforts to craft a temporary spending bill necessary to avoid a US government shutdown at the end of the month fell back on Friday amid a battle to fund farms rescue that is a major priority for US President Donald Trump and Republicans on Capitol Hill. For his part, a spokesman for the House Appropriations Committee said that the measure, which his aides expected to be issued on Friday evening, will not be revealed until this week. This measure must be passed by the end of the budget year on September 30th to prevent non-essential government jobs from closing.

A tentative proposal by House Speaker Nancy Pelosi to allow Trump to continue giving agricultural money this campaign season in exchange for food aid to the poor was faced with severe turmoil by the Democrats in the House and Senate.

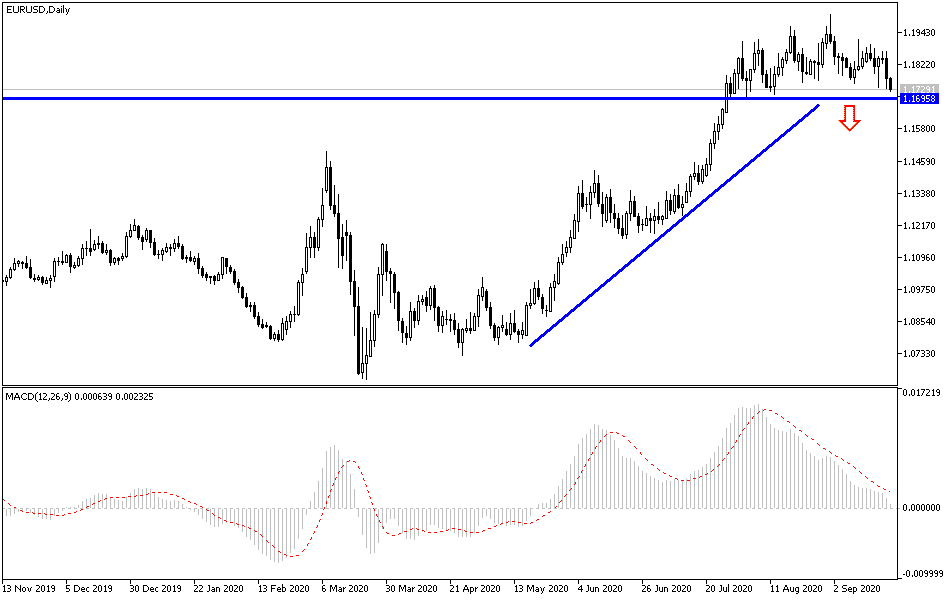

According to the technical analysis of the pair: The general trend of the EUR/USD pair is getting stronger and stability below the support level may push the pair towards stronger support levels, the closest of which are currently at 1.1745, 1.1680, and 1.1600, respectively. In general, I would still prefer buying the pair below the 1.1700 level. In return, there will be no real return to the bulls' control without pushing above the psychological resistance level at 1.2000, otherwise, the general trend of the pair will remain to the downside. Jerome Powell's statements this week will have a great impact on determining the direction of the pair in the coming days.

As for today's economic calendar data: Consumer confidence in the Eurozone, US existing home sales will be released, followed by testimony from Federal Reserve Governor Jerome Powell.