The EUR/USD pair succeeded in achieving a quick compensation for last week's losses. As we have previously expected, the continued abandonment of the USD may push the pair to the 1.2000 psychological resistance, which happened in the Tuesday’s morning trading hours. Euro’s gains are the highest in two years. The sell-off of the dollar against most of the other major currencies intensified after the Fed confirmed last Thursday that it would intentionally boost inflation above target and that interest rates would remain low around historical levels as price pressures rose. Previously, it was likely that above-targeted inflation would raise interest rates, but now the Fed says it will leave rates at their lowest levels to boost inflation above target in order to adjust past and current periods as the bank has failed to meet its 2% price growth target.

The policy shift was in line with what many analysts had been expecting, but indicated a further decline in "real" bond yields, or inflation-adjusted returns, that investors have achieved, widely referred to as being behind the declines in the dollar in recent months as well as late last week. Commenting on the pair’s performance, Andreas Steno Larsen, Chief Forex Strategist at Nordea Markets says, “The EUR/USD pair continues to knock on the door of the 1.20 high but has so far failed in every attempt before it gets (too) close. It may only be a matter of time before this happens, but the ECB will have a clear interest in the struggle, and it is in the short to medium term given that European inflation is still very fragile.”

Euro gains and losses against the US dollar helped lift the trade-weighted exchange rate in the Eurozone to the highs last seen in 2017, which represent headwinds of economic recovery in the Eurozone and outright risks to inflation expectations in the bloc countries. The strength of the single European currency means that the most important Eurozone exports are becoming less competitive and are also working to offset the same inflation pressures that the European Central Bank (ECB) is trying to bolster through its monetary policy.

Nevertheless, says Karen Jones, head of technical analysis for currencies, commodities, and bonds at Commerzbank: “The pair stabilizing above 1.2015 will provide room for further gains to 1.2635/66.”

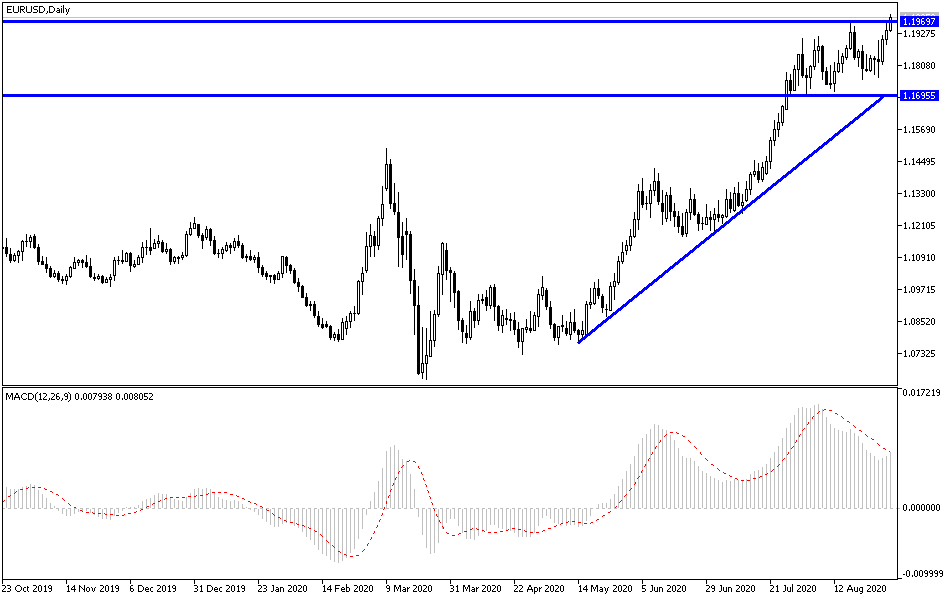

Some are not concerned about the economic impact of the strong Euro, although others, including Larsen of Nordia, believe that a final break above the 1.20 high is likely to incite intervention, albeit with rhetoric, from policymakers at the European Central Bank that may ultimately restrict the single currency of achieving more. The EUR bullish trend will remain strong as long as it is above 1.16 and the market is increasingly bearish in its dollar outlook, and the European Central Bank intervention may only mean that the EUR is lagging slightly behind other major currencies.

According to the technical analysis of the pair: The reversal of the general EUR/USD trend upwards strengthened by surpassing the 1.2000 psychological resistance. As I mentioned before, I now confirm that those gains have pushed the technical indicators into strong overbought areas and with that, awaits profit-taking selling and Forex traders might think about taking short positions from the resistance levels at 1.2050, 1.2120, and 1.2200, respectively. In return, bears will not regain control of the performance without breaching the 1.1770 support.

As for today's economic calendar data: The manufacturing PMI reading for bloc countries will be announced, followed by the rate of change in German employment and the Eurozone consumer price index. From the United States, the ISM manufacturing PMI and construction spending index will be announced.