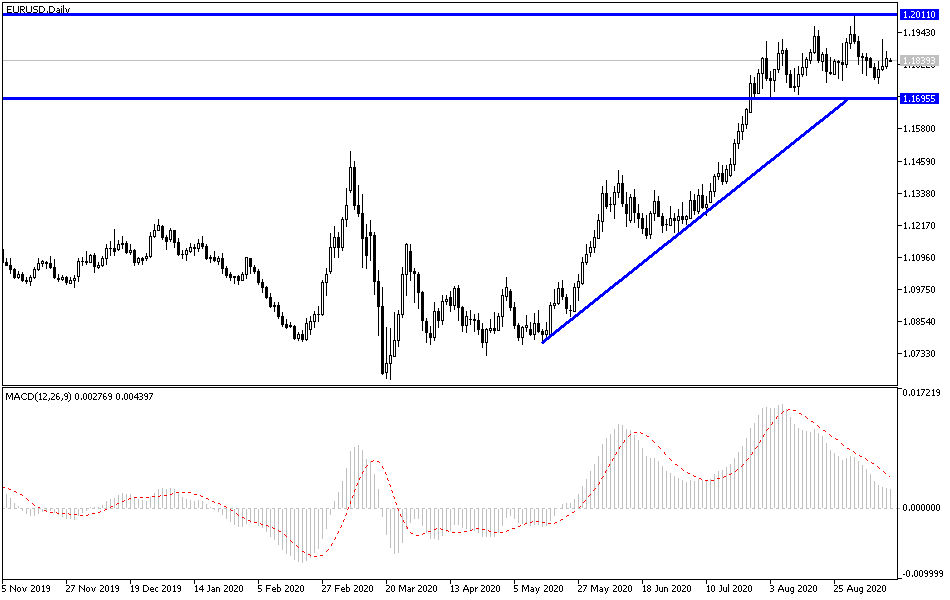

Since the middle of last week’s trading, the EUR/USD has been trying to correct up and regain its recent losses, which pushed it towards the 1.1752 support, starting from the 1.2010 psychological resistance, its highest level in more than two years, after hinting at the damage from Euro strength on the European economy. Attempts to correct upwards pushed the pair towards the 1.1917 resistance and settle around 1.1850 at the beginning of this week's trading. Forex traders and those interested in the main, the most prominent pair in this market, are waiting for the opportunity to achieve gains again, especially with the European Central Bank not worried about the strength of the Euro.

In this regard, chief economist at the European Central Bank, Philip Lynn, said on Friday that he and other policymakers will continue to carefully evaluate the information coming from the economy "including developments related to the exchange rate" because "the recent rise in the Euro exchange rate weakens inflation expectations" and as a result, "The size of the upward adjustment in core inflation has largely subsided due to the rise in the Euro exchange rate."

Lynn's role in the ECB is believed to be increasingly important not only because there is a receding pandemic that leaves economic devastation to a historic system but also because the newly installed ECB president is not an economist or financial expert. Christine Lagarde, the former head of the International Monetary Fund, is a lawyer who closely resembles Federal Reserve Chairman Jerome Powell. Philippe Lynn of the European Central Bank has reportedly “stressed” the central bank’s statements aimed at thwarting the Euro's rise.

Steven Gallo, European head of foreign exchange strategy at BMO Capital Markets, says the risk of a moderate policy error is increasing after Lagarde told reporters that there is no need to "overreact" to the strength of the EUR. "The more policymakers focus on the currency, the more the central bank will appear to undermine its message." Lynn's comments came after the European Central Bank effectively ignored a two-digit Euro appreciation that helped lift the trade-weighted currency by nearly six percent.

In general, the rise in the Euro price threatens to lower import and consumer prices in the Eurozone economy as inflation pressures have been insufficient for a long time. Besides, the strength of currencies could also weaken the competitiveness of exports and thus undermine the economy, although this, in addition to the exchange rate, is only important to the ECB to the extent that it prevents the ever-elusive target of producing inflation “close to, but lower”. From 2% ”.

According to the technical analysis of the pair: The return of EUR/USD stability above the 1.1900 resistance, will stimulate the bulls to push the pair back to stronger ascending levels, and the 1.2010 psychological resistance will remain important for the return of their control over performance. In return, the support at 1.1750 will remain important to complete the last downward path. All in all, I would still prefer to buy the pair from every downside. As for the major economic releases today, only the Eurozone industrial production rate will be released, and there is no significant US data today.