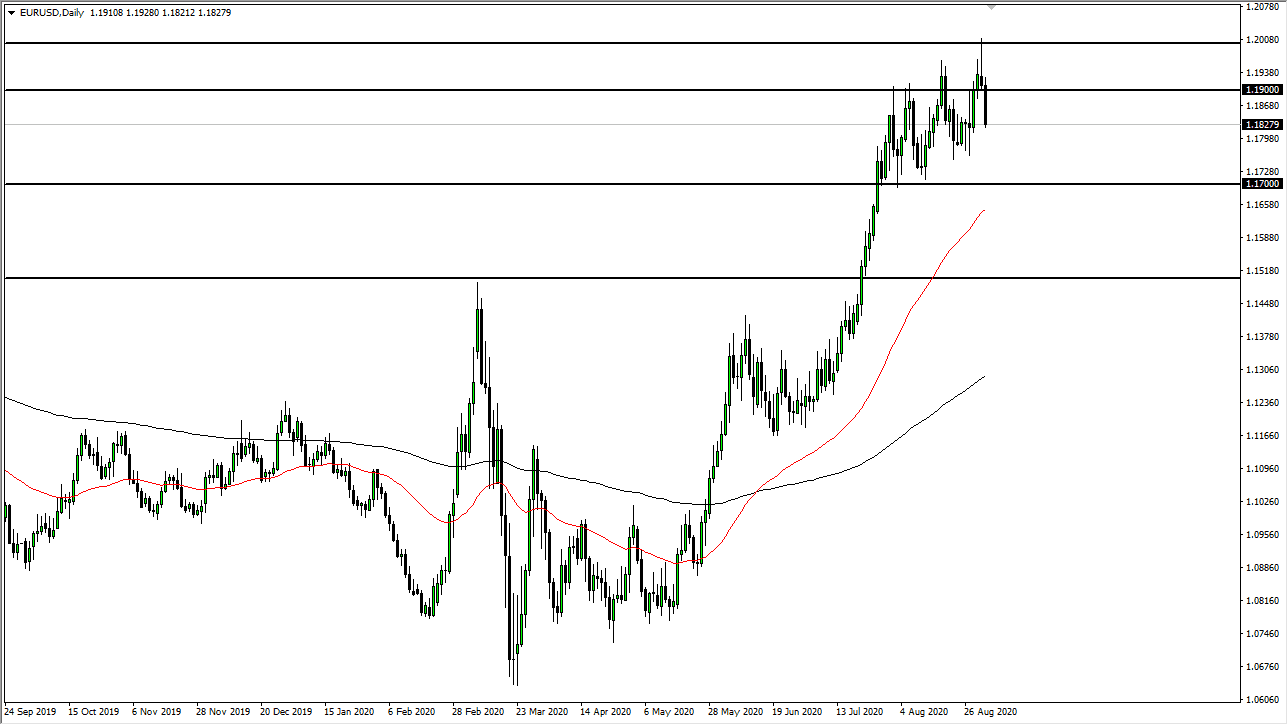

The Euro has broken down significantly during the trading session on Wednesday, as we have reached below the 1.1850 level. That being said, it is very likely that we will continue to see buyers jump into this market, based upon the structural attitude that the market has had for some time. The market continues to make higher highs and higher lows, so it is something worth paying attention to.

The significant pullback was from the psychologically and structurally important one point to zero level, and therefore it is not a huge surprise to see that perhaps a lot of stops had been tested in the short term. I think pullbacks at this point in time will more than likely offer buying opportunities, especially if the lows continue to grind higher, forming the up-trending channel. Ultimately, this is a market that I think will find a reason to go higher, even if it is based upon the jobs figure on Friday. I do not necessarily like the idea of shorting this pair, at least not until we break down rather significantly, and at that point, I would have to reassess the entire situation.

Currently, I see the 1.17 level as a massive support level that will continue to be attractive for value hunters. The 50 day EMA is sitting in that same area, so that could cause a bit of support as well. We have been in an uptrend for some time, so this makes quite a bit of sense. There is the up-trending channel but at this point in time, I think that is not as important as the 1.17 handle. Even if we break down below there, it is likely that we go looking towards 1.15 level after that. Both of those areas could be significant areas to look for value, so at this point, I have no interest in shorting this pair. Granted, I recognize that we cannot go straight up in the air, so I look at these pullbacks as natural and it is very likely we will continue to see more of a grind higher than anything else. Once we break above the highs from the Tuesday session, then the market is likely to go much higher, perhaps opening up the door to the 1.25 handle above.