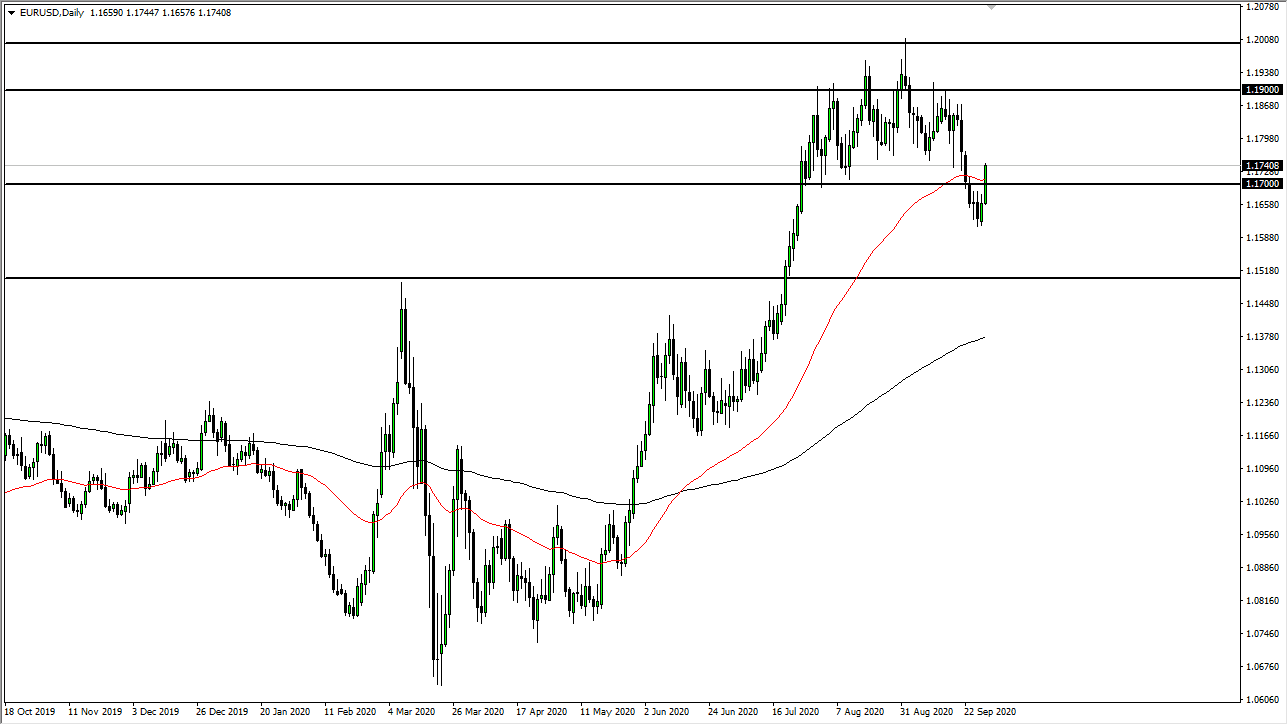

The Euro has rallied rather significantly during the trading session on Tuesday, slicing through the 50 day EMA but the market is facing a significant amount of resistance near the 1.1750 level, an area that is important on shorter-term charts. Ultimately, the area between 1.17 and 1.1750 level should continue to cause a lot of interest in this pair, so at this point in time, I think that we are still ripe for some type of selling pressure. After all, there are a whole host of issues with the Euro going forward that could cause problems.

The European Union has seen a rise in coronavirus figures, and that does not help the economic outlook of the continent. Beyond that, the European Union has to deal with Brexit, and nobody really knows how that is going to turn out. During the trading session on Tuesday, we got wind that Germany believes that a significant EU coronavirus relief package may take longer than anticipated. That caused a little bit of short-term selling in the Euro, but at the end of the day we still rallied. At this point, the market is going to be asking a lot of questions about the Euro and perhaps even more importantly the US dollar. What is interesting is that a lot of people are trading the US dollar-based upon the Federal Reserve and quantitative easing, but at the same time we see the bond markets telling us that the US dollar is not going to lose massive amounts of value.

At this point, if the Euro breaks down below the 1.17 level again, that would be a very negative sign. At this point, we could reach down towards the 1.15 handle underneath which is the measured move of the rounded top that has been down. You can also make an argument for the market testing a previous uptrend line, which means that we do not have that much further to go to the upside. Either way, we are likely to see a certain amount of exhaustion come into this market that people fade. It is a bit difficult to get overly excited about Euro right now, because there are far too many issues in the European Union that have yet to be resolved.