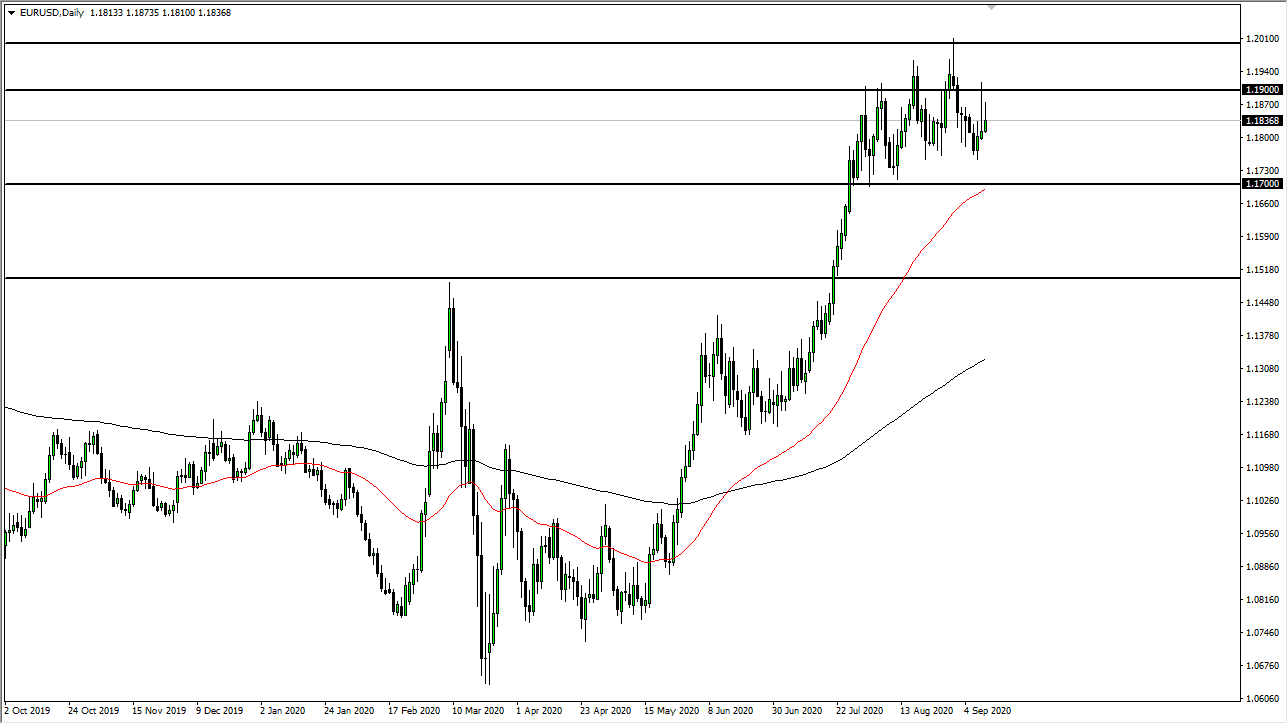

The Euro has rallied significantly during the trading session on Friday, just as we did on Thursday. However, just like on Thursday we sold off from the highs as it looks like the buyers of the Euro cannot hang on. As I look at this chart, it is starting to look more and more “tired”, so I think that perhaps a pullback might be in the works. The most obvious support level just below would be the 1.17 handle, where we have the 50 day EMA heading towards currently. After that, then we have the 1.15 level offering significant support as well due to the fact that it is not only structurally important but psychologically as well.

On the upside, the 1.20 level continues to be a massive target and could be a massive resistance barrier that if being broken could send this market much higher. That could in fact kick off a move towards the 1.25 handle which is a longer-term target of a lot of pundits out there. However, the last couple of days certainly will not have done much to boost confidence, even though the ECB suggested that they were not paying close attention to currency pairs right now, the Euro could not hang onto the gains above the 1.19 level. With that in mind, I do think it is probably only a matter of time before this market breaks down again. The question is not necessarily whether or not we are still in an uptrend, but whether or not we need to pull back in order to continue the bullish momentum. It is very possible that is the case, so having said that I think that the market has a real risk to the downside currently, but the 1.17 level should attract enough attention to at least make an attempt to save the Euro.

All of that being said, it appears that the global economy is struggling and the coronavirus cases are picking up again in the European Union, which might be part of what being reflected on this chart. Nonetheless, it is obvious that there is an absolute ton of resistance above the 1.19 level extending all the way to the 1.20 level. Getting above there would be a major victory for the buyers, but I think that is something that is going to take quite a bit of time to occur.