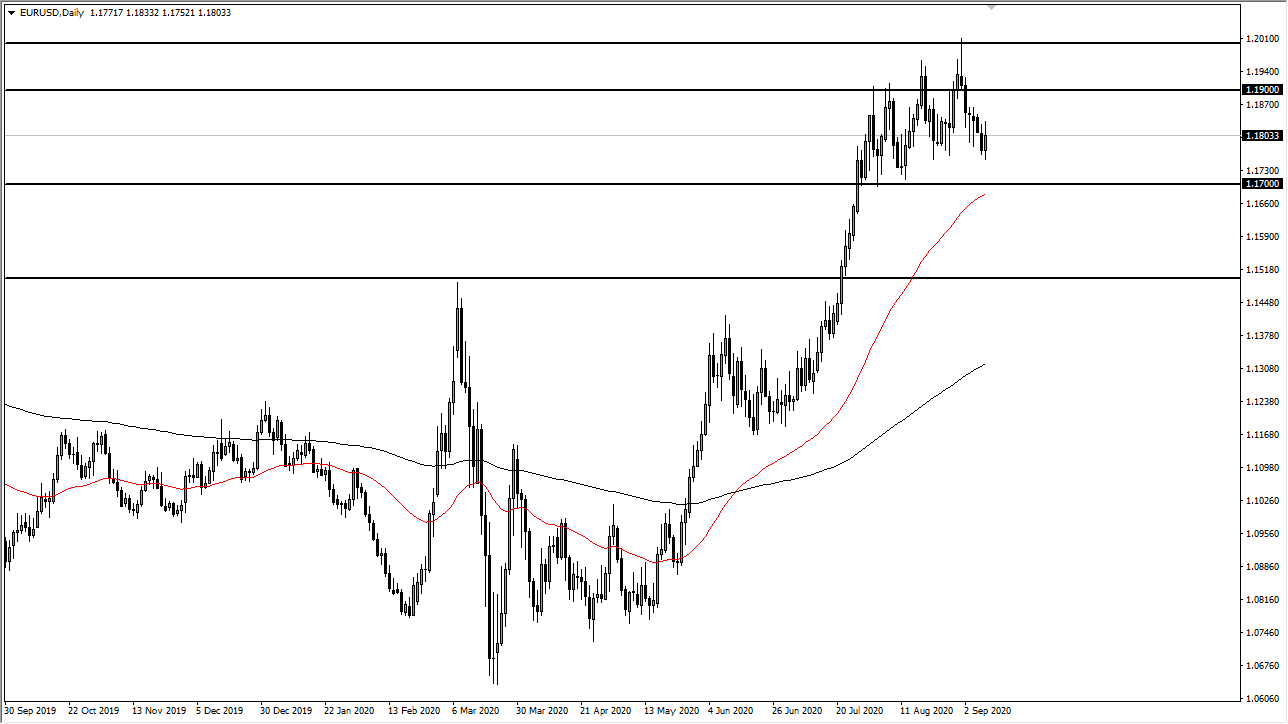

The Euro has bounced quite nicely during the trading session on Wednesday, but we have the ECB meeting on Thursday that will certainly put a lot of volatility into this market. That being said, I would be very cautious about putting money to work in this pair for at least the next 24 hours. At the very least, we need to see a break above the top of the candlestick for the trading session on Wednesday in order to suggest bullish behavior, but even then, I would be very cautious with this market and would use about half my normal position size.

If we do fall back down, and that is very possible because let us be honest here: the ECB wants the Euro to go lower. The economic conditions in the European Union have been deteriorating as of late, so that could have the market reaching towards lower levels as well. The 1.17 level underneath would be massive in its importance, not only do to the large, round, psychological importance of the handle, but also that the 50 day EMA is sitting in that area. With all that being said, the market is likely to see a lot of interest in this area, and therefore I think it is going to take quite a bit of negativity to breakthrough here. If we do break down below the 1.17 level, then it is likely that we go down towards the 1.15 level underneath. That is an area that obviously is crucial from a longer-term standpoint based upon psychology and was an area where we had seen a massive breakout. The Euro is being very choppy but that is nothing new as it is one of the choppier and noisier currency pairs to trade.

If we break above the 1.20 level, then it could open up the move for much higher levels, but I think we are a bit exhausted, and it certainly looks as if it is starting to “tilt lower.” Unfortunately, that is not necessarily a sell signal, it is just an observation. Shorter-term traders will probably be looking to fade rallies that show signs of exhaustion, but with the ECB coming up in the next several hours, just about anything could happen. Caution will be needed, as volatility seems to be very high in most markets that show anything along the lines of risk appetite.