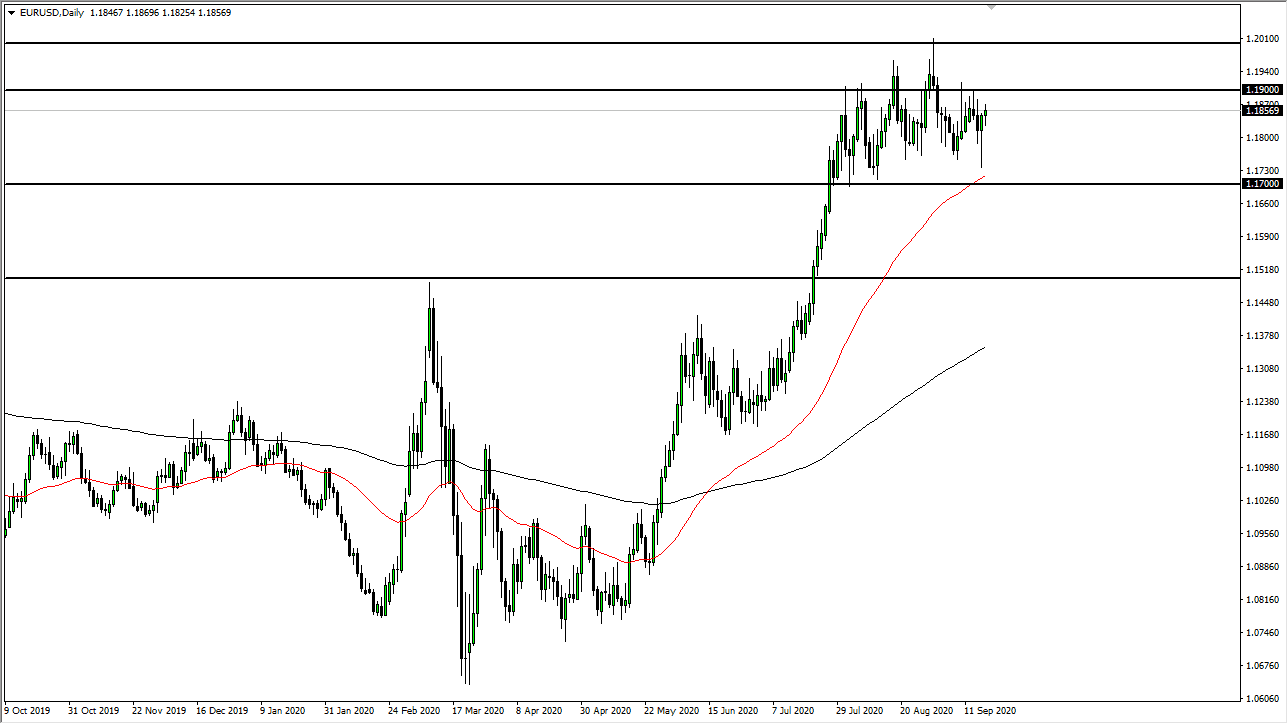

The Euro has gone back and forth during the trading session on Friday but at this point, it looks as if it is still struggling with the idea of the 1.19 level above, which has offered significant resistance. This is a market that I think will continue to see a lot of volatility because there are a lot of moving pieces right now out there that could cause people running to the safety of the US dollar, or selling it for that matter.

I believe that there is a significant amount of resistance starting at the 1.19 level that extends all the way to the 1.20 level. The 1.20 level is the gateway to much higher pricing, but we have not been able to break above there quite yet and therefore I think it is obvious that there is a ton of resistance there. If we do break above the 1.0 level, then the market is likely to go looking towards 1.25 handle from a longer-term perspective.

On the other hand, the market was to break down below the 1.17 level underneath, then it could open up a move down to the 1.15 handle. We are starting to see the US dollar push back a little bit, and that could cause quite a bit of choppiness. The market is currently bouncing around between the 1.17 level underneath, and the 1.19 level above. I think that short-term trading continues to be the best way forward, and it is worth noting that recently the highs continue to get lower, while the low on Thursday with lower than we had seen for some time. I think at this point we are about to get some type of impulsive candlestick that sends this market either higher or lower, so you should be on the lookout for it. In the short term, you need to keep an eye on the two levels mentioned previously, because they have been so important for so long. At this point, the Euro looks a bit tired, so it will be interesting to see how this plays out over the next couple of sessions. Until I see something different, I am simply trading it back and forth but recognizing that a bigger move is only a matter of time.