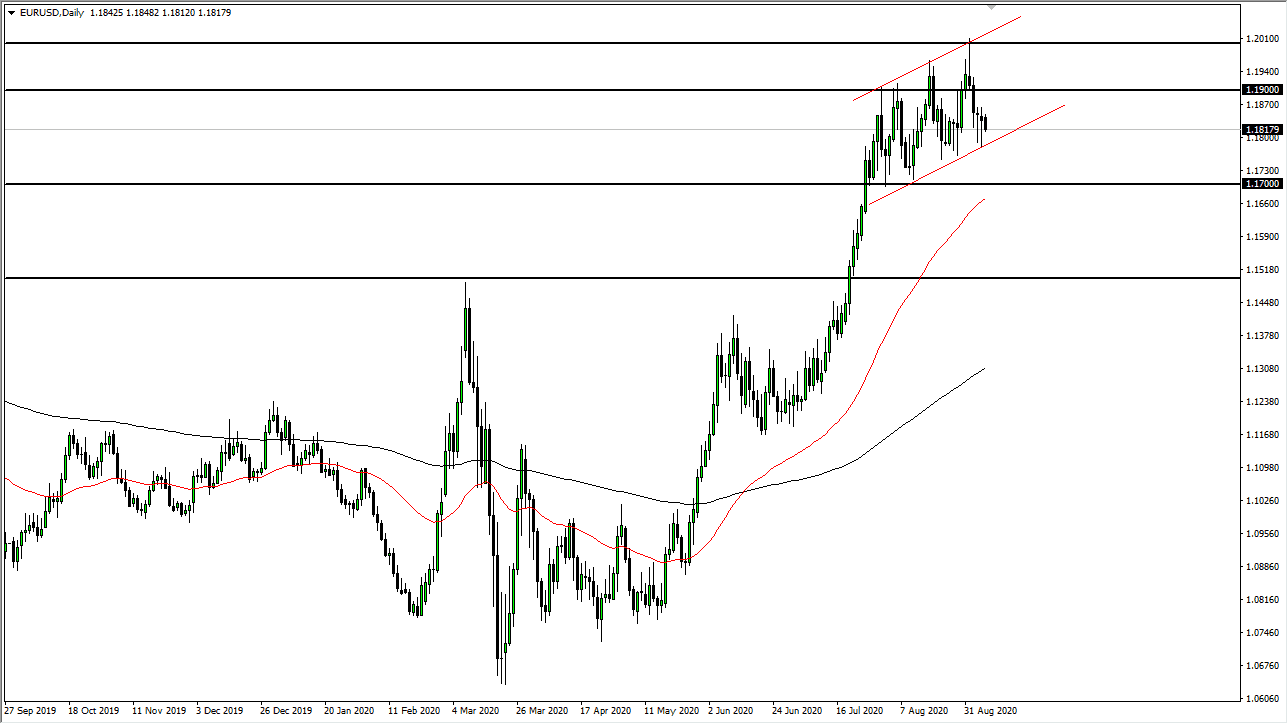

The Euro has pulled back a bit during the trading session on Monday, but you should keep in mind that it was Labor Day in the United States so therefore there was a serious lack of liquidity during at least half of the session. Ultimately, this is a market that I think will continue to grind higher, but we should be paying attention to the bottom of the last couple of candlesticks because we have formed a couple of hammers, which is a very bullish sign. There is also an uptrend line just underneath so that something worth paying attention to as well.

As long as we can continue to find buyers on dips, this is a market that I think eventually takes off to the upside, perhaps reaching towards the 1.20 level yet again. Ultimately, this is an area that will cause significant resistance, so it will probably take multiple attempts to finally break out above there. We are in an uptrend and channel, so that is something to pay attention to as well. That being said, if we do break down below this uptrend line, then we need to start to pay attention to some other possibilities.

The 1.17 level underneath will be significant support, and a break down below there would kick off even more selling. This probably would be important due to a “risk-off” type of scenario, so it is worth paying attention to what happens in the global markets overall. I think that the only thing that you can do at this point in time is to grind higher, at least until the market tells you that it is going to do something different. The Federal Reserve continues to work against the value of the greenback’s which makes quite a bit of sense that we would see this pair continue to flex its muscles.

Adding more credence to the idea of the 1.17 level as being supported is the fact that the 50 day EMA is coming into that area. While nothing is 100% guaranteed, the 1.18 level does seem as if it has been offering significant support as of late, so that is also something that you should be taking heed of when looking at the chart, and as a result, it does still appear as the uptrend is still very much intact.