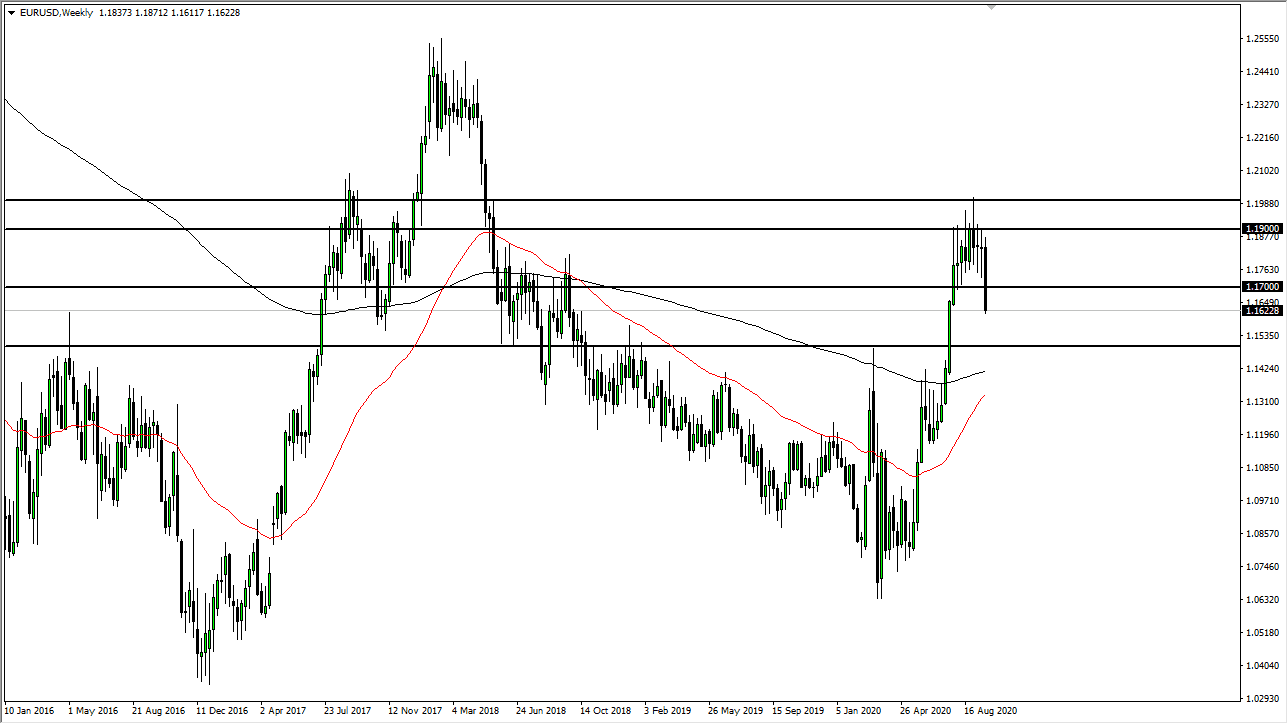

We have been in an uptrend for some time, so the question is not so much as to whether or not the Euro will continue to fall, just where will we find buyers? It certainly looks as if we will probably get some continuation in this pair, because quite frankly it is closing towards the very bottom of the candlestick. A little bit of a bounce, and then further selling pressure will probably present itself.

As you can see on the chart, it certainly looks as if we have some negativity ahead of ourselves. However, the 1.15 level is an area that a lot of people will be paying attention to so I think this will more or less be a “sell the rallies” type of scenario in the early part of the month, perhaps changing later. The US dollar has been strengthening quite a bit against a lot of currencies right now, so that should not be a huge surprise that it would show this type of strength against the Euro.

Keep in mind that the European Union is currently struggling with worse coronavirus figures, so that is going to continue to weigh upon the market as well. That being the case, I think that you probably need to see cheaper prices to get long at this point. Somewhere between the 1.15 level and the 200 week EMA, roughly the 1.14 level, should offer enough interest for traders to get involved. I do not necessarily think that we have seen the last of the “sell the US dollar trade”, but we probably need a bit of a recovery from the massive selloff that we had seen. This market had gotten a bit parabolic, so it does make quite a bit of sense that we need to sell it off in the short term. If we were to sell below the 1.13 level, that could collapse this pair completely, and as far away as it sounds, that would only be roughly 50% of the move that we had made from the bottom. Keep in mind that the Federal Reserve will do everything it can to drive down the value of the US dollar and given enough time we will see that come into play as well.