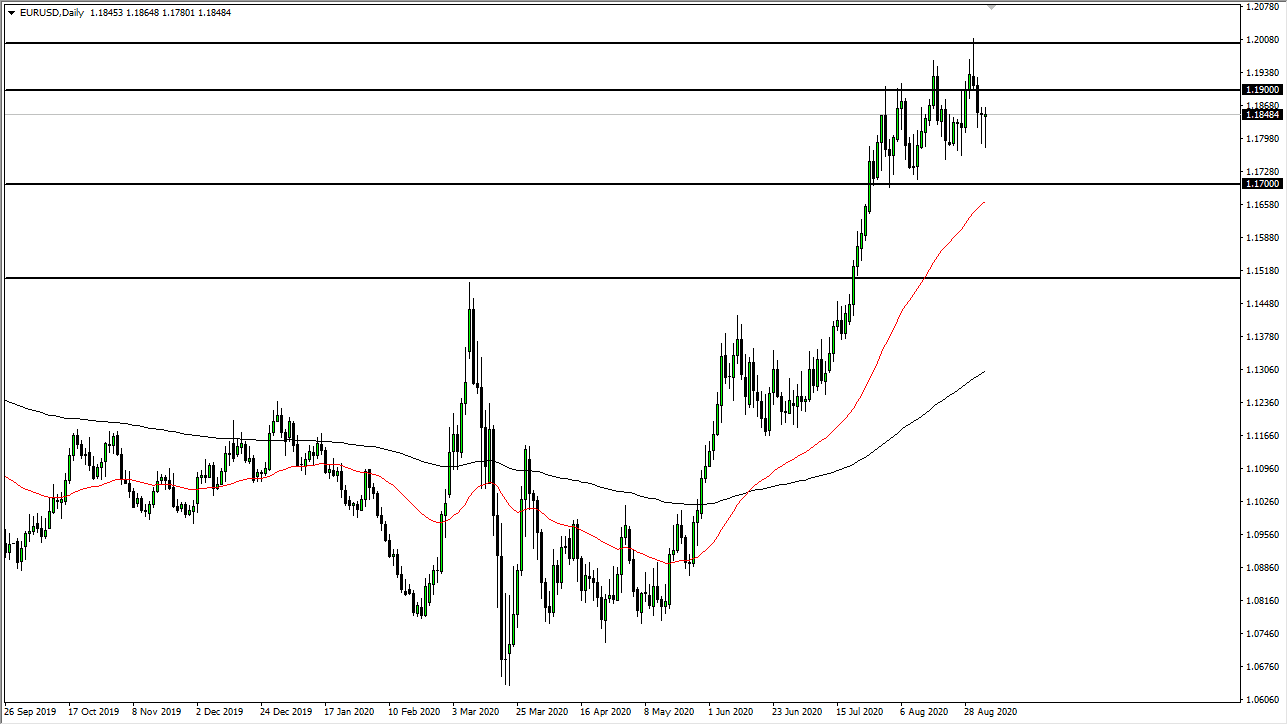

The Euro fell again during the trading session on Friday, but just as we had seen on Thursday, sellers got beat back near the 1.18 level. From the bottom, the market recaptured 50 pips or so, forming a hammer for the second day in a row. Ultimately, the market has seen quite a bit of noisy trading, but at this point, I think what we are going to see is more of a back-and-forth type of market, due to the fact that we had gotten a bit ahead of ourselves.

When you look at the recent trading, we have been rallying in an uptrend and channel, which shows plenty of strength. That is a nice setup, because it is so obvious. If we were to break down below the candlesticks over the last couple of days, then the market probably goes looking towards the 1.17 level underneath, which is a massive support level and a large, round, psychologically significant figure. Not only do we have the large figure there, but we also have the 50 day EMA sitting just below there as well.

With the Federal Reserve flooding the marketplace with liquidity that means that we are going to see more and more US dollars “printed”, and that helped other currencies rally, including the Euro. At this point, we are looking at the 1.20 level above as a major barrier, and it is going to take a couple of times to turn things around and smash through there. If we can break above the 1.20 level, then the market will more than likely go looking towards the 1.25 handle. A lot of bigger money managers are calling for that figure, so will have to see whether or not we get there. Nonetheless, it certainly looks as if the market is trying to do that move, so I still like the idea of buying dips.

If we do break down below the 1.17 level, it could open up a move down towards the 1.15 handle underneath. That is a big “midcentury figure” that will attract a certain amount of attention. This does not mean that the market goes there, just that the area will almost certainly be a significant support level. The market is likely to see more bullish pressure than anything else, so having said that I do like the idea of buying dips.