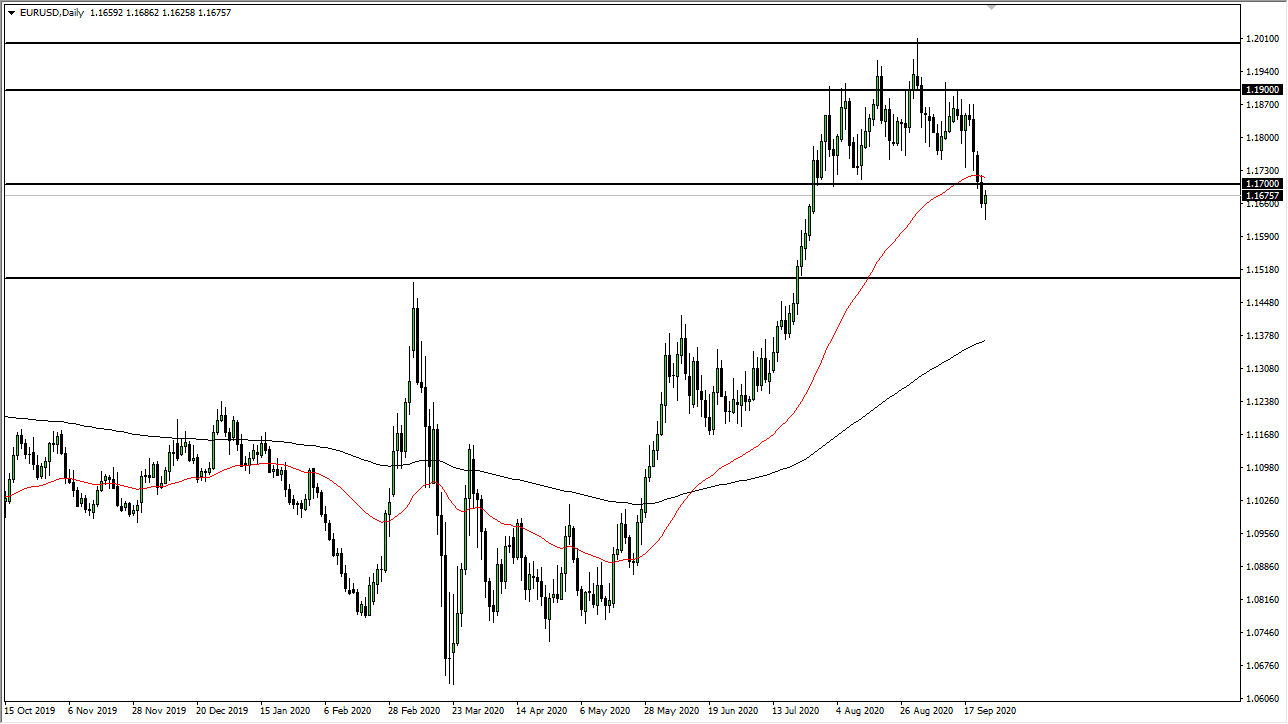

The Euro has pulled back a bit during the trading session again on Thursday but then turned around to show signs of strength later in the day. Perhaps this was a bit of short covering, as the US dollar was overbought but the 1.17 level above is obvious resistance that I think a lot of people will be paying close attention to. With that being the case, I think somewhere between there and the 1.18 level we will see a lot of selling pressure. At this point in time, I more than willing to fade rallies and I do think that the Euro it has bigger problems ahead of it. Ultimately, I think that we are going to continue to see a lot of concerns out there when it comes to the global economy, and therefore it makes quite a bit of sense that the markets will be looking to pick up US dollars “

Ultimately, this is a market that I think goes looking towards the 1.15 handle given enough time. That does not mean that we will get the occasional bounce, just that we have the high likelihood of a bigger move to the downside as we have cleared the 1.17 level and of course the 50 day EMA. The candlestick does look somewhat supportive, but as we head into the end of the session, it looks like any short-term bounce will probably be sold into. That is essentially how I am playing this market; I am fading rallies that give me an opportunity to pick up “cheap dollars.”

We have recently broken down below the bottom of a “rounded top”, and therefore the technical signal is most decidedly bearish in the short term as well. In fact, that pattern suggests that we are going to have a 200 point drop from the recent drop, also lining up for a move to the 1.15 handle. With that being said, I think that if you are willing to write out volatility you can stay short, or you can re-short the market every time it bounces. It is not until we break above the 1.18 level that I would be concerned about the downtrend, and this is one of those scenarios where we could see a significant acceleration to the downside if we get fear enter in the market again.