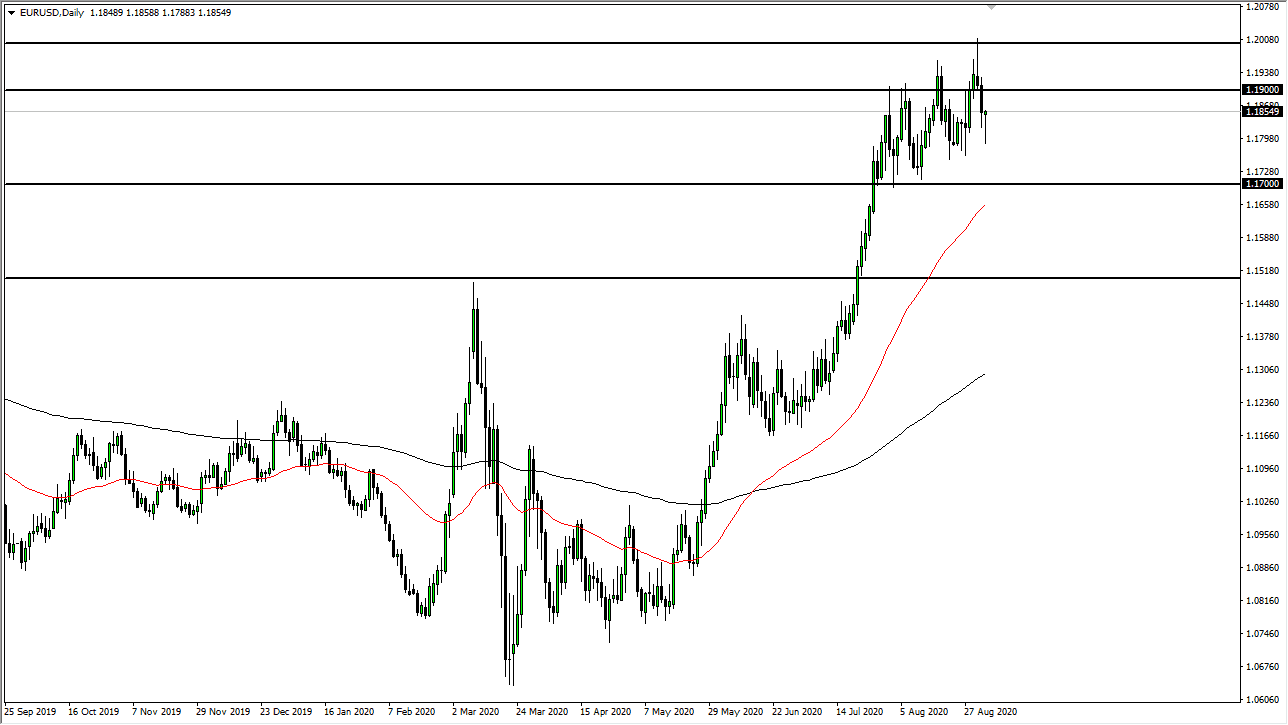

The Euro fell hard for the last couple of days, but the Thursday session was interesting as we turned around and recovered enough to form a massive hammer. This is a very bullish sign, and I think that the Euro continues to build up steam in order to make a serious challenge on the 1.20 level. That being said, I do not have any interest in trying to get too cute with this, I am simply going to be looking at the up trending channel that we are currently stuck in, and I recognize that the easiest way to trade the market is to simply go along with whatever it is trying to do. At this point, it looks like the market is trying to do what it has been doing for the last several weeks, channel to the upside.

To the downside, the bottom of the candlestick for the trading session on Thursday should be supportive, and most certainly the 1.17 level underneath should be as well. This is a market that is trying to break out above the 1.20 level, and that is going to take a lot of effort. We are grinding as hard as we can to get above there, and eventually it looks like the markets will eventually break through. Once they do, it is very likely that the market goes looking towards 1.25. This is a major breakout just waiting to happen, and as long as the Federal Reserve continues to step on the gas it is likely that the US dollar will continue to lose strength.

Unlike the European Union, the United States does not seem to have a coherent plan to fight the coronavirus, so that is part of what has been working against the US dollar as well. Economic numbers in the European Union are not exactly strong, and the ECB of course will not like the fact that the Euro is above the 1.20 level, but with everybody betting against the US dollar it is likely that we will continue to see this pair rise higher anyways. It is not just here, but it is also against other currencies as well.

Even if we did break down below the 1.17 level, I think there is plenty of support underneath at the 1.15 level as well, so it is only a matter of time before the buyers will return. A lesser some major fundamental difference, this remains a “buy on the dips” trading vehicle.