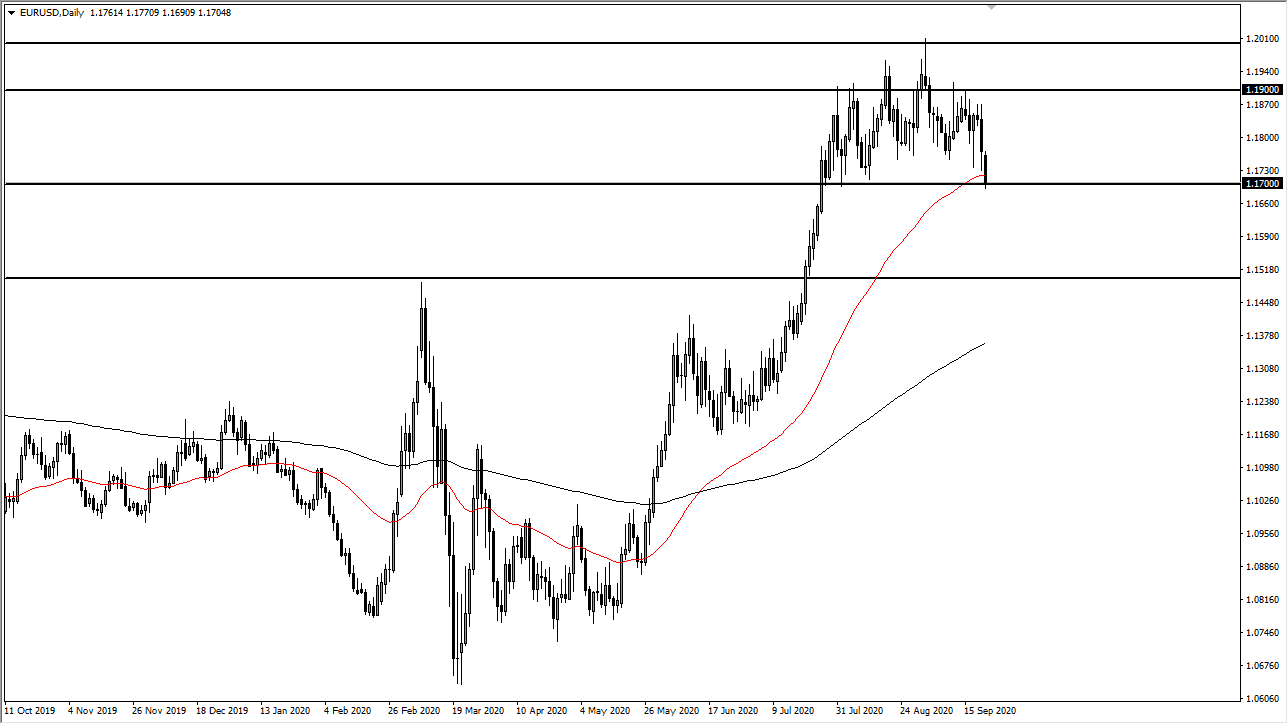

The Euro has broken down significantly during the trading session on Tuesday, reaching down towards the 1.17 handle, and even poking through at one point. When you look at this chart, it is very easy to see that we are forming a topping pattern, which is roughly 200 points tall. If that is going to be the case, then it makes quite a bit of sense that we will go looking towards 1.15 level underneath as it is the “measured move.”

The 50 day EMA has been sliced through and will attract a certain amount of attention. This is why I am going to wait until we break down below the bottom of the daily candlestick for Tuesday to start selling, but for me it is obvious that this market continues to struggle to go higher, and you can make an argument for a “rounding top”, one of my least favorite patterns but it is one that appears occasionally. If this does kick-off to the downside, then we need to start thinking about where we go later, not only just the 1.15 handle but where this comes into play when it comes to the 200 day EMA as well.

We are closing towards the bottom of the candlestick, so that is bearish as well. Short-term rallies should continue to be selling opportunities, at least until something changes when it comes to the US dollar in general. If we break above the top of the candlestick for the Tuesday session, then it would be very bullish but even then I think I would be looking at the 1.1850 level as an opportunity to start selling again.

It is actually not until we break above the 1.20 level on a daily candlestick that I would be convinced of the efficacy of the rally, and it is worth noting that the coronavirus numbers in the European Union are starting to increase again, and there is talk about possibly shutting down the continent. If that is going to be the case, then it obviously will favor the greenback as well. I think there are a lot of things going on at the same time that could pressure this market to the downside, so ultimately it is at a very important level to pay attention to right now, and we could get a big move soon.