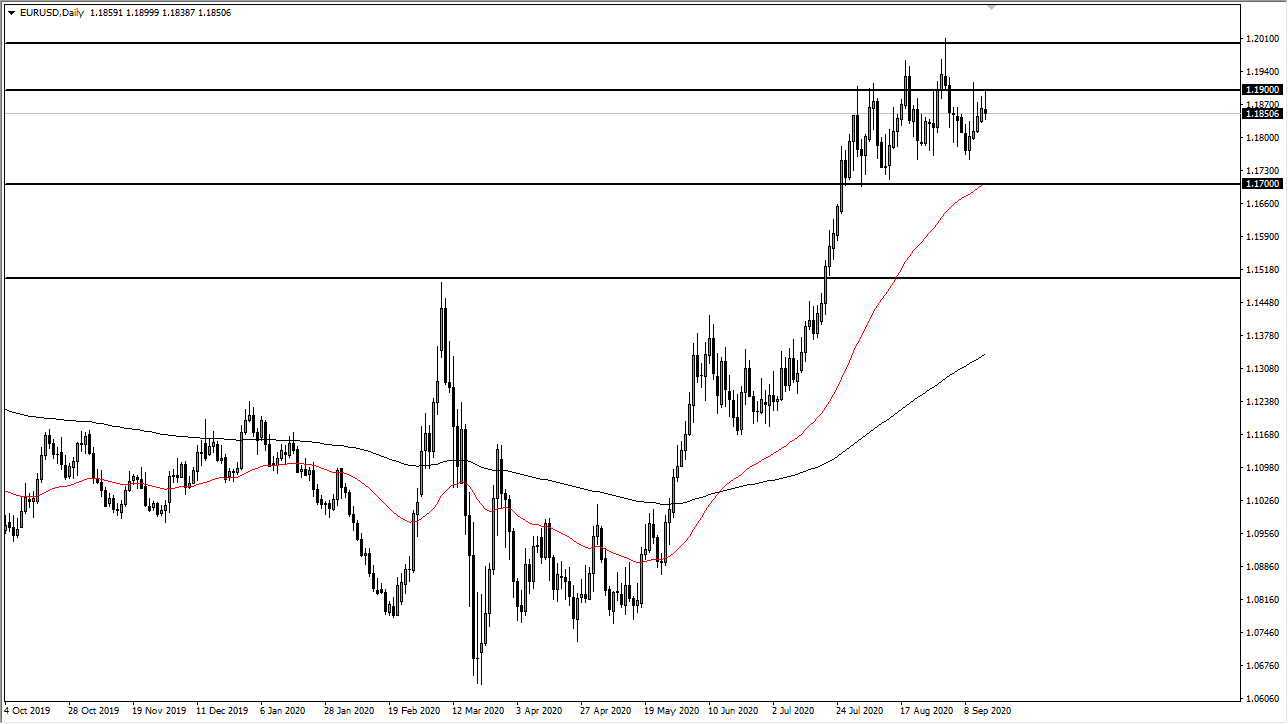

The Euro rallied during the trading session on Tuesday, reaching towards 1.19 level again. However, the market could not break above there for any significant amount of time, so we turned around at that level and start selling off again. By the end of the day, we have formed a bit of a shooting star, so this suggests that perhaps we are going to see this pair will rollover.

To the downside, I believe that the 1.18 level would be the first target, followed by the 1.1750 level, and then the 1.17 level which has been important more than once. I do not necessarily think that we are going to see some type of major meltdown, but to me, it is clear that this market is getting exhausted. After all, we have gone straight up in the air over the course of just a few weeks, so the market needs to settle back down. The shape of the candlestick is something to pay attention to as it is a shooting star, and that will capture the attention of a lot of technical traders.

If we were to turn around and break above the 1.19 level, it would be a bullish sign, but the reality is that above the 1.19 level we have seen a lot of selling pressure that extends all the way to the 1.20 level. In fact, I think that is a major resistance barrier for the market overcome. If we were to break above there, that could send this market much higher, perhaps reaching as high as 1.25 over the longer term. I think it is only a matter of time before the market has to make a longer-term decision, and even though I do believe that the Federal Reserve may get its desire for a lower US dollar, we may have some consolidation and perhaps even strengthening of the greenback ahead of us before that does happen. The 50 day EMA is sitting at the 1.17 level, so that is something to pay attention to as well. If we were to break down below there then the market is likely to go hunting the 1.15 handle, which was a major level previously as well. Looking at this choppy behavior, it is worth noting that the most recent high is lower than the one before it, which is almost always a negative sign.