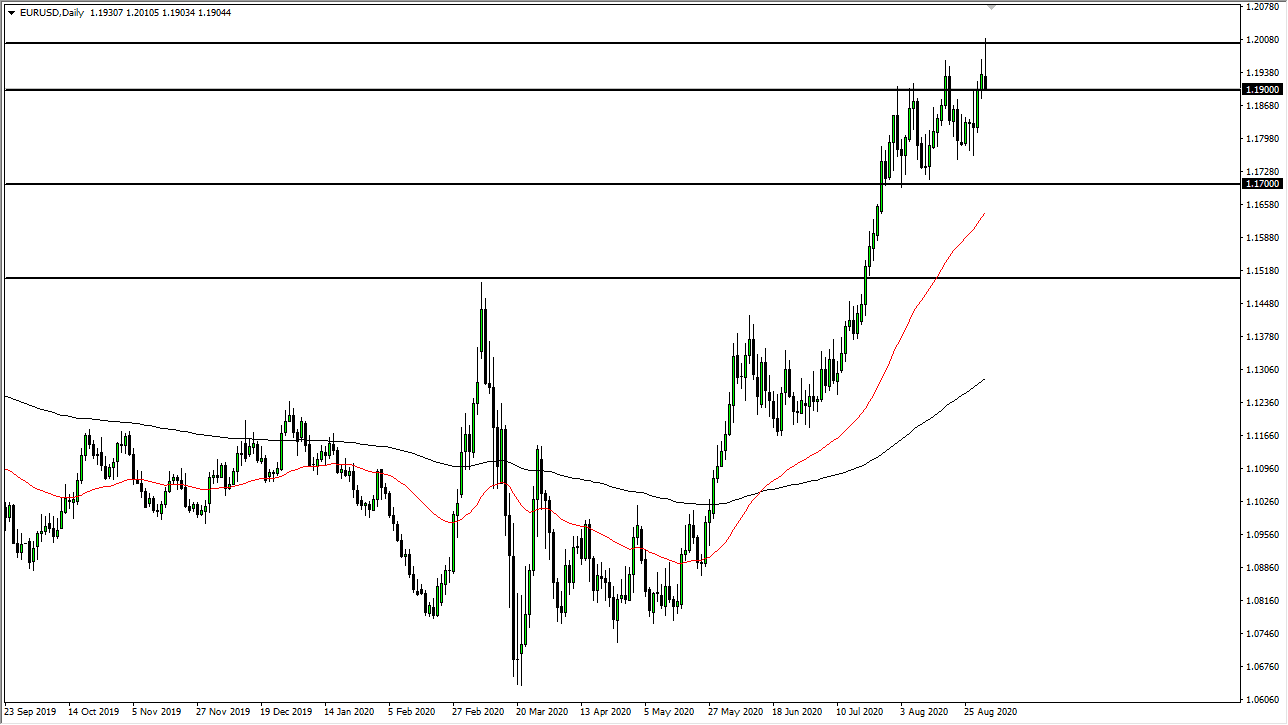

The Euro initially shot higher during the trading session on Tuesday, reaching towards the 1.20 level. That is an area that has been on my mind for a while, and I think a lot of traders out there are also paying attention. There was a large barrier just waiting to happen there, and it clearly took hold of the US dollar during the trading session on Tuesday. In fact, we ended up forming a very ugly shooting star at the top of a range that makes quite a bit of sense for bearish traders to be excited about. However, I am not one of them as I am not bearish overall.

I recognize that the 1.19 level is significant support, so it is worth paying attention to but if we break down below there it is likely that we will then go looking towards 1.18 handle. We have been grinding higher for some time, forming “higher highs” while we have also been forming “higher lows.” That is the very definition of an uptrend, despite the fact that we have formed the perfect candlestick at the perfect place. All of a sudden we see some type of massive run to the US dollar, I just do not see how this pair breaks down more than for a pullback. I am looking for support underneath to take advantage of, so I will probably wait until we get a daily candlestick to take advantage of.

Keep in mind that the Friday session features the job number, and therefore people will probably be a bit cautious ahead of it. Nonetheless, I think it gives us an opportunity to set up for a bigger move. If we get some type of job number that shocks the markets and might be the catalyst to finally break above the 1.20 level handily. If we do, that opens up a move towards the 1.25 handle. In the meantime, I think this is simply a “buy on the dips” type of situation, as the 1.17 level looks very likely to be the absolute “floor in the market.” The 50 day EMA is also reaching towards that area, so I think it is also going to come in and reinforce that handle as a potential floor.