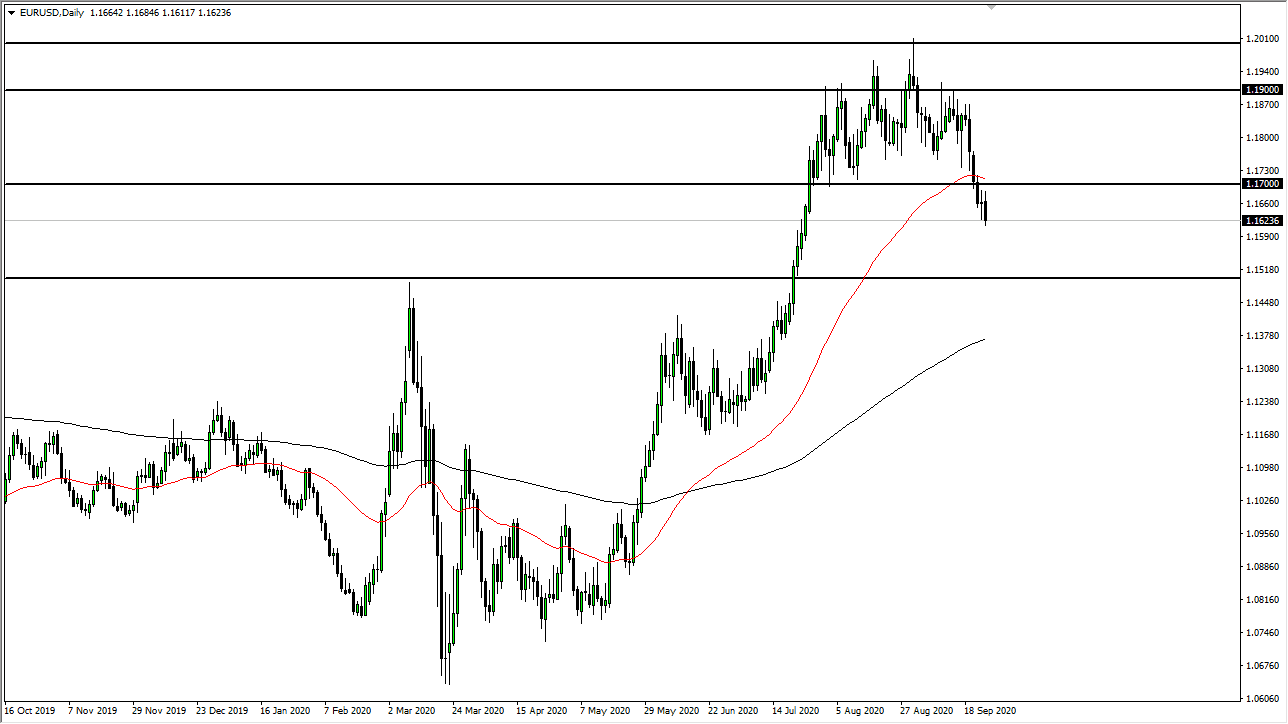

The Euro initially tried to rally during the trading session on Friday but gave back the gains rather quickly as we reached towards the 1.17 level. At this point, I think we are likely to see a lot of back-and-forth trading, but with an emphasis on the downward momentum. The 1.17 level should offer plenty of resistance going forward and therefore think it is only a matter of time before sellers will return to push this pair lower.

Europe is suffering at the hands of less than impressive economic figures, and of course the coronavirus is clearly starting to take its toll on the continent as well. With that in mind, I believe that fading short-term rallies will continue to work in the Euro, as the US dollar will be favored due to the safety aspect. Furthermore, the United States seems to be getting a lot of the virus under control and that helps the markets as well.

The 1.17 level also features the 50 day EMA sitting just above at offering resistance, so there is yet another technical reason to think that the sellers will return. I do not have any interest in trying to get too cute with this in trying to buy dips, rather I am looking to fade rallies that show signs of exhaustion. When we get down to the 1.15 level, I will reassess the entire nature of the market, but it is clearly starting to favor the US dollar against most currencies, especially in this case as the Euro has so many other headwinds involved. Remember, we are still dealing with Brexit, and that of course is going to cause a lot of issues when it comes to the European Union.

The US Treasury market continues to attract a lot of foreign inflows, and therefore it is worth noting that the US dollar will probably continue to strengthen. After all, this past week we had seen a record bid for seven year notes. These are all priced in US dollars obviously, so it does drive up the demand for the greenback. Over the longer term, I think a lot of questions will be asked at the 1.15 handle, and I think we need to get there in order to asked them. As far as buying is concerned, I would need to see the 1.18 level taken out to the upside and I just do not see that happening. Yes, we are oversold in the short term, but look at any rally as an opportunity to pick up “cheap dollars.”