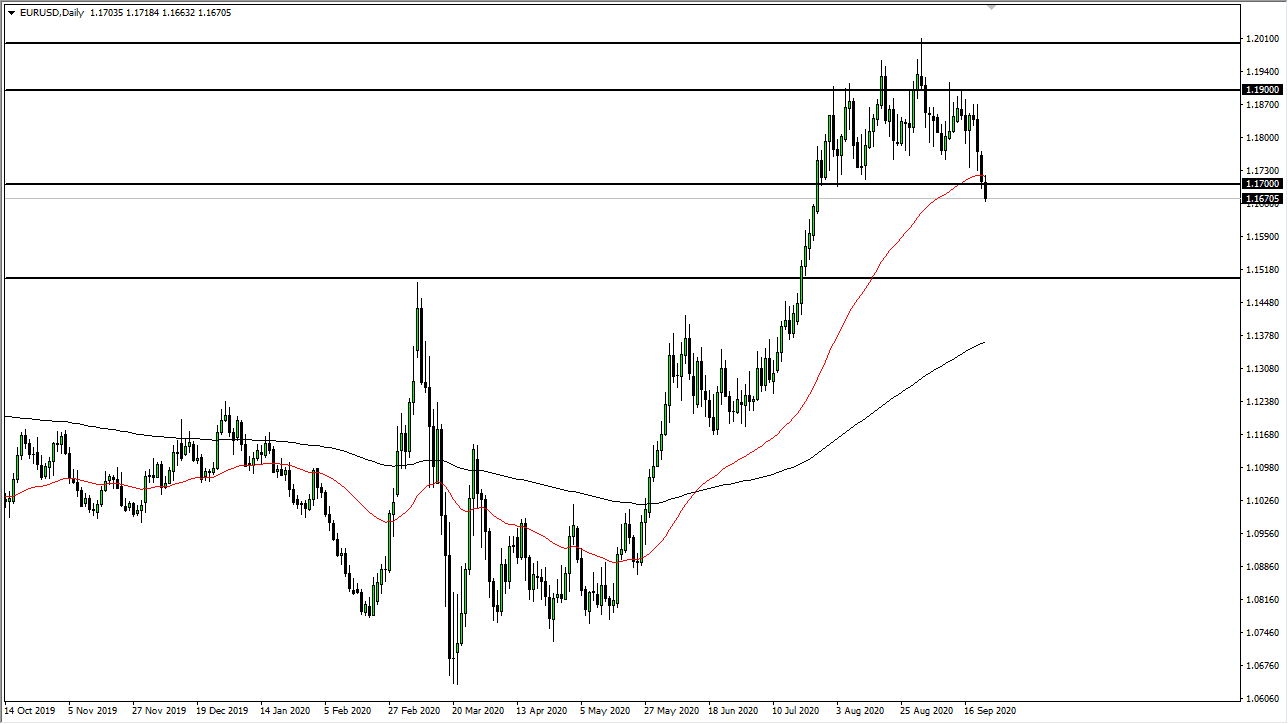

The Euro has initially tried to rally during the trading session on Wednesday, but then broke down from the 50 day EMA to show signs of massive negativity. As we have broken below the 1.17 handle, and now it looks like we are ready to go much lower. With this being the case, I do think that it is only a matter of time before we see market participants try to drive this pair down towards the 1.15 handle.

Now that we have completed the “rounding top” and looks like we could go much lower. I going to be fading rallies going forward, and it is most certainly a time where we are going to continue to fade short-term rallies that show signs of exhaustion. Given enough time, I do believe that this is a market that will at the very least go looking towards the 1.15 handle, which could line up with the 200 day EMA. Alternately, if we did turn around a break above the 50 day EMA we could see this market go much higher, but I believe that the 1.18 level is now going to serve as a bit of a “ceiling” in the market.

The “rounding top” measures for a move down towards the 1.15 level as well, and as a result I think a lot of technical traders will be pressing this issue as well. With all that being said, I have no interest in trying to get too cute, and I do recognize that there will be significant amount of volatility going forward. I believe that the trading session on Wednesday was almost certainly a turning point, at least for the intermediate term and it is worth noting that the US Dollar Index has been trying to turn around for a while now. The Wednesday session was the inflection point that finally got things rolling.

Looking at this chart, the 1.20 level above is obvious resistance, and I believe at this point in time it continues to be the intermediate ceiling in the market. To the downside, if we were to break down below the 1.15 handle, that could get things looking rather ugly as well. Ultimately, this is a market that I think has made its intentions known ultimately, and therefore it is obvious that we are going lower given enough time.