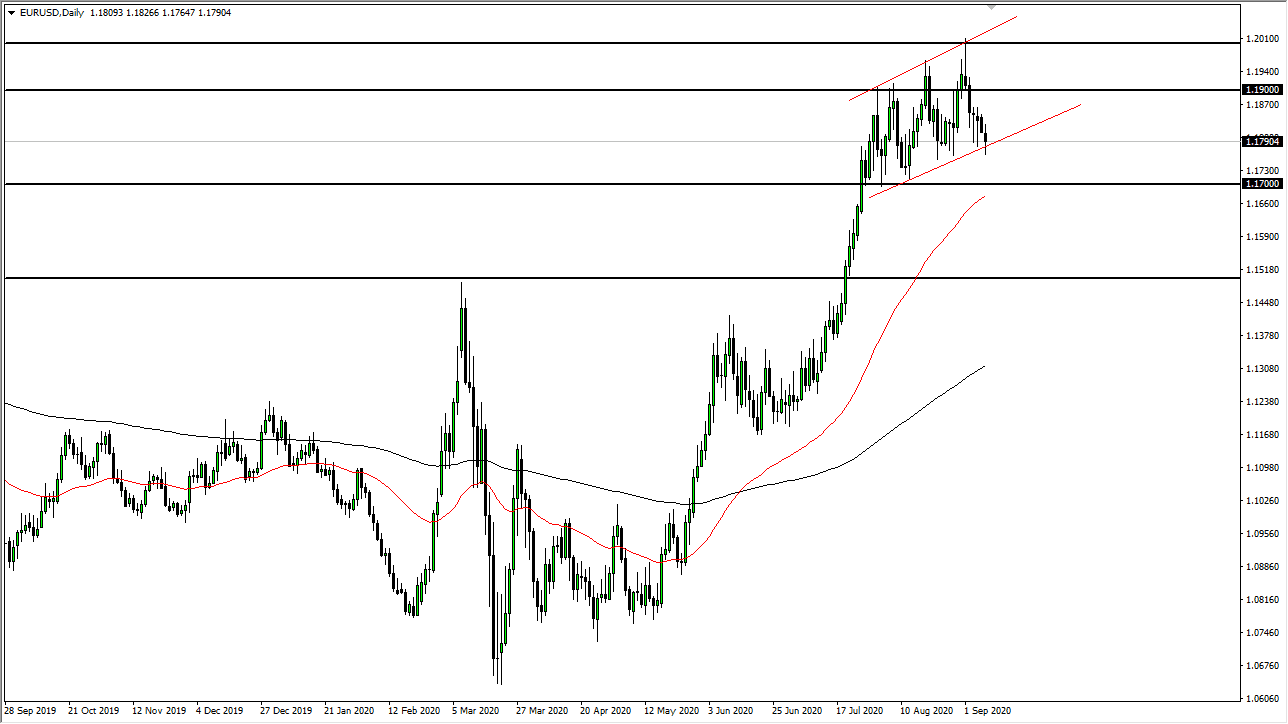

The Euro initially tried to rally during the trading session on Tuesday, but as you can see, it fell a bit to break down through a trendline. By doing so, the market looks like it is trying to break down towards the 1.17 level underneath which is structural sideways support. Furthermore, there is a lot of interest in the idea of the 50 day EMA in that general vicinity as well, so although this is a relatively negative move over the last several days, there still are areas where the Euro could come back in and save itself.

Having said all of that, the ECB has a meeting this weekend to question whether or not they will do something or say something to suggest even more dovish behavior. If they do, that might kick this pair right over the edge in order to break down even more significantly. There are a lot of questions as to what the ECB will do because it is kind of a poorly kept secret that they do not like the idea of the EUR/USD breaking above the 1.20 level. If that is going to be the case, then you have the possibility of a “ceiling” in the market. There are a lot of moving pieces right now, and just about anything is possible. That being said, I would expect to see a lot of noise in this market and it certainly looks as if the US dollar is oversold from a technical point of view. When you look at the US Dollar Index, it is trying to bounce from a major weekly trendline.

Going forward, if we do break down below the 1.17 level, it could be a massive breaking apart of the trend, and we could go looking towards the 1.15 level. There are so many moving pieces right now and the one thing that you should do is bring down your position size because you could find yourself in a lot of trouble. What is interesting to pay attention to is that a lot of professional traders have come back from vacation, so one would have to wonder whether or not we are starting to see the beginning of something bigger? Multiple risk appetite influenced markets all went in the same direction, so at this point, one has to wonder whether this is not going to start some bigger move.