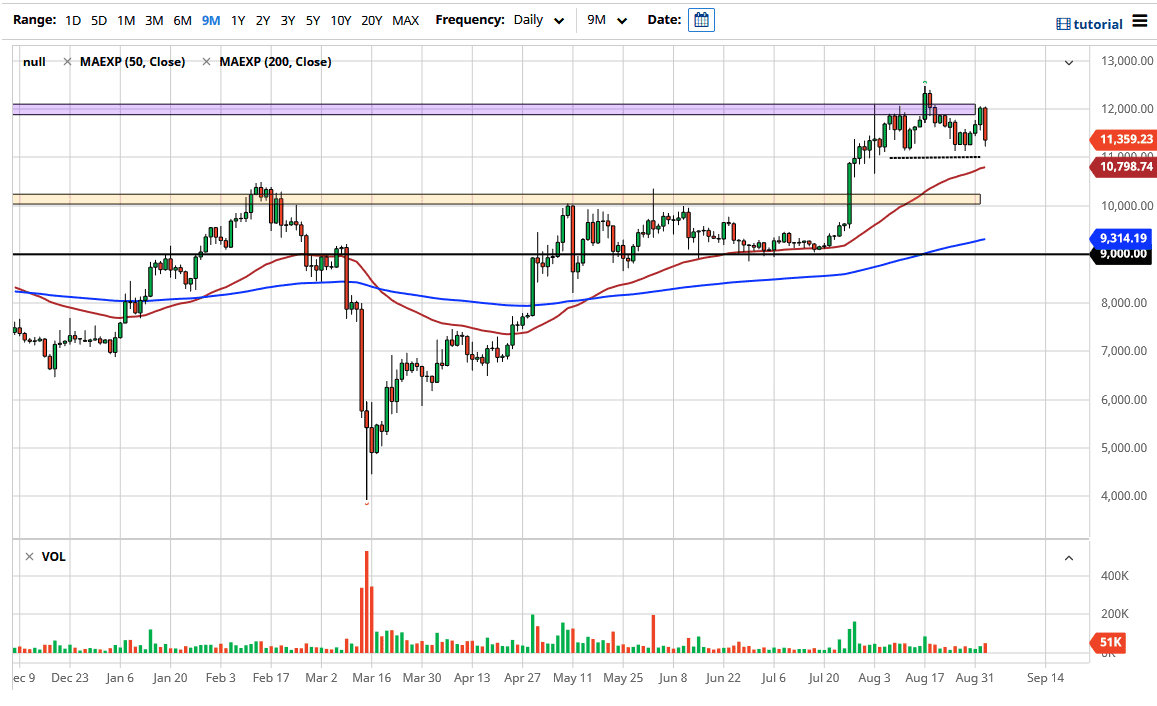

The bitcoin market got absently crushed as it touched the $12,000 level, as we have reached down towards the 11,300 level during the day. This is a market that continues to see a lot of trouble at the $12,000 level, so one has to keep that in the back of their mind when the next position is put on. After all, it is obvious that we have seen a massive amount of pressure in that general vicinity, so therefore I think is going to take something significant to finally break above there. However, if we were to finally break above there then the market is likely to take off to the upside.

In the meantime, it looks as if the $11,000 level will continue to offer a significant amount of support as we have seen the market bounce from there a couple of times. Furthermore, the 50 day EMA is starting to reach towards that area, and it is likely that there would be a certain amount of technical support based upon that. Having said that, the market could find sellers jump in and push this market down towards the $10,000 level. I know this will irritate a lot of people, Bitcoin and gold are trading in the same way, and for the same reason. The Federal Reserve loosening monetary policy will continue to drive down the value of the US dollar, and it should continue to give a little bit of a lift to both of these commodities. Bitcoin has become a commodity, or at least it looks like it trades like that.

To the upside, if we were to clear the $12,000 level on a daily candlestick, then it is likely that we would go looking towards the $12,500 level, and then possibly even the $13,000 level. If we break down below the $10,000 level, the next major support level will be the 200 day EMA, and then the $9000 level. I think at this point we are likely to see the Bitcoin market move back and forth in $500 increments, and it looks quite confused at the moment. Having said that, it is worth noting that the most recent high was a little bit lower than the one before it, but not markedly so, so I think this is more indicative of a sideways market than anything else.