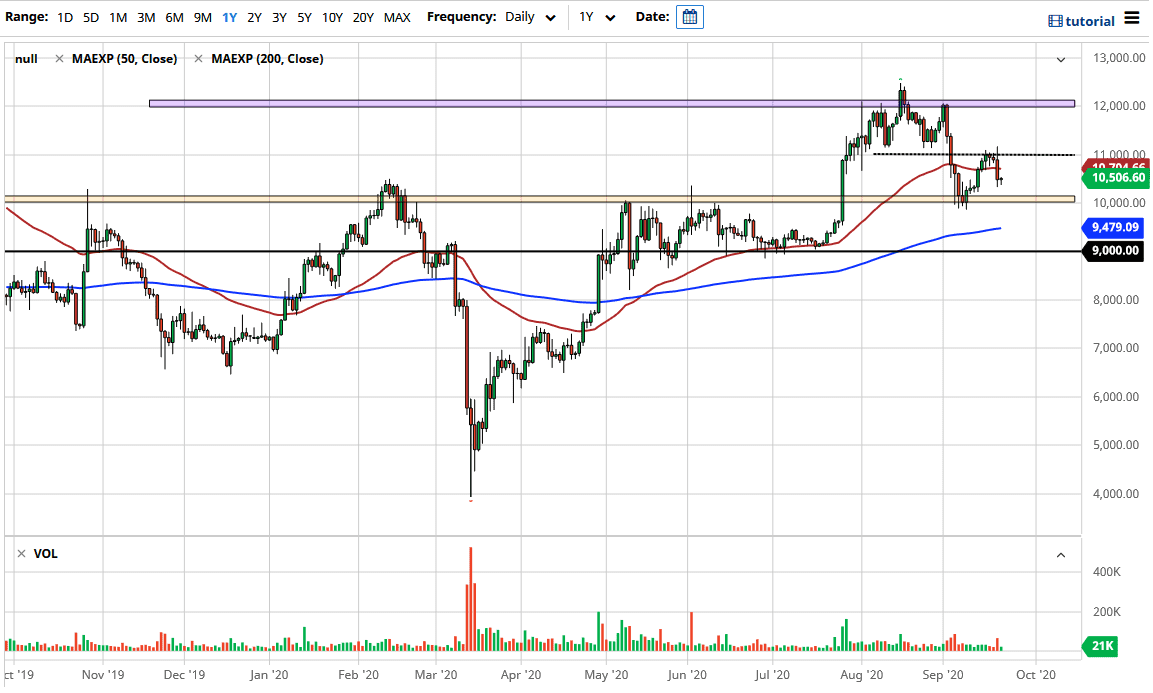

The bitcoin market has dipped slightly during the trading session on Tuesday, as we continue to see a lot of confusion. Ultimately, this comes down to the fact that the US dollar was all over the place during the trading session, so that did not help the situation. The $10,000 level underneath should continue to offer support based upon psychological support and previous resistance. At this point in time, it looks as if the buyers will jump in and try to push this market to the upside, perhaps reaching towards the $11,000 level.

Bitcoin is likely to see a lot of volatility due to the fact that the US dollar is all over the place. If we break above the top of the candlestick from the trading session on Monday, then it is likely that we go looking towards the $12,000 level. That has been a massive resistance, so it does make sense that it will be a bit of a magnet for price. The question is whether or not we can break above there? If we were to break above, there then it is likely that Bitcoin would continue to go much higher. Having said that, I think that we are going to bang around in this overall range, but if we were to break down below the $10,000 level it is likely that the market could go down towards the 200 day EMA, which is closer to the $9500 level. Under there, the $9000 level is even more structurally supportive, but at this point, I think the one thing you can count on is a lot of noise more than anything else.

It is worth noting that the candlestick from Monday was horrible, so until we wipe that out there is going to be a certain amount of concern and fear out there. The longer-term Bitcoin traders continue to be bullish in general, so there is always somewhat of a bid for this market. The only thing that we can take away from this is that the US dollar is going to be extraordinarily influential and would need to pay attention to the fact that this is a currency pair, not just the Bitcoin market. If the US dollar is falling, then that should help Bitcoin. Of course, the opposite is true so keep an eye on the US Dollar Index.