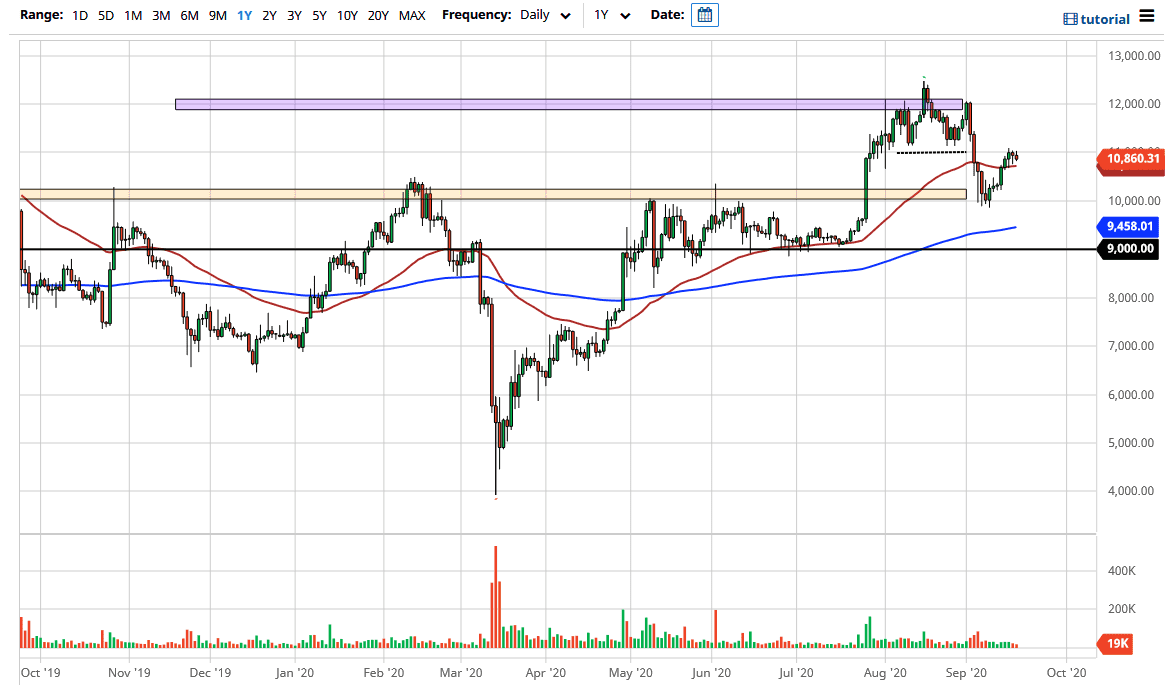

Bitcoin markets have fallen a bit during the trading session on Friday, as we try to get above the $11,000 level. That is an area that has been a bit resistive in the past, so it would make a certain amount of sense that the market would continue to look at it as important. It has even been supported, so this is a lot of “market memory” just waiting to happen.

Underneath, we have the 50 day EMA and that is an area that a lot of technical traders will pay attention to. In fact, it has offered support for the last four trading days. Because of this, we are essentially bouncing back and forth between the 50 day EMA and the $11,000 level, and it certainly looks as if we are trying to make a decision in one direction or another. If we break down below the 50 day EMA, then it is very likely we returned towards the $10,000 level, maybe $10,250 as both of those are areas that could attract a certain amount of support. Ultimately, if we break above the $11,000 level on a daily close, then it is possible that we go looking towards the $11,500 level, and then the $12,000 level which has been so resistive.

Heading into the weekend, liquidity will drop, as we have seen very little in the way of volume over the weekends recently. However, a lot of this is going to come down to the US dollar and whether or not it is rising or falling. This makes perfect sense because the Bitcoin market is all based around getting away from fiat currency. When you trade Bitcoin, you are essentially betting on the US dollar going down in value, and therefore it is important to pay attention to the US dollar in the traditional currency markets. Currently, it does look like the US dollar is trying to find its footing, and if that does in fact happen to be the case, it will work against the value of Bitcoin. Alternately, if the US dollar continues to slide a bit, then it is likely that Bitcoin will continue to reach towards the $12,000 level, and possibly even higher than that. As the market has matured, it has become more of a currency market than anything else.