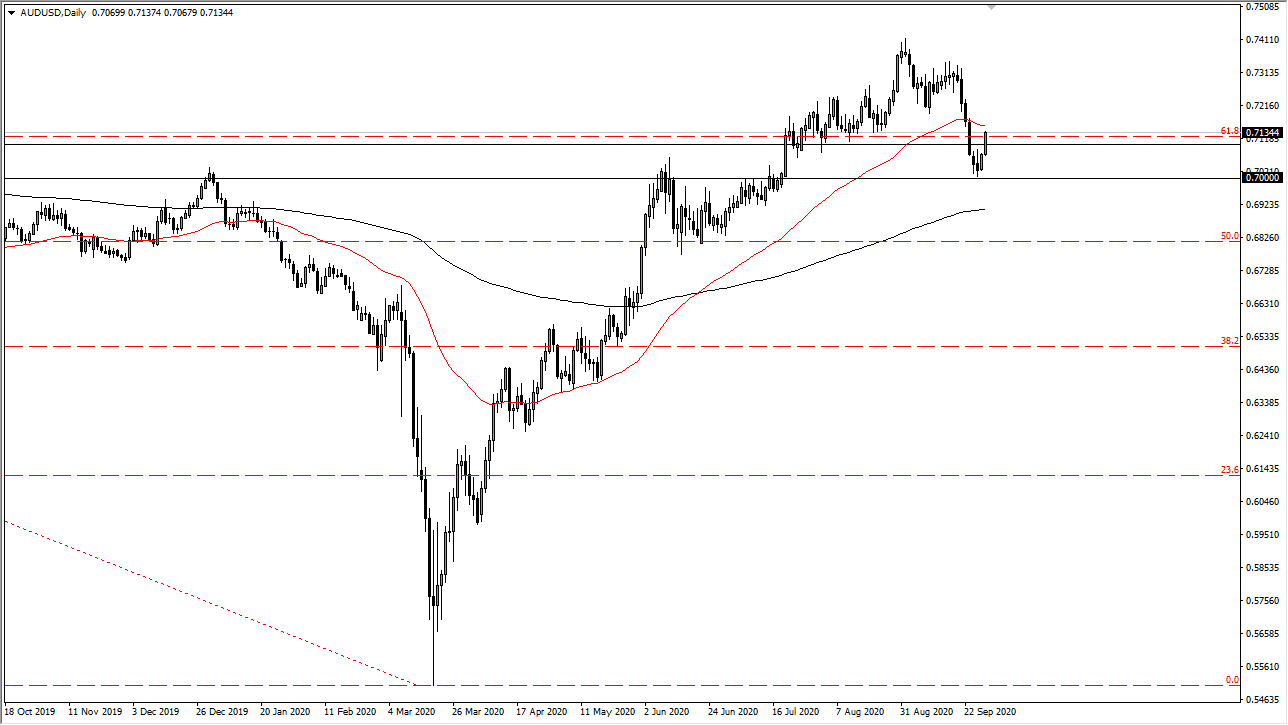

The Australian dollar has rallied significantly during the trading session on Tuesday, slicing through the 0.71 handle. Ultimately, the market looks as if it is reaching towards the 50 day EMA, and if we can break above there, I think more traders will come in and try to pick up the Aussie dollar. Having said that, the market is very noisy, and it is this reason that I am not overly excited about jumping in right away. Having said that, it is obvious that the Australian dollar is not a currency you should want to short anytime soon, so that being said, this is a market that I think you are only buying or sitting on the sidelines.

If we can get above that 50 day EMA, it is likely that we go looking towards the 0.7350 level. If we were to break above there, then it is likely that the market is going to break to all-time highs and perhaps even go much higher, reaching towards the 0.75 handle above. To the downside, I think there is plenty of support all the way down to the 0.70 level, an area that is a large, round, psychologically significant figure, and an area that we have seen a lot of trading in recently. If we were to break down below there it is likely that the market could break down.

If we break back down below the 0.70 level it is likely that the market goes down to the 200 day EMA, and then perhaps even lower than that. Ultimately, this is a market that I think has a lot of noise ahead of it and could be a bit insulated due to the fact that the Australian dollar is highly levered to China. In other words, if the US dollar is suddenly going to get much stronger, you may wish to buy it against other currencies, not the Aussie. On the other hand, if the US dollar falls, that is likely that the Aussie will be one of the biggest beneficiaries as it has been one of the strongest currencies that we have been monitoring over the last several months. With that being the case, expect volatility but I only have one direction in general that I am paying attention to.