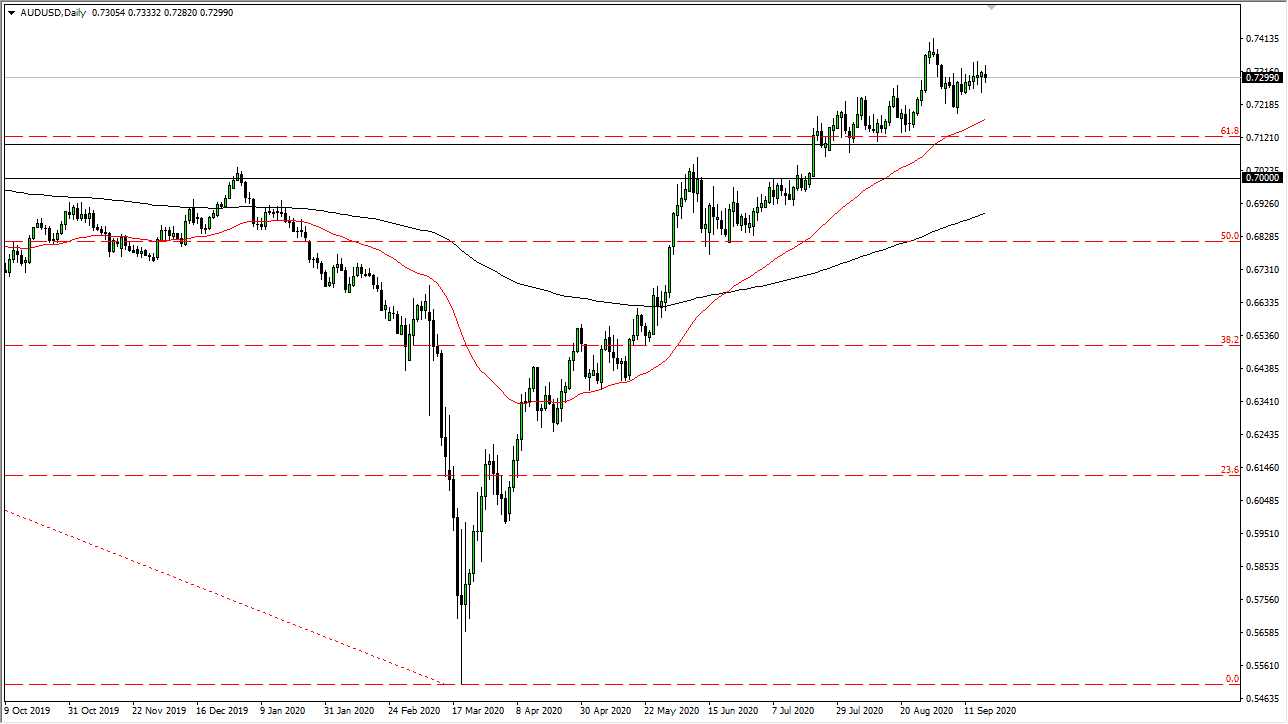

The Australian dollar has gone back and forth during the trading session on Friday, initially trying to pull back before rallying and before pulling back again only to settle on a relatively unchanged candle. That being said, the Aussie is most certainly at an extended level, so it does make sense that we need to grind sideways a bit in order to work off some of the recent gains. When you look at the longer-term chart, we have essentially gone straight up in the air, and therefore digesting is probably the most obvious reaction.

That being said, I do not have any interest in shorting this market, because the Aussie dollar has the benefit of being attached to the Chinese economy, which is humming right along right now. As long as that is going to be the case, there will be a bit of a floor in the Aussie dollar, despite the fact that it has been so overbought. Quite frankly, as the US dollar strengthens, it could strengthen over here as well, but it will probably have a lot less momentum to the downside in this pair that would be against other currencies such as the Euro and the Pound.

Ultimately, the US dollar does start to fall apart again, and this is a market that will probably really start to take off. This will be especially true if we continue to get better than anticipated Chinese numbers and could open up the door for a move towards the 0.75 handle. After that, then we would be talking about the 0.80 level longer term. To the downside, we have a significant amount of support at the 0.72 handle, the 0.71 handle, and most decidedly at the 0.70 level. It is not until we break down below the 200 day EMA that I would consider shorting this market, and right now that is closer to the 0.6850 level. It would take a significant change in attitude to break this pair down below that level, so I believe that at this point we are likely to see more of a “buy the dips” type of mentality here. After the significant move to the upside, we could spend quite a bit of time going sideways, so be cognizant of the fact that the markets may be relatively quiet. In the short term, I like buying dips closer to the major handles.