The Australian dollar initially tried to rally during the trading session on Friday, but then gave back the gains again to crash back into the 0.70 level. That is of course a large, round, psychologically significant figure, which of course always attracts a lot of attention. If you been following my work here at Daily Forex, you know that I have been talking about the range between 0.70 and 0.71 as a major important level for longer-term trading. Now that we are at the bottom of it, we are on the precipice of breaking down significantly if we just get that last little push.

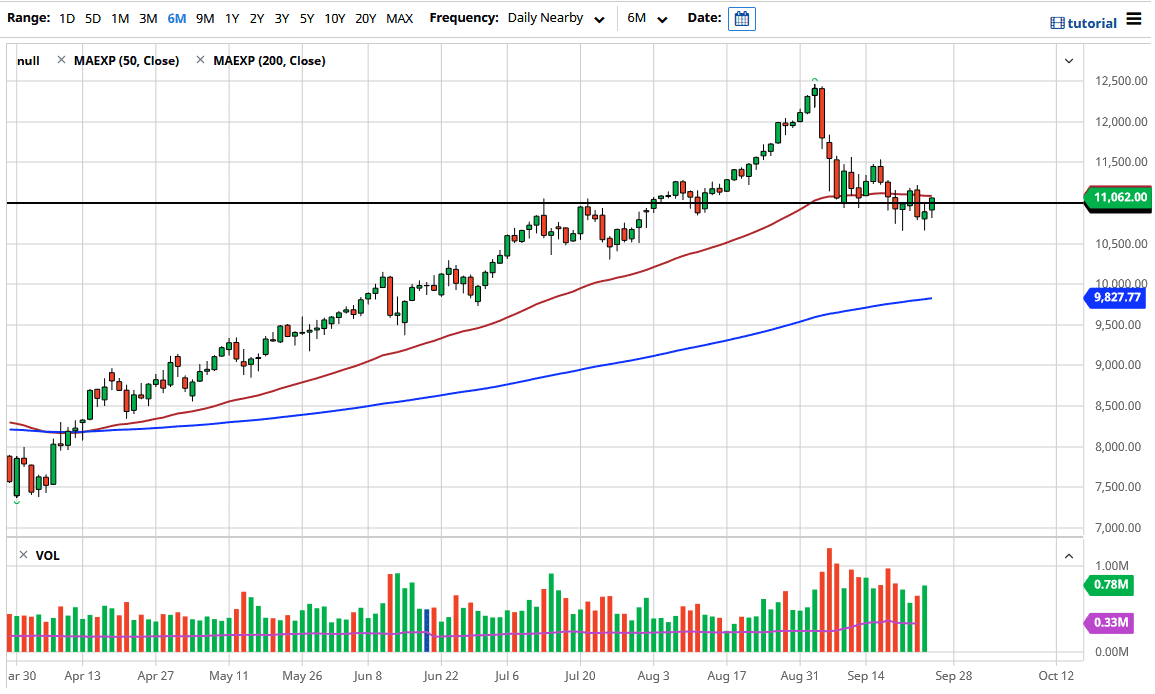

Given enough time, I think that the market is going to have to make a significant decision, and if we can break down below the 0.70 level on a daily close, that opens up the possibility of a move down towards the 200 day EMA. That of course is a major technical indicator that a lot of people will pay attention to, and with that I think will attract a lot of attention. If we break down below the 200 day EMA, that will be essentially the “trapdoor opening” in the market.

On the other hand, if we break above the 0.71 handle on a daily close, it is likely that the market will go looking towards the 0.74 level. That would be a continuation of the overall trend and of course the Australian dollar is helped out by the Chinese economy, which a lot of people are paying attention to due to the fact that it is one of the few places growing in a significant way. Ultimately, the market is on the precipice of making a big enough move, so if you are cautious and patient, you can get an opportunity to place a bigger trade. This is a market that is going to be volatile to say the least, but we need to hang on to this area in order to save the uptrend. Looking at the candlestick for the trading session on Friday, it does suggest that we probably are going to drift a bit lower. With this, we have significant headwinds out there that could come into play, so as long as there is a lot of risk out there, the Australian dollar could struggle a bit overall as is considered to be a risk currency.