There are a lot of moving pieces right now and they continue to cause issues. Therefore, I think what we are seeing here is a scenario where the market needs to come back a bit in order to attract enough value hunters to go long again. That being said, the market is still a bit noisy and volatile, so you need to be very cautious about your position size.

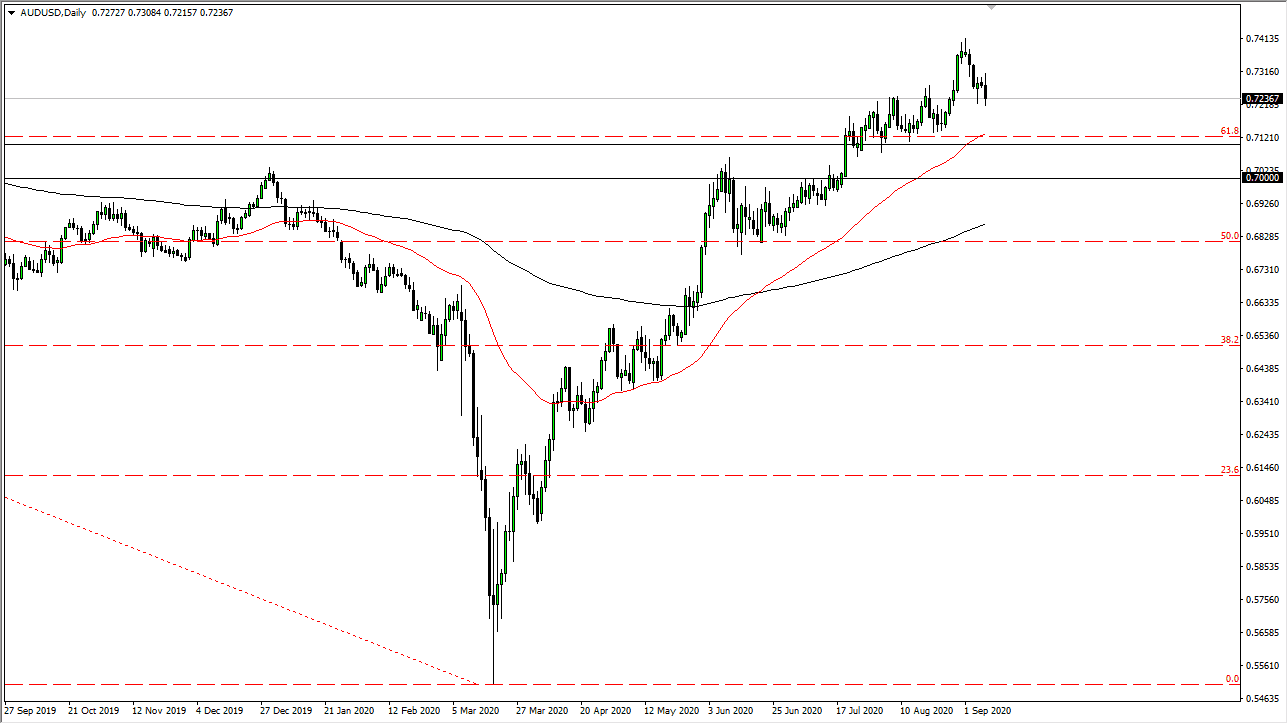

To the downside, I think there is significant support at the 0.72 handle, the 0.71 handle, and then again at the 0.70 level. Any type of bounce from these areas could offer a nice buying opportunity, in what has been a rather strong uptrend for some time. I do think that it is only a matter of time before we see a bit of value hunting, but it should be noted that we are seeing a lot of pressure to push the US dollar higher in general. That being said, if we get some good news when it comes to risk appetite that should benefit the Australian dollar directly. For what it is worth, I still believe that this is a market that you need to buy on dips, but we may have to be very patient about going long of the Aussie at this point.

The 50 day EMA is currently just above the 0.71 handle, just as the 200 day EMA is at the 0.68 level. It is not until we break down below the 200 day EMA that I would be a seller of the Aussie, and I think we would need to see a significant shift in the attitude of traders around the world in order to make that happen. The volatility continues to be out of control when it comes to risk appetite, so it is very possible that we need to keep in mind that our position sizes will more than likely greatly determine how we end up as far as our profit and loss is concerned. These are very difficult times, so keep that in mind and stay focused on the longer term, as it can guide you through a lot of these massive moves. Longer-term, I still think we are going to go looking towards the 0.75 handle.