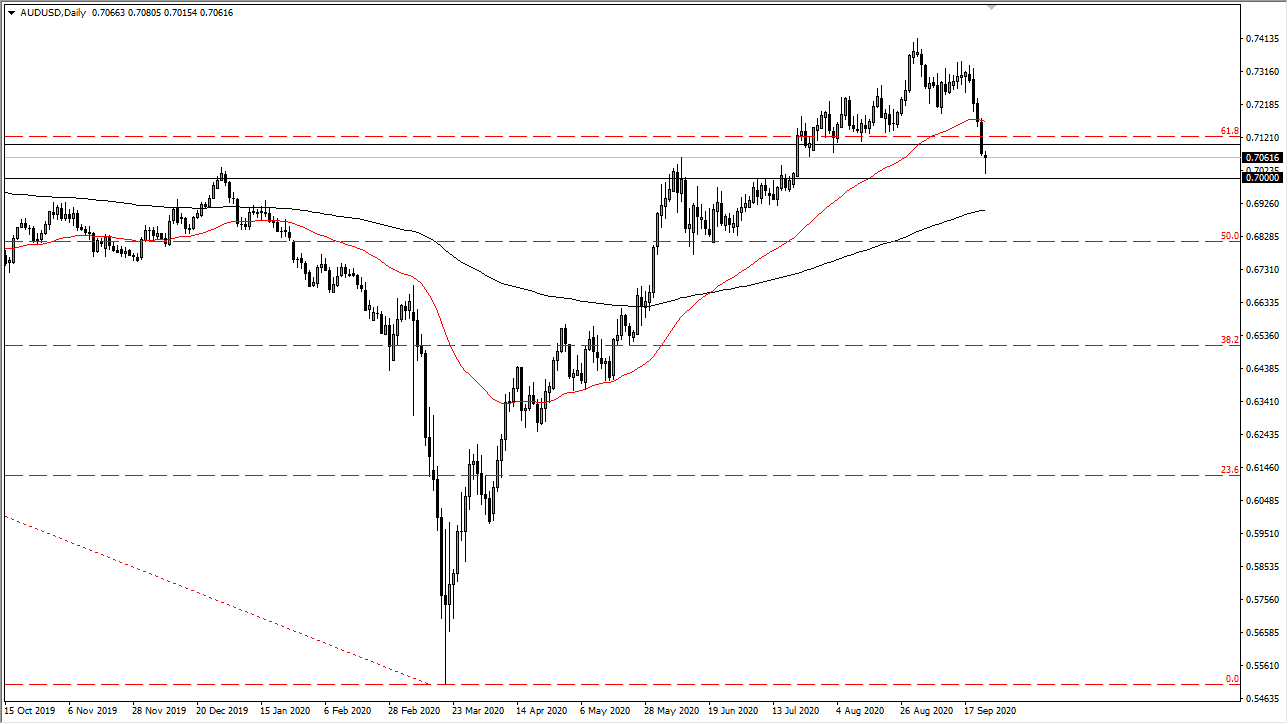

The Australian dollar fell a bit during the trading session on Thursday, reaching down towards the crucial 0.70 level. This is an area that I think continues to be crucial as it is a large, round, psychologically significant figure and an area where we have seen a lot of interest in this general vicinity, and therefore I think it is only a matter of time before we have to make a bigger decision. For what it is worth, the fact that we formed a hammer on Thursday does in fact suggest that we may get a bit of a bounce from here and go higher. That to me is the short term move. The longer-term move is going to be based around the US dollar itself.

The market breaking below the 0.70 level would be a very bearish sign, but I do not necessarily think we are going to see it on Friday. I think what we are going to see is a short-term bounce, and then perhaps a continuation of the negativity. It will be difficult to trade this pair in the short term, but I suspect we are probably more susceptible to upward pressure than down, just simply because the US dollar has gotten overbought in the short term. Longer-term though, we have a lot of questions about what is going on out there, and essentially the Australian dollar is an argument between inflation and deflation. This has been the debate for the last couple of years, but recently we are starting to see more people argue about it.

Inflation looks to be picking up in general, but the question is whether or not it is “reflation” rather than the real thing? After all, we have seen central banks around the world trying to cause inflation over the last 12 years, and therefore as long as we are in a deflationary environment, longer-term the US dollar probably strengthens. This seems to be the argument that everybody is having right now, and the last week has shown the Aussie falling apart. Further exacerbating the argument for a pro-US dollar regime is the fact that the Euro has broken below the 1.17 handle, and of course the British pound has fallen apart. While I do expect a short-term bounce, a move below the 0.70 level has me thinking that the Australian dollar will finally falloff. It may still be more resilient than some of the other currencies, but the US dollar tends to move in one direction against everything.