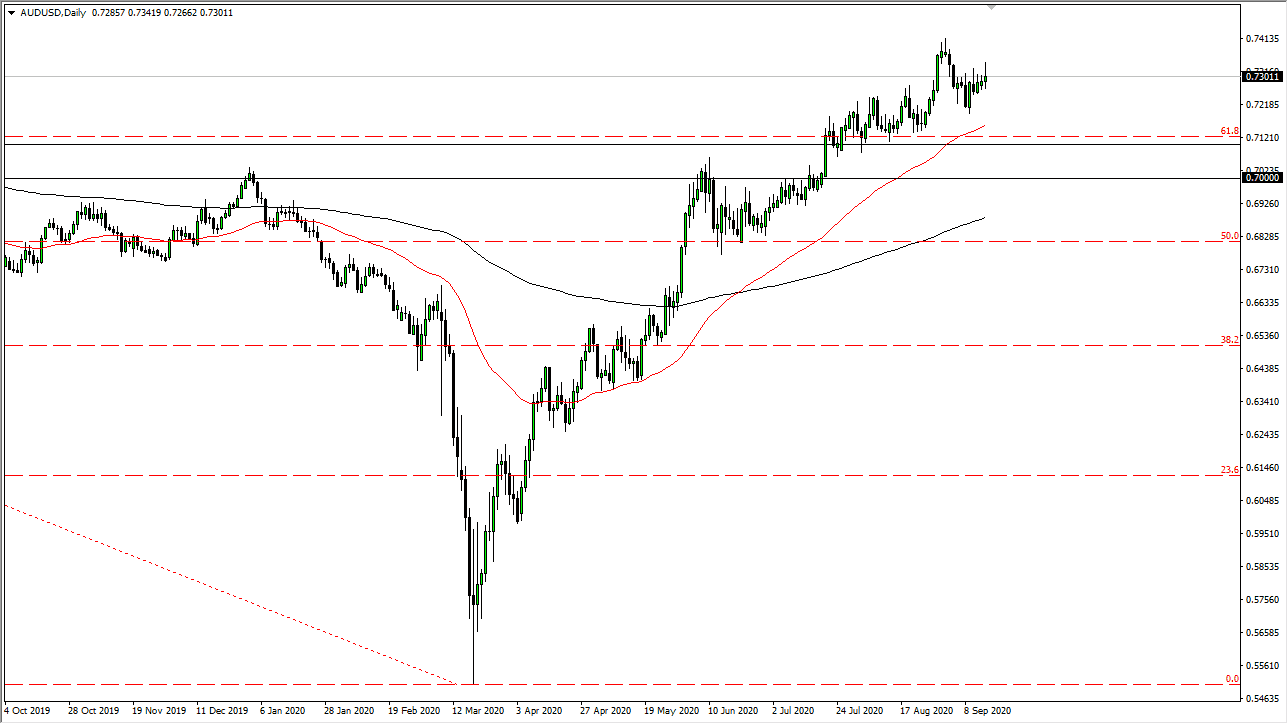

The Australian dollar has initially pulled back a bit during the trading session on Tuesday only to see strength again after the RBA came out with its announcement. A lot of the strength that we may have seen is quite possibly due to the Chinese economic numbers and the Chinese economy on the whole. After all, the Australian dollar is a bit of a proxy for China, so keep that in mind. I believe at this point we continue to see more bullish pressure than bearish, but it does look like we are struggling a bit to get above current trading.

To the downside, the 0.71 level continues to be massive support that extends down to the 0.70 level. That is a major area of support based upon a larger range, as opposed to a particular number. However, the 50 day EMA has now broken above there and that of course is something worth paying attention to as well. A lot of traders will look towards the 50 day EMA as a bit of a guide because of this, I think that as we pull back and go closer to that EMA, we could find technical traders jumping into the market based upon that alone. At this point, the market looks as if it is going to be looking towards the 0.75 handle, perhaps even the 0.80 level after that. Obviously though, that is a long term call, and not something that we will be looking to see the next few days.

If we did break down significantly, I would not be concerned about the Aussie dollar until we clear the 200 day EMA underneath, which is currently near the 0.6850, and it now looks likely that we will not be anywhere near that level anytime soon, but if we did break down below there then it is obvious that it would be time to jump ship. This would more than likely be based upon some major “risk-off” and that would be of the global magnitude, something that is not completely out of the question but unlikely at this point. I believe in buying dips because even though we have rallied as strongly as we have over the last couple of months, we are still at very depressed levels when it comes to the Aussie dollar overall. Furthermore, the Federal Reserve is going to continue to keep monetary policy loose.