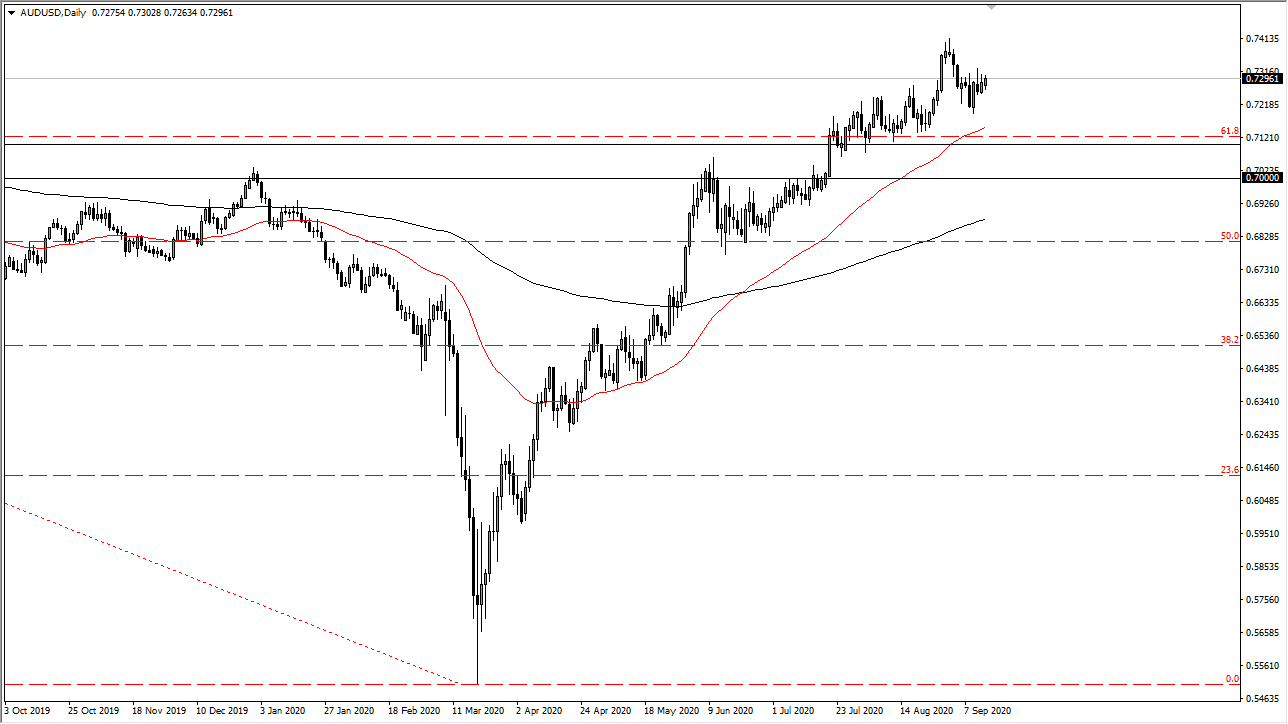

The Australian dollar rallied a bit during the trading session on Monday to kick off the week, but we continue to see a lot of simple grinding back and forth with a slightly upward pattern that has been a mainstay of the Australian dollar/US dollar pair for some time. At this point, I think it is much more likely that pullbacks will continue to offer buying opportunities based upon value. I believe that the resistance above is going to be difficult to overcome though, so that is something to pay attention to.

The 0.71 level is a massive support barrier, but support might even be higher than that at this point as the 50 day EMA has crossed that level quite drastically. At this point in time, I still look at buying dips as the best way to trade this market, but I also recognize that we have a lot of work to do in order to digest all of the massive gains that had been experienced in this market. Because of this, I think that the next several weeks in this pair will probably be very choppy. Furthermore, the US dollar is starting to show signs of strength against other currencies, so that could come into play here as well.

I still believe in buying on the dips unless something changes drastically when it comes to Chinese demand for commodities. They are picking up commodities left and right, so it does make a certain amount of sense that Australia will be one of the major beneficiaries as they are such a huge supplier of commodities to that country. Having said all of that, if there is a sudden “risk-off move” around the world when it comes to equities, commodities, and the light, it will more than likely affect this pair as well. If we break down below the 0.70 level, I would be very cautious because a slip to the 200 day EMA would almost certainly be assured. To the upside, I believe that the 0.75 level is the target, but it may take some time to get there as there are so many headlines out there that could cause major issues. Expect volatility, so therefore you may want to keep your position size somewhat smaller than usual, but that could probably be said for most currency pairs right now.