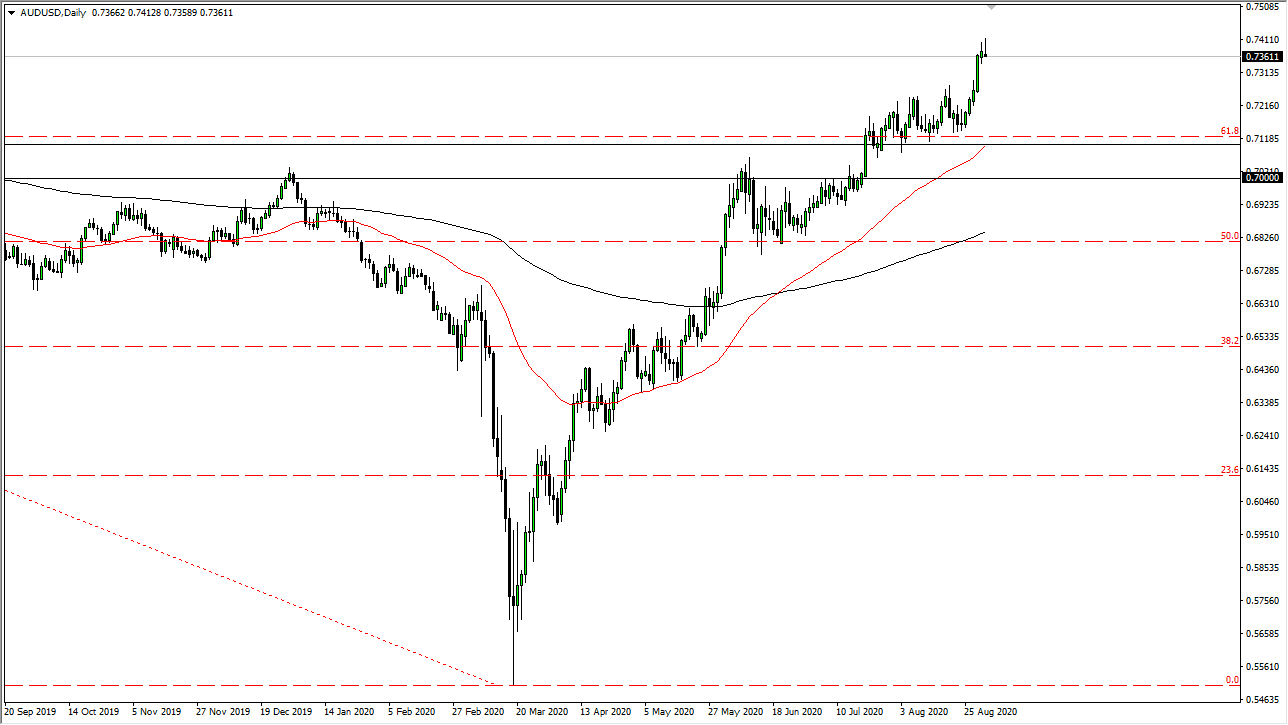

The Australian dollar initially shot higher during the trading session on Tuesday but has pulled back to form a rather ugly shooting star. This tells you that there is a certain amount of exhaustion in the market in the one thing that you can take away from this is that it looks a lot like all of the other major currency pairs at the moment, with the US dollar recovering nicely late in the session. The shooting star is a very negative candlestick, and it certainly will have caught a lot of attention from traders. That being said, I think that if you are patient enough, you should find value in the Aussie dollar and be able to take advantage of how cheap this market is.

Underneath, the 50 day EMA is approaching the 0.71 handle, which is the top of a matter of significant support extending down to the 0.70 level. That is an area that was previously resistant, so it would make quite a bit of sense that the market would use “market memory” to take advantage of that. The Federal Reserve continues to loosen monetary policy, but the US dollar had been a bit oversold as of late, although this pair is not as bad as some of the other ones.

It would also make a certain amount of sense that the market roles over a bit heading into the jobs number, which comes out on Friday. At that point, I think that we will see a continuation of the trend, so therefore I am looking for a dip to take advantage of. Alternately, if the market were to break above the top of the candlestick for the trading session on Tuesday, it would be the market overcoming the 0.74 handle, getting ready to look towards the 0.75 level above which is the longer-term target.

We have seen a massive recovery in the Australian dollar, maybe not so much to do to anything going on in Australia or Asia for that matter but due to the Federal Reserve loosening economic conditions through its monetary policy. Furthermore, the gold markets have been on fire until recently, and that helps the Aussie dollar as well as it is quite often used as a proxy for that commodity. Regardless, I do not have any interest whatsoever in trying to short this market.