The trend has not changed, despite the fact that the candlestick for the Thursday session is rather ugly. Quite the contrary, I am not looking to short this market I believe that there is a lot of value to be found underneath. The fact that Friday is the jobs number of course will come into play as well, so that is worth talking about.

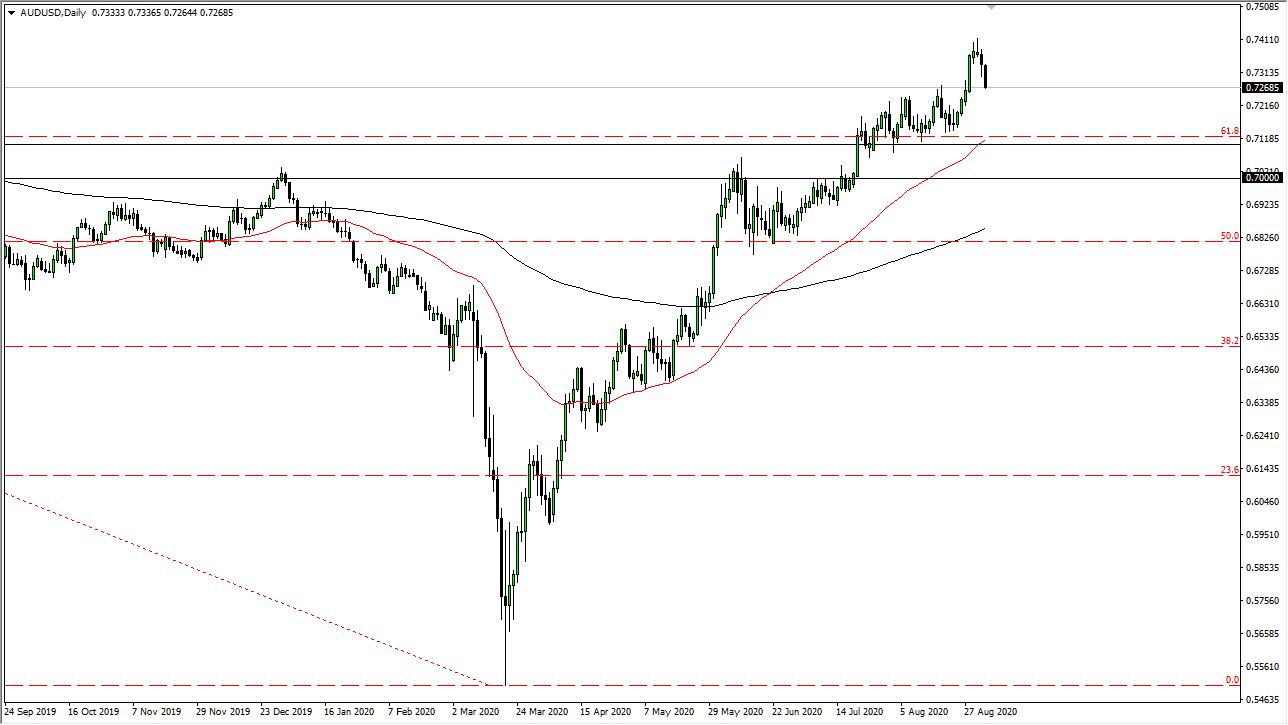

At 8:30 AM New York time, we will get the Non-Farm Payroll numbers out of the United States, which of course typically causes a lot of volatility. That being said, we get some type of sharp pullback in this pair, I will be more than willing to buy into it as I see a massive amount of support extending between 0.71 and 0.70 underneath. The 50 day EMA is also right around the 0.71 handle, so quite frankly I think it is only a matter of time before the buyers would return. It is very rare that one employment figure changes the overall trend, and over the last couple of years most of the time you end up right back where you started at the end of the session.

The Australian dollar has been relentless in its Drive higher and I think that will probably continue to be a major thing to pay attention to, because not only is the Australian dollar not the US dollar, but it also has the benefit of the Chinese economy which is starting to pick up as restrictions are loosened. The Australians provide the Chinese with most of the raw materials for construction and quite a bit for manufacturing, so that of course makes the Aussie dollar a proxy for China as well. With that, I believe that a short-term pullback should offer value that you will probably want to take advantage of, and I do believe that we will eventually see the 0.75 level above. I have no interest in shorting this pair, at least not until we break down below the 200 day EMA which is currently just above the 0.68 handle, far below where we are right now.