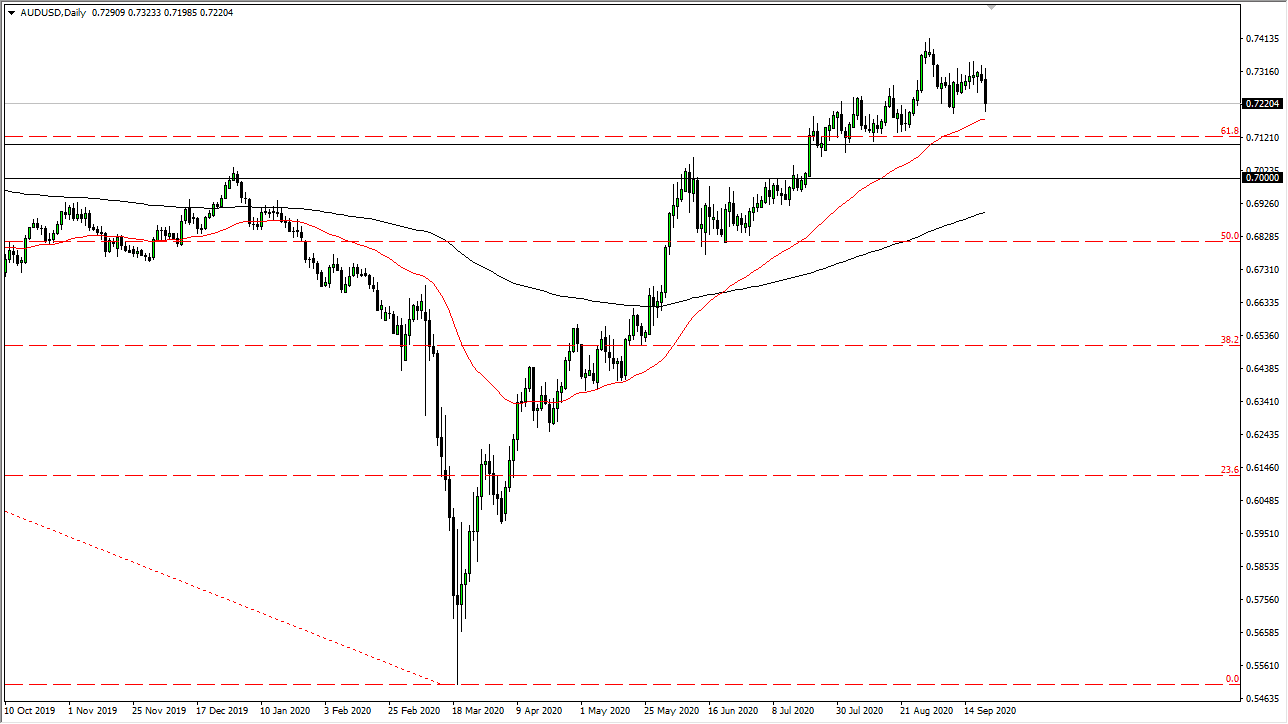

The Australian dollar initially tried to rally during the trading session on Monday but gave back the gains as we have reached towards the 0.72 level. That is an area that also features the 50 day EMA, so it should be paid attention to due to the fact that a lot of technical traders will be paying attention to it as well. Ultimately, I think that the market has plenty of support underneath, so with that in the back of our mind, we should not be a seller of the Australian dollar, even if we do want to buy the US dollar. I think it would be easier to buy the US dollar which gets a whole host of other currencies because the Aussie has been so strong and it is highly levered to the Chinese economy.

There is an area between 0.71 and 0.70 then should be massive support, based upon the action that we had seen in that general vicinity. Underneath that, the market has the 200 day EMA racing towards the 0.69 level, and so it is not until we break down below there that I become worried about the Australian dollar. If we were to break down below the 200 day EMA it could kick off a bigger move to the downside. A breakdown below that level opens up the possibility of a move to the Australian dollar reaching towards the 0.65 level underneath, perhaps possibly the 0.6250 level.

All things being equal though, I think that even if the US dollar does strengthen against currencies in general, you are probably best leaving this one alone. To the upside, the 0.74 level has been significant resistance and even if we can break above there it is likely that the market goes looking towards the 0.75 level which is much more interesting from a longer-term standpoint. Above there, the market could then go to the 0.80 level which is a crucial area on the monthly chart. Either way, I think it is best to look for a buying opportunity based upon a supportive daily candlestick, or perhaps even a bigger candlestick that show signs of positivity. Probably best to step on the sidelines and pay attention to the US Dollar Index as to which direction you may want to look at in this market.