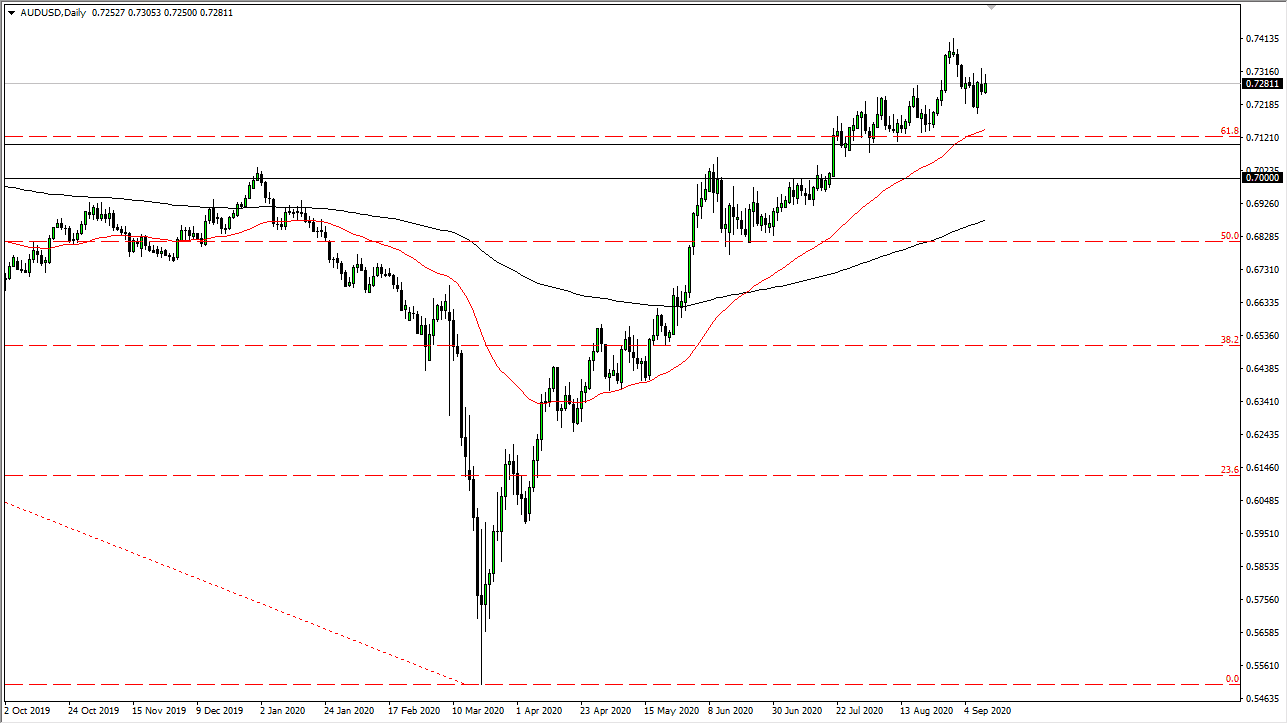

The Australian dollar has rallied a bit during the trading session on Friday but gave back some of the gains as the 0.73 level will continue to offer a bit of resistance. Longer-term though, it does look like we are trying to rally but it should be noted that the US dollar is trying to recover some of its losses against multiple other currencies. The Australian dollar does not live in a vacuum, so this is something that should be paid close attention to. With that being the case, I think that if we get a signal to start selling the Aussie dollar, it may actually come from somewhere else like the Euro.

From a technical analysis standpoint, the 0.71 level underneath should be supported, extending down to the 0.70 level. At this point, the market is likely to continue to show a lot of interest, especially if the Chinese economy continues to perform fairly well. Looking at this chart, it is worth noting that we continue to struggle to get above the 0.73 level for any length of time. That being said, you should also keep in mind that it is the Friday candlestick that we are paying attention to, and it is a bit difficult to imagine a scenario where people want to put on a bunch of risk heading into the weekend.

Underneath, the 50 day EMA is dancing around the 0.71 handle, so that also could have an influence on how this market behaves and whether or not buyers underneath are waiting. If we were to break down below the 0.70 level, then we probably go looking towards the 200 day EMA underneath which is closer to the 0.6850 level. At this point, it still looks as if dips will continue to offer value, as the Chinese economy is doing fairly well, and commodities are getting a bit of a boost due to the reflation trade. As long as that is going to be the case, the Australian dollar is probably going to outperform other currencies against the greenback, even if it pulls back. However, if there is a sudden run back towards the greenback, this pair will be affected. Longer-term, I believe that we are still going to try to get towards the 0.75 level, possibly even the 0.80 level but with the recent move being such a massive spike higher, a bit of grinding makes sense.