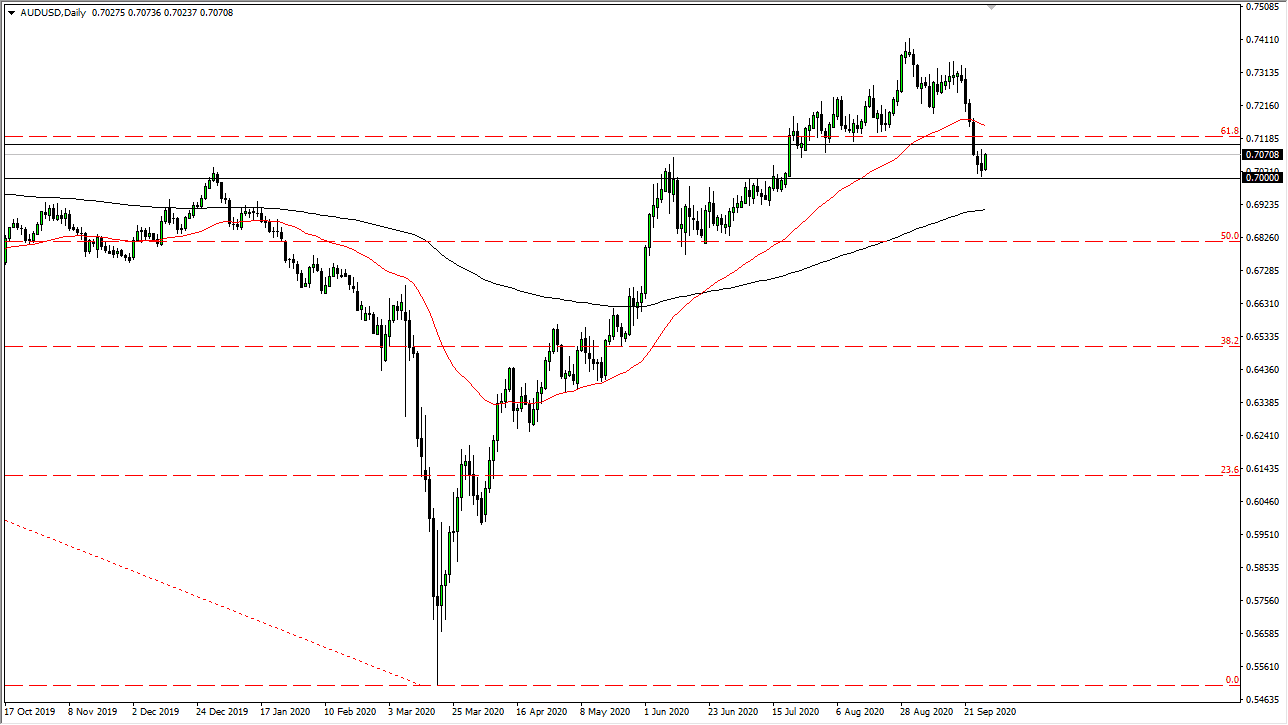

The Australian dollar has rallied a bit during the trading session on Monday as traders came back to work, using the 0.70 level underneath as support. If you have been following my analysis here at Daily Forex, you know that I had mentioned that the 0.70 level is the beginning of significant support and resistance all the way to the 0.71 handle, making and essentially a “zone of interest” when it comes to the Aussie dollar.

The market has recently broken down below the 50 day EMA which of course is negative, but we also have the 200 day EMA underneath that is offering support. If we can break back above the 0.71 handle, then it is likely that the Australian dollar may make a move towards the 0.73 handle above. That does not mean that it will be easy to do, but it certainly looks as if we are going to try to get there. As far as breaking down is concerned, a move below the 0.70 level probably sends this market down towards the 200 day EMA.

All things being equal, if you are looking to buy the US dollar it is probably difficult to do it against the Australian dollar, as the Australian dollar is highly levered to China, and of course it has that boost due to the fact that the Chinese economy seems to be doing fairly well. Beyond that, gold markets also have an influence on the Australian dollar so that is another reason to think that at the very least the Aussie will be resilient. With that in mind, uses more or less as an indicator of the US dollar strength more than anything else right now. If this pair starts to fall, I will be looking to short other pairs such as the EUR/USD pair, GBP/USD pair, and the NZD/USD pair which is highly correlated to what goes on here. It is not that I cannot short this pair, I just recognize that it is going to be a lot more stubborn than some of the others. A breakdown below the 200 day EMA in this pair which is currently sitting near the 0.6875 handle could open up a trapdoor effect to lower levels, but at that point I suspect that the US dollar will be strengthening against just about anything you can look at.