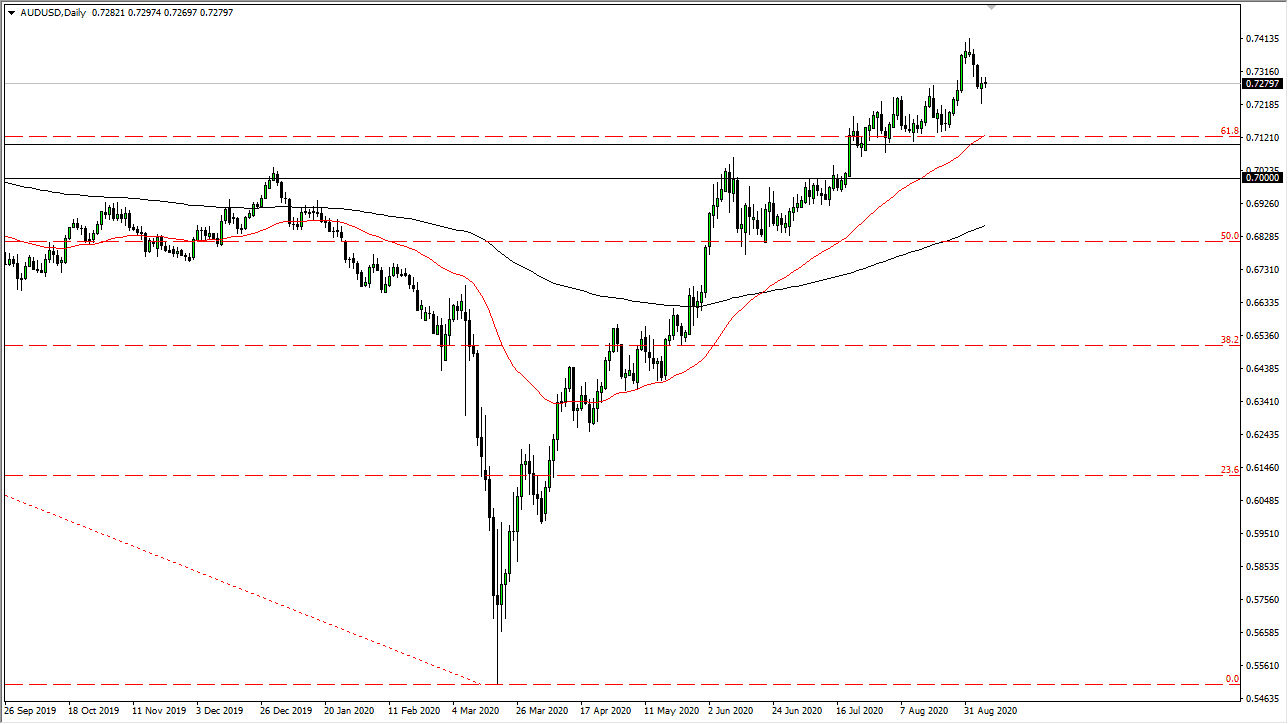

The Australian dollar has done very little during the trading session on Monday, but you would expect that as it was Labor Day in the United States. This means that a lot of the large banks out there will not be trading, and therefore it is likely that you cannot look at this market over the last 24 hours and read too much into it. The hammer that formed on Friday was a little bit of a signal though, so by turning around to form this hammer it is likely that we will continue to find buyers on dips, so at this point, it is very likely that we will continue to go higher over the longer term. The 0.71 level underneath is massive support, but for that matter so is the 0.72 handle.

The 50 day EMA is sitting at the 0.71 level, and it is likely that we continue to be very supported all the way down to the 0.70 level. All things being equal, I think it is only a matter of time before the buyers come in to pick up a dip, as the Australian dollar has been one of the better performing currencies. At this point in time, I recognize that the market has rallied quite significantly, and then has been influenced quite a bit by the Federal Reserve loosening the monetary policy in general, so that should continue to work against the greenback itself.

At this point, as long as we stay above the 200 day EMA, which is sitting just above the 0.68 level, then it is likely that the trend continues to the upside, even if we do get the occasional dip. By reaching towards the 0.74 level and pulling back, it suggests that the market is ready to try to break out to the upside eventually, but this pullback was probably necessary as we got a bit ahead of ourselves. Keep in mind that we had been very bullish for some time, so the occasional pullback helps us hold up the overall trend. After all, we cannot go straight up in the air forever. Longer-term, I believe that the market is going to test the 0.75 handle, and then eventually the 0.80 level after that. If we did break down below the 0.68 level, then the market probably falls down to the 0.65 handle, but we are a long way from that happening.